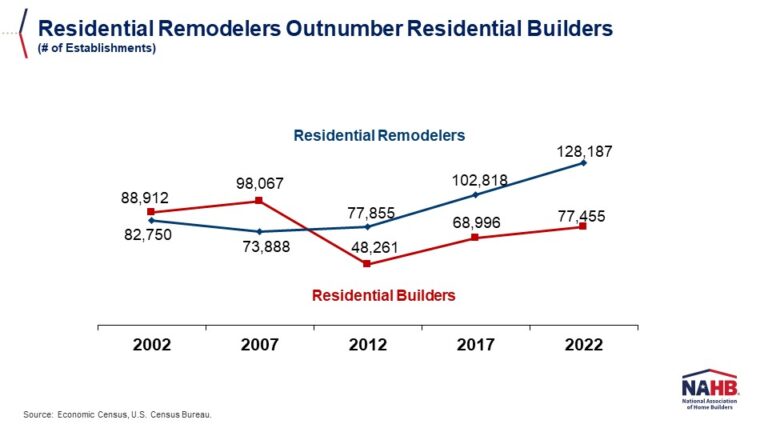

The number of residential remodelers in the U.S. has reached a record high of 128,187 establishments, 65% higher than the number of residential builders (single-family and multifamily), which stands at 77,455. These official government counts were released by the U.S. Census Bureau as part of its 2022 Economic Census, which tallies American businesses every five years (in years ending in 2 and 7).

Growth in the number of remodelers significantly outpaced that of builders between 2017 and 2022. In that 5-year span, the remodeler count increased by 25% (102,818 to 128,187), while the number of builders grew at half that pace–by 12% (68,996 to 77,455).

A starker dichotomy emerges when comparing 2022 counts to those in 2007, prior to the financial crisis and the ensuing housing recession. In that 15-year period, the official number of residential remodelers in the U.S. grew by 73% (73,888 to 128,187), while the official number of residential builders contracted by 21% (98,067 to 77,455).

Another way to analyze this data is by creating a combined universe of both builders and remodelers and then calculating each group’s share of the total. In 2022, for example, remodelers represented 62% of the total number of builders and remodelers in the U.S, while builders made up a minority share of 38%. Remodelers have accounted for at least 60% of this total in the last three Economic Census (2012, 2017, and 2022).

The last time builders comprised a majority share was in 2007, when they represented 57% of the combined total number of builders and remodelers in the country.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .