Private residential construction spending declined by 0.4% in March, largely driven by a decrease in home improvement spending. This decline followed five consecutive months of growth. Despite the monthly drop, spending remained 2.8% higher than a year ago, showing the resilience of the housing market.

According to the latest U.S Census Construction Spending data, improvement spending declined by 1.2% in March, aligned with the weakness in the Remodeling Market Sentiment of the first quarter of 2025. Still, spending on improvements was 13.4% higher than in March of 2024. Meanwhile, spending on single-family construction edged up by 0.1% in March, continuing its growth after a five-month decline from April to August 2024. However, single-family construction spending remained 0.8% lower than a year ago. Multifamily construction spending stayed unchanged in March, staying in the downward trends that began in December 2023. Compared to March 2024, it was down 12.1%.

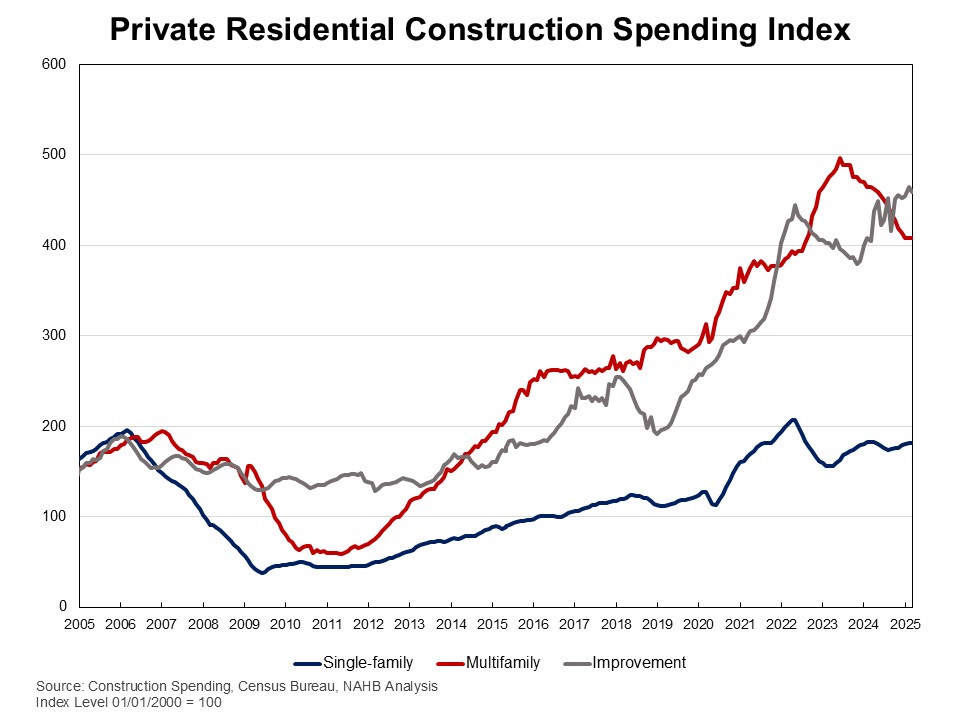

The NAHB construction spending index is shown in the graph below. The index illustrates how spending on single-family construction has slowed since early 2024 under the pressure of elevated interest rates and concerns over building material tariffs. Multifamily construction spending growth has also slowed down after the peak in July 2023. Meanwhile, improvement spending has increased its pace since late 2023.

Spending on private nonresidential construction was up 1.6% over a year ago. The annual private nonresidential spending increase was mainly due to higher spending for the class of power ($8.7 billion), followed by the manufacturing category ($8.1 billion).

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .