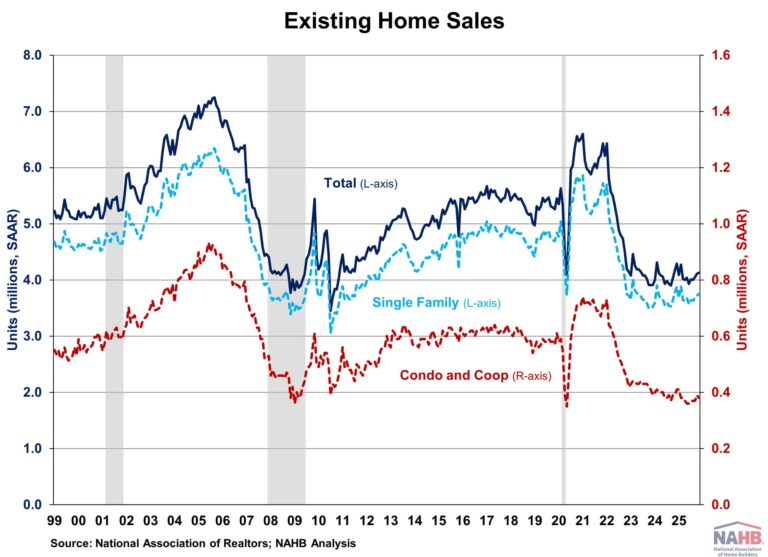

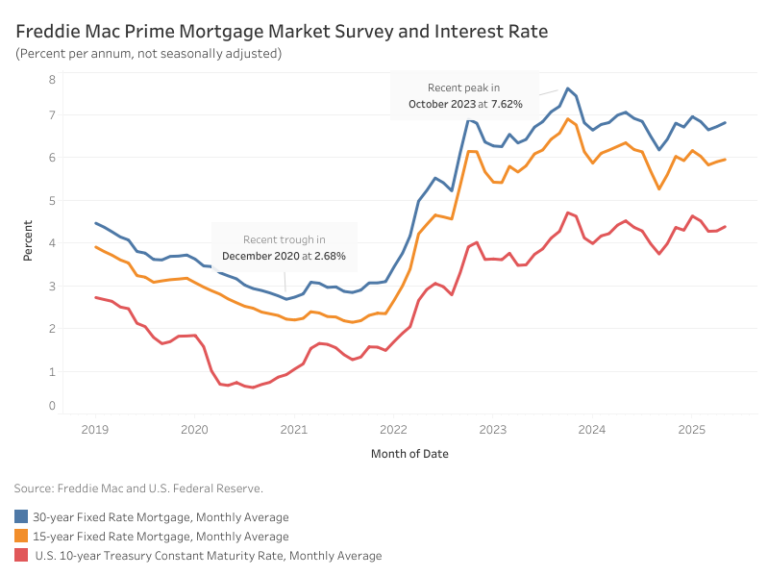

Existing home sales rose for the third consecutive month in November as lower mortgage rates continued to boost home sales, according to the National Association of Realtors (NAR). However, the increase remained modest as mortgage rates still stayed above 6% while down from recent highs. The weakening job market also weighed on buyer activity.

Meanwhile, inventory fell for the fourth consecutive month as homeowners with record-high housing wealth held back from listing properties. Relatively tight supply continued to push home prices higher and challenge housing affordability, even as wage growth outpaced home price gains.

Total existing home sales, including single-family homes, townhomes, condominiums, and co-ops, rose 0.5% to a seasonally adjusted annual rate of 4.13 million in November, the highest level since February. However, on a year-over-year basis, sales were 1.0% lower than a year ago.

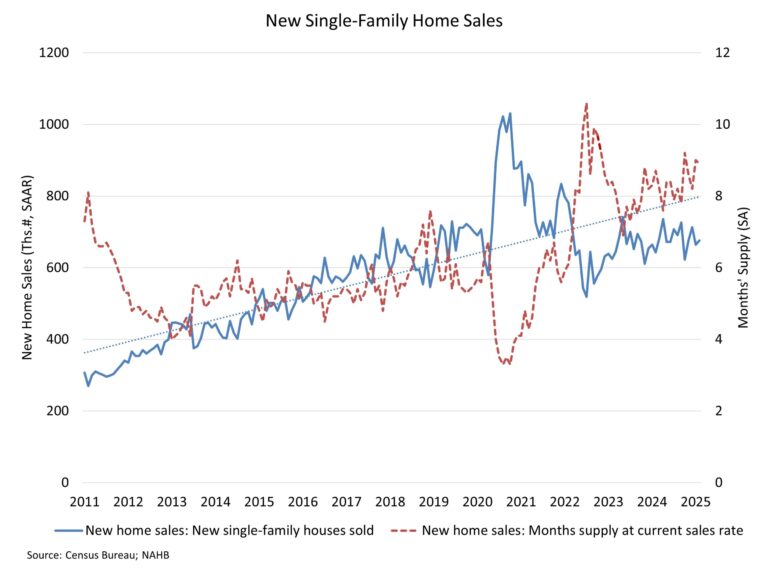

The existing home inventory level was 1.43 million units in November, down 5.9% from October but up 7.5% from a year ago. At the current sales rate, November unsold inventory sits at a 4.2-months’ supply, down from 4.4-months in October but up from 3.8-months in November 2024. Inventory between 4.5 to 6 months’ supply is generally considered a balanced market.

Homes stayed on the market for a median of 36 days in November, up from 34 days last month and 32 days in November 2024.

The first-time buyer share was 30% in November, down from 32% in October but unchanged from a year ago.

The November all-cash sales share was 27% of transactions, down from 29% in October but up from 25% a year ago. All-cash buyers are less affected by changes in interest rates.

The November median sales price of all existing homes was $409,200, up 1.2% from last year. This marks the 29th consecutive month of year-over-year increases. The median condominium/co-op price in November was up 0.1% from a year ago at $358,600. Recent gains for home inventory will put downward pressure on resale home prices in most markets in 2025.

Existing home sales in November were mixed across the four major regions. Sales rose in the Northeast (+4.1%) and South (+1.1%), fell in the Midwest (-2.0%), and remained unchanged in the West. On a year-over-year basis, sales were unchanged in the Northeast and South (2.8%), while down in the Midwest (-3.0%) and West (-1.3%).

The Pending Home Sales Index (PHSI) is a forward-looking indicator based on signed contracts. The PHSI rose from 74.9 to 76.3 in October. On a year-over-year basis, pending sales were 0.4% lower than a year ago, according to the National Association of Realtors’ data.

This article was originally published by a eyeonhousing.org . Read the Original article here. .