Personal income increased by 0.3% in June, following a 0.4% dip in May, according to the latest data from the Bureau of Economic Analysis. The gains in personal income were largely driven by higher wages and social benefits. However, the pace of personal income growth slowed from its peak monthly gain of 1.4% in January 2024.

Real disposable income, the amount remaining after adjusted for taxes and inflation, was unchanged in June, following a 0.7% decline in May. On a year-over-year basis, real (inflation-adjusted) disposable income rose 1.7%, down from a 6.5% year-over-year peak recorded in June 2023.

Spending also showed signs of softening. Personal consumption expenditures rose 0.3% in June, after staying flat in May. Real spending, adjusted to remove inflation, increased 0.1% in June, with expenditures on goods climbing 0.1% and spending on services up 0.1%.

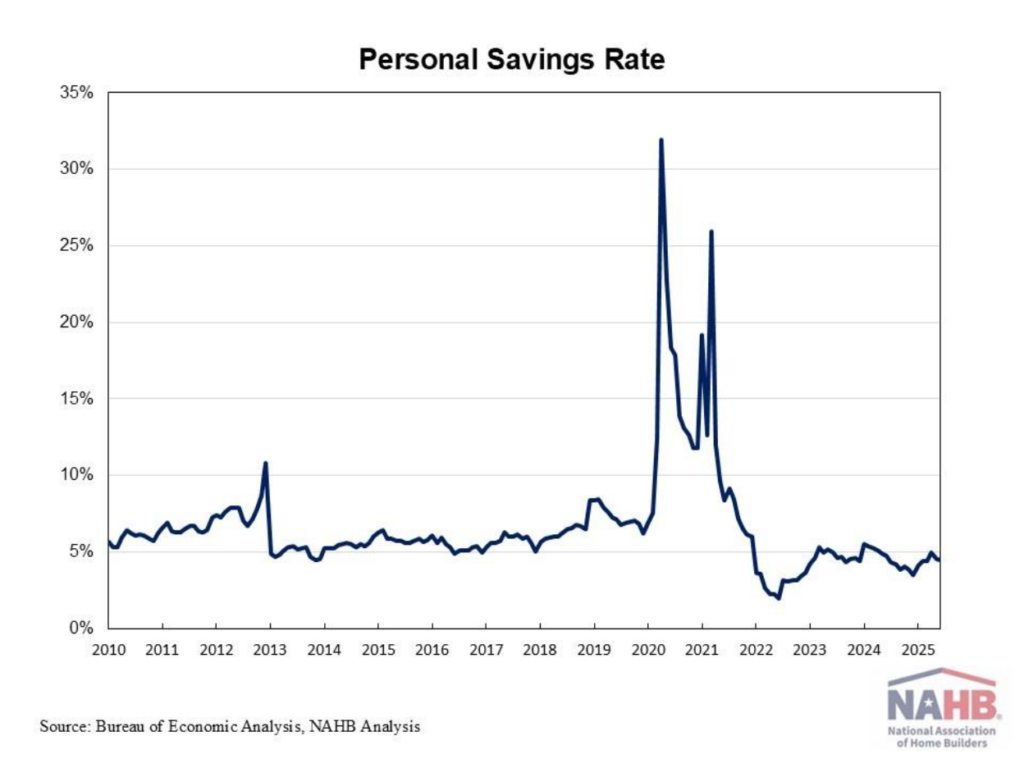

With income growth outpacing spending, the personal savings rate increased to 4.5% in June. But with inflation eroding compensation gains, people are dipping into savings to support spending. This trend will ultimately lead to a slowing of consumer spending.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .