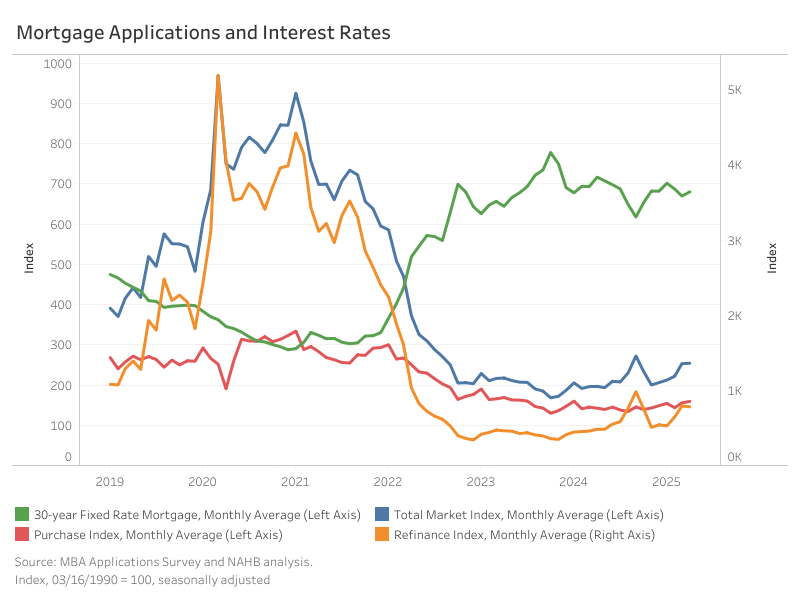

Mortgage loan applications saw little change in April, as refinancing activity decreased. The Market Composite Index, which measures mortgage loan application volume based on the Mortgage Bankers Association (MBA) weekly survey, experienced a 0.4% month-over month increase on a seasonally adjusted (SA) basis. However, year-over-year, the index is up 29.3% compared to April 2024.

The average rate for a 30-year fixed mortgage climbed 10 basis points in April, reaching 6.8%, according to the MBA survey. As rates edged higher, purchase activity posted a modest 1.9% month-over-month gain (SA), while the Refinance Index declined by 1.4% (SA). Compared to a year ago, mortgage rates are down 37 bps, and thus, purchase applications are higher by 11.2%, while refinance activity has jumped 62.0%.

Loan sizes remained relatively stable. In April, the average loan size across the total market (including purchases and refinances) held steady at $403,500, month-over-month, on a non-seasonally adjusted basis (NSA). Purchase loans sizes edged down 1.3% to $444,000, while refinance loan sizes increased 0.5% to $339,300. Notably, the average loan size for adjustable-rate mortgages (ARMs) fell 7.8%, from $1.14 million to $1.05 million.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .