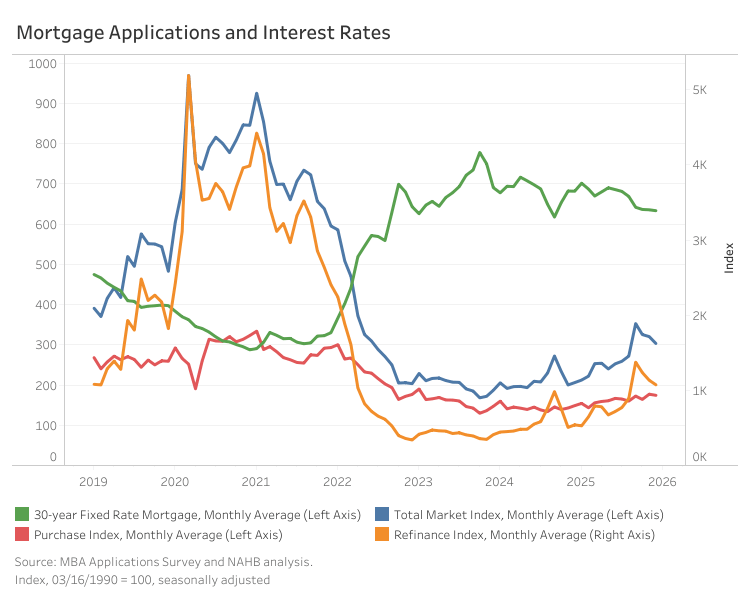

Mortgage application activity declined in December despite a modest easing in mortgage rates. The Mortgage Bankers Association’s (MBA) Market Composite Index, a measure of total mortgage application volume, fell 5.3% from November on a seasonally adjusted basis, though it remained 47.1% higher than a year ago.

The average contract interest rate for 30-year fixed mortgages edged down 2 basis points to 6.3%, the lowest level of 2025. Nonetheless, both purchase and refinance applications declined month-over-month, down 1.6% and 5.3%, respectively. Relative to December 2024, purchase activity increased 16.8%, while refinance applications were up 98.6%.

By loan type, applications for both fixed-rate mortgages (FRMs) and adjustable-rate mortgages (ARMs) declined from November, decreasing 4.8% and 13.6%, respectively. On a year-over-year basis, FRM applications were up by 43.9%, while ARM applications have more than doubled, rising 105.1%. As of December 2025, ARMs accounted for an average 7.5% of total applications on a non-seasonally adjusted basis, down 0.3 percentage points from November but 2.2 percentage points higher than a year earlier.

For loan sizes, the average loan amount across all loan types increased marginally by 0.6% to $397,500. Average purchase loan sizes declined 0.8% to $424,800, while the refinance loan size increased 2.5% to $377,300. The average size of ARM loans edged down 0.1% to $968,000.

This article was originally published by a eyeonhousing.org . Read the Original article here. .