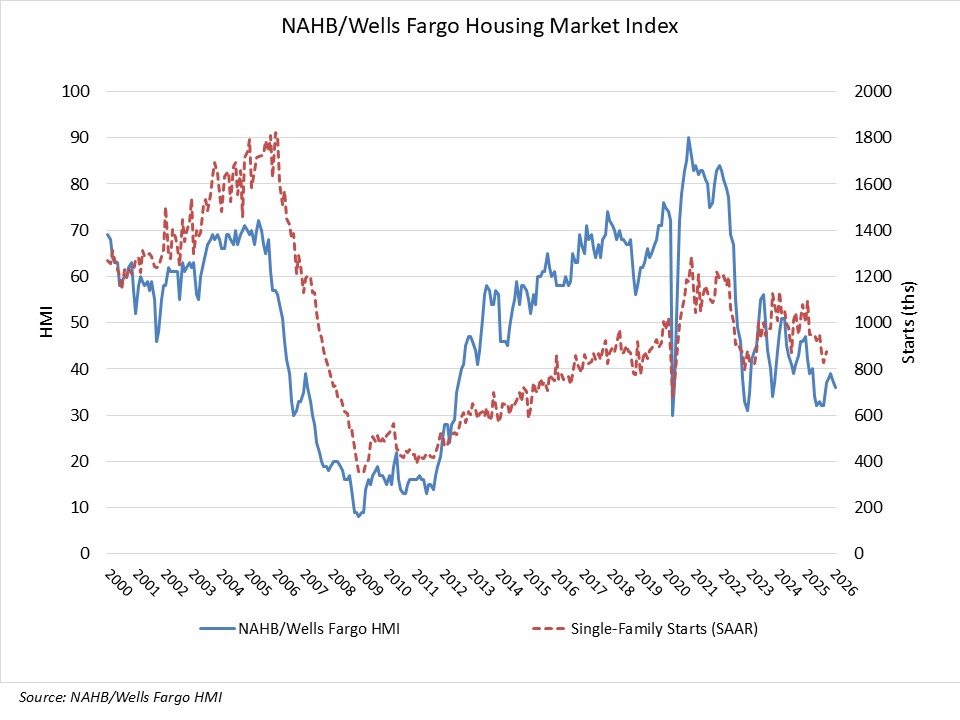

Builder confidence in the market for newly built single-family homes fell one point to 36 in February, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI).

Persistent affordability challenges, including high housing price-to-income ratios and elevated land and construction costs, helped push builder confidence lower for the second straight month to start the year.

Housing affordability remains an ongoing challenge at the start of 2026. The solution for the housing market is the enactment of policies that will bend the construction cost curve and enable additional supply of attainable housing. On the positive side, easing inflation should continue to allow lower interest rates for mortgages and builder loans.

The latest HMI survey also revealed that 36% of builders cut prices in February, down from 40% in January. While this marks the lowest incidence of price-cutting since last May (34%), the average price reduction remains at 6%. The use of sales incentives was 65% in February, unchanged from January, and marking the 11th consecutive month this share has exceeded 60%.

While the majority of builders continue to deploy buyer incentives, including price cuts, many prospective buyers remain on the sidelines. Although demand for new construction has weakened, remodeling demand has remained solid given a lack of household mobility, per comments from builders in the HMI.

Derived from a monthly survey that NAHB has been conducting for more than 40 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

The HMI index gauging current sales conditions held steady at 41 from January to February, the index measuring future sales fell three points to 46 and the gauge charting traffic of prospective buyers fell two points to 22.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell one point to 43, the Midwest held steady at 43, the South dropped one point to 35 and the West fell two points to 33. HMI tables can be found at nahb.org/hmi.

Editor’s Note: With the official 2026 release schedule for the Survey of Construction still unavailable from the U.S. Census Bureau, NAHB confirms the HMI for March 2026 will be released on March 16. A schedule for the rest of the year will be available as soon as possible.

This article was originally published by a eyeonhousing.org . Read the Original article here. .