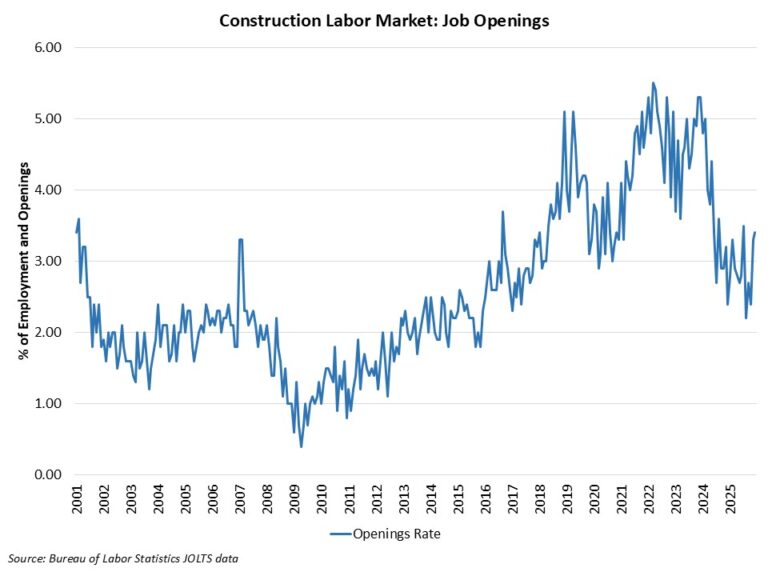

Running counter to the data for the full economy, the count of open, unfilled positions in the construction industry increased in December, per the delayed Bureau of Labor Statistics Job Openings and Labor Turnover Survey (JOLTS). The current level of open jobs is down measurably from two years ago due to declines in construction activity, particularly in housing.

The number of open jobs for the overall economy declined as the labor market weakened at the end of 2025, falling from 6.982 million in November to 6.542 million in December. The December reading was down from a year ago (7.508 million).

Previous NAHB analysis indicated that this number had to fall below eight million on a sustained basis for the Federal Reserve to move forward on interest rate reductions. With estimates remaining below eight million for national job openings, the Fed, in theory, should be able to cut further.

The number of open construction sector jobs increased from 284,000 in November to 292,000 in December. This total is higher compared to a year ago (205,000), although the reading is notably lower than two years ago. The chart below notes the declining trend that has been in place for unfilled construction jobs since the Fed raised the federal funds rate and home building weakened. While home building employment was declining during the second half of 2025, other subsectors of the construction industry have expanded (e.g. data centers).

The construction job openings rate increased to 3.4% in December, higher than the 3.2% rate estimated a year ago.

The layoff rate in construction declined to 1.5% in December. The quits increased to 1.5% for the month.

This article was originally published by a eyeonhousing.org . Read the Original article here. .