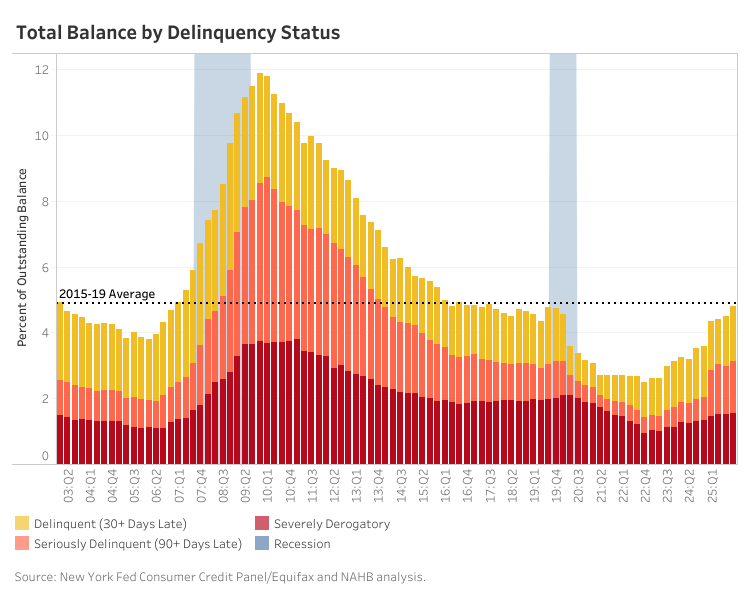

Delinquent consumer loans have steadily increased as pandemic distortions fade, returning broadly to pre-pandemic levels. According to the latest Quarterly Report on Household Debt and Credit from the Federal Reserve Bank of New York, 4.8% of outstanding household debt was delinquent at the end of 2025, 0.3 percentage points higher than the third quarter of 2025 and 1.2% higher from year-end 2024.

This increase reflects a normalization period coming out of the pandemic, when delinquency rates were suppressed by payment forbearance and fiscal support. As these government assistance programs ended and credit reporting normalized, delinquency rates rose steadily and are now on par with pre-pandemic levels.

While aggregate delinquency has normalized, transitions into serious delinquency (defined as 90+ days past due) show diverging patterns across loan types. Student loans and credit cards stand out as having significantly higher inflows into serious delinquency than before the pandemic, while mortgages, HELOC and auto loan transitions remain comparatively stable.

Late student loan payments saw a sharp rise in early 2025, and by the fourth quarter of 2025, 16.2% of student loan balances became seriously delinquent over the past year. This surge reflects the re-entering of delinquent balances into credit reports following a nearly 5-year pause due to the pandemic. Credit cards, on the other hand, show signs of deterioration with new seriously delinquent balances rapidly rising mid-2022 before moderating around 7% in recent years. In the fourth quarter of 2025, about 7.1% of credit card balances transitioned into serious delinquency over the past year, a rate comparable to levels observed during the early stages of the Great Recession.

Mortgage transitions into serious delinquency remain low at around 1.4% annually, despite edging higher in recent years and are currently slightly higher than pre-pandemic levels. In a further analysis on the credit report data from Equifax, the deterioration is concentrated among borrowers living in lower-income zip codes, where serious mortgage delinquency rates for this group of borrowers have reached roughly 3.0% by late 2025.

Comparing delinquency transitions with the overall balance of seriously delinquent loans provides a clearer understanding of current credit conditions. Credit cards display a concerning trend in which both transition rate and overall balance of seriously delinquent loan balances are rising. For example, the share of credit card balances 90+ days past due is only about one percentage point below its post-great recession peak in 2010 at 12.7%, which seems to suggest persistent issues in repayment by borrowers.

Mortgages show the opposite dynamic, whereby the balance of seriously delinquent mortgages has remained stable despite a steady increase in transitions into serious delinquency. This divergence indicates higher recovery rates or shorter delinquency periods, an implication that mortgage borrowers prioritize meeting their mortgage payments which would be rational if borrowers had locked in historic low mortgage rates and have built up sufficient home equity.

While it is too early to determine if elevated transition rates will translate into increasing seriously delinquent student loan balances, this rate remains high at 9.6% at the end of 2025. Furthermore, the credit scores of student loan borrowers that improved during the student loan payment pause, will now be affected and could weigh on borrowers’ demand or ability to access other forms of credit, especially in an environment of tighter labor markets.

This article was originally published by a eyeonhousing.org . Read the Original article here. .