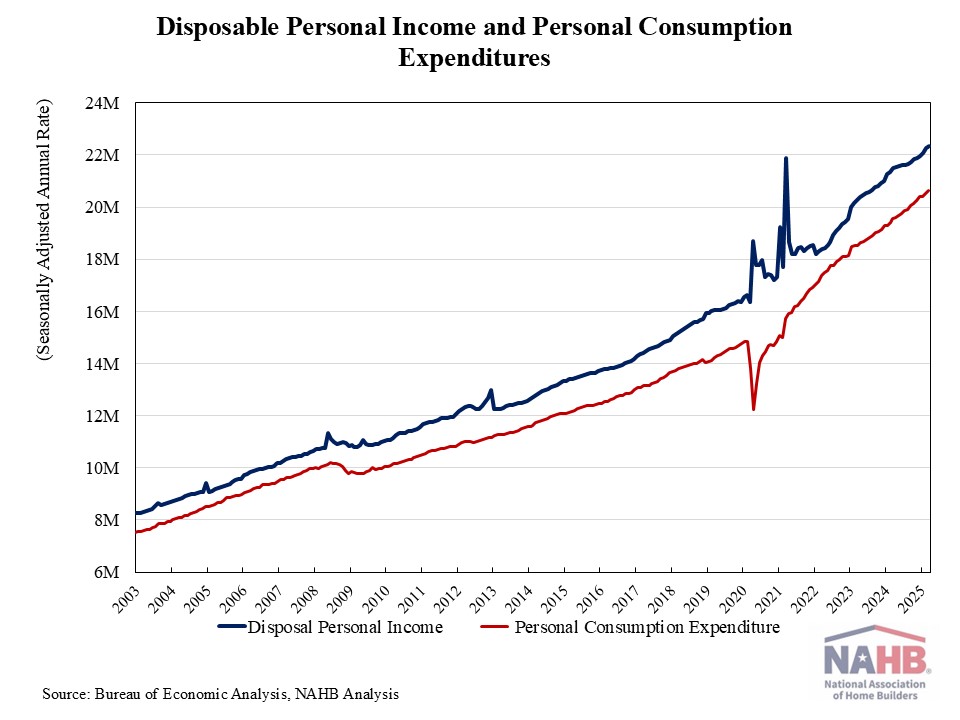

Personal income increased by 0.5% in March, following a 0.7% rise in February and a 0.6% gain in January, according to the latest data from the Bureau of Economic Analysis. The gains in personal income were largely driven by higher wages and salaries. However, the pace of personal income growth slowed from its peak monthly gain of 1.4% in January 2024.

Real disposable income, the amount remaining after adjusted for taxes and inflation, inched up 0.5% in March, following a 0.4% increase in February and 0.2% gain in January. On a year-over-year basis, real (inflation-adjusted) disposable income rose 1.7%, down from a 6.5% year-over-year peak recorded in June 2023. No adjustments were made to personal income for the federal employees’ deferred resignation program in March, as participants are still considered as employed and continue to receive compensations until their official separation from the federal government.

Meanwhile, personal consumption expenditures rose 0.7% in March, building on a 0.5% increase in February. Real spending, adjusted to remove inflation, increased 0.7% in March, with expenditures on goods climbing 1.3% and spending on services up 0.4%.

As spending outpaced personal income growth, the personal savings rate dipped to 3.9% in March. With inflation eroding compensation gains, people are dipping into savings to support spending. This trend will ultimately lead to a slowing of consumer spending.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .