Inflation unexpectedly eased in November, according to the Bureau of Labor Statistics (BLS) latest report. This data release was originally scheduled for December 10 but was delayed due to the recent government shutdown. While most indexes showed deceleration, this report does not necessarily prove a downward trend in inflation due to missing October data and incomplete November collection. December’s report may be more pivotal for markets and the Fed.

The recent record-long government shutdown disrupted data collection for many macroeconomic indicators including the CPI. About two-thirds of price data is collected through personal visits to brick-and-mortar stores, with the remaining third collected online or via telephone. Since the government remained shut down throughout October, BLS cannot retroactively collect survey data for the month. While data collection resumed on November 14 following the November 13 reopening, this month’s report potentially has downward bias due to lower collection rates and holiday sales promotions. This also suggests higher likelihood for monthly volatility in the near term.

Though inflation is expected to peak in the first quarter of 2026, the Fed is likely to continue easing given signs of labor market weakening. The housing market’s sensitivity to interest rates suggests rate cuts could help ease the affordability crisis and support housing supply even as builders continue to face supply-side challenges.

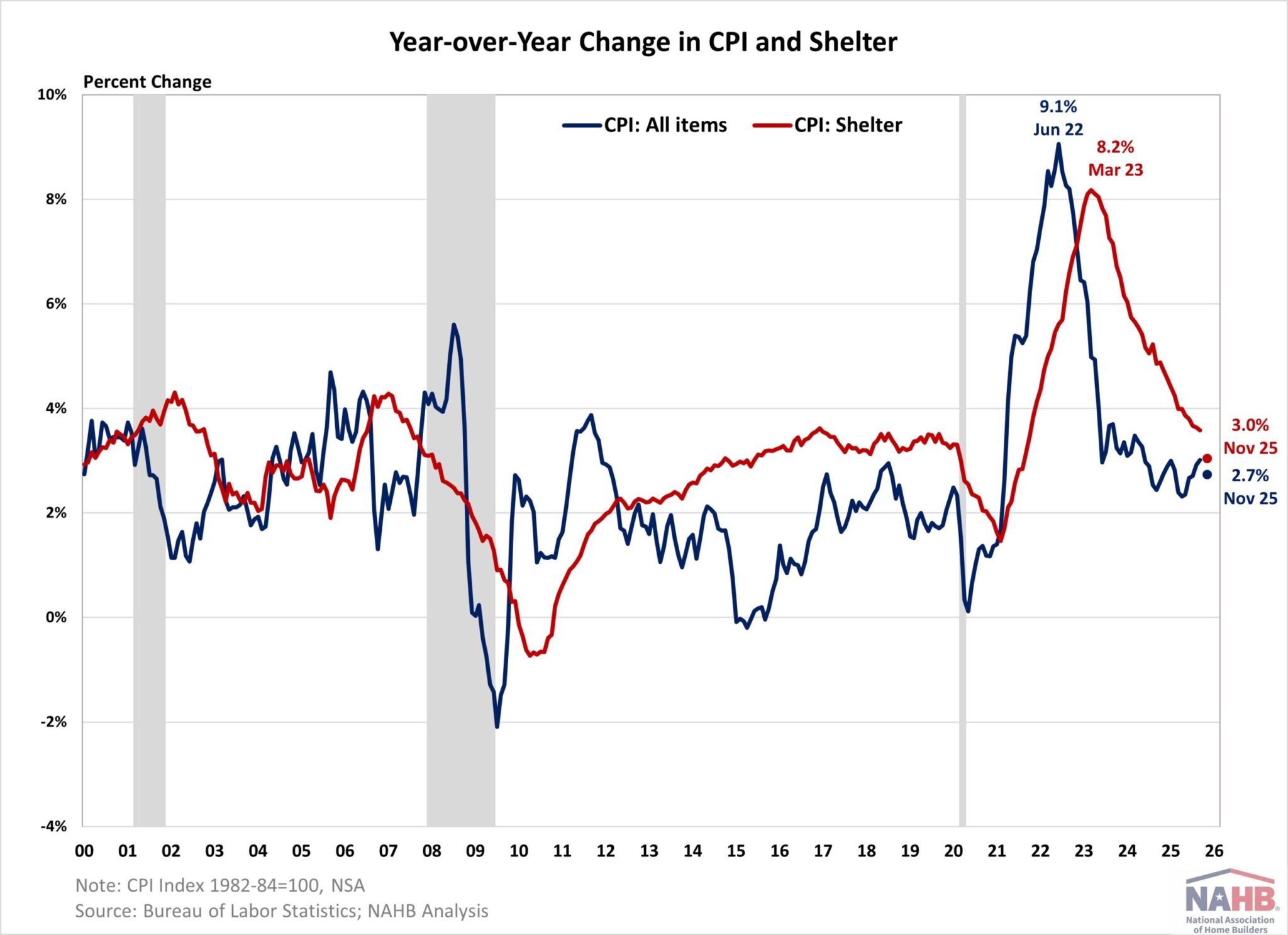

During the past twelve months, on a non-seasonally adjusted basis, the Consumer Price Index (CPI) rose by 2.7% in November. Excluding the volatile food and energy components, the “core” CPI increased by 2.6% over the past twelve months, the lowest reading since April 2021. A large portion of the “core” CPI is the housing shelter index, which increased 3.0% over the year, the lowest reading since August 2021. Meanwhile, the component index of food rose by 2.6%, and the energy component index increased by 4.2%.

Given the notable shift in the November data, especially for the shelter inflation component, the November data are shown with data dot points (red for shelter, blue for overall CPI respectively) in the chart below. The December report will identify whether these data points are confirmed positive trends.

Due to the gap in data collection during the government shutdown, this report covers a two-month period instead of the standard one month. From September to November, the CPI rose by 0.2% (seasonally adjusted), down from a 0.7% increase over the two-month period ending in September. The “core” CPI increased by 0.2% over the two months ending in November, compared to 0.6% in the prior two-month period.

From September to November, the price index for a broad set of energy sources rose by 1.1% and the food index rose by 0.1%. The index for shelter, which makes up more than 40% of the “core” CPI, rose by 0.2% over the two-month period, down from 0.6% in the previous period. Other contributors that increased included indexes for household furnishings and operations, communication, as well as personal care.

NAHB constructs a “real” rent index to indicate whether inflation in rents is faster or slower than core inflation. It provides insight into the supply and demand conditions for rental housing. When inflation in rents is rising faster than core inflation, the real rent index rises and vice versa. The real rent index is calculated by dividing the price index for rent by the core CPI (to exclude the volatile food and energy components).

From September to November, the Real Rent Index remained unchanged over the two-month period. Due to the missing October data, the average monthly growth rate for 2025 cannot be directly compared to prior years.

This article was originally published by a eyeonhousing.org . Read the Original article here. .