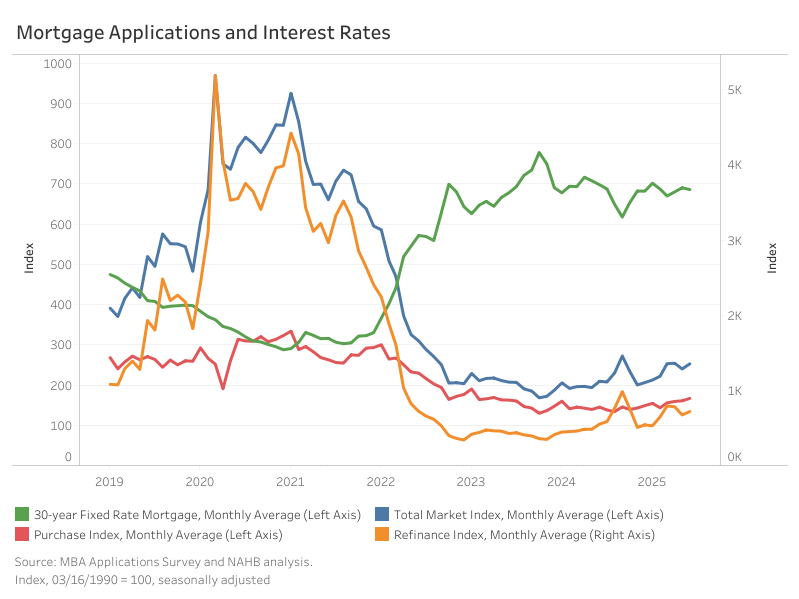

Mortgage application activity picked up in June, supported by a slight decline in interest rates. The Mortgage Bankers Association’s (MBA) Market Composite Index, which tracks mortgage application volume, rose 5.4% from May on a seasonally adjusted basis. Compared to June 2024, total applications were up 21.1%.

The average contract rate for 30-year fixed mortgages edged down by 4 basis points to 6.86%. In response, purchase applications increased 3.7% month-over-month, while refinance activity climbed 6.5%. On a year-over-year basis, the 30-year rate was 12 basis points lower, with purchase and refinance applications up 15.2% and 30.3%, respectively.

Loan sizes continued to trend lower. The average loan amount across all loan types declined 2% to $383,000. Purchase loans edged down 0.9% to $439,800, and refinance loans decreased 1.8% to $290,500. Adjustable-rate mortgage (ARM) loan sizes dropped 3.1% to $1.03 million.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .