Builder confidence inched higher to end the year but still remains well into negative territory as builders continue to grapple with rising construction costs, tariff and economic uncertainty, and many potential buyers remaining on the sidelines due to affordability concerns.

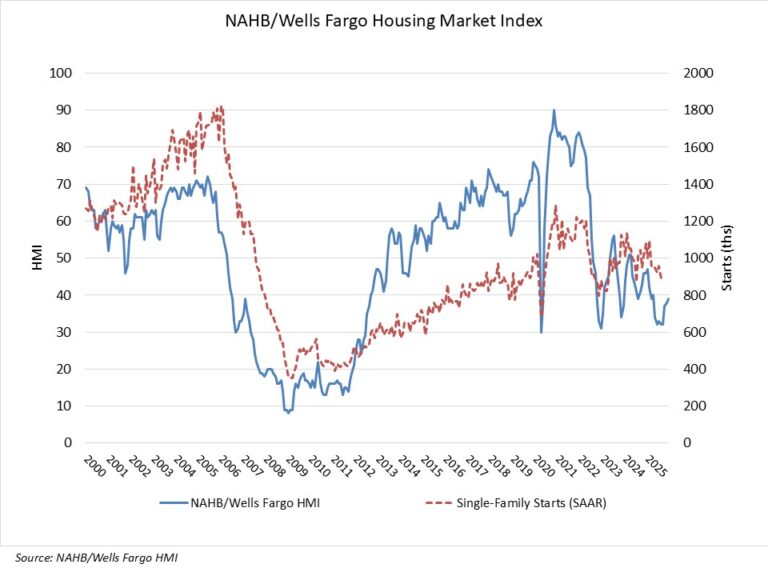

Builder confidence in the market for newly built single-family homes rose one point to 39 in December, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI). Sentiment levels were below the breakeven point of 50 every month in 2025 and ranged in the high 30s in the final quarter of the year.

Market conditions remain challenging with two-thirds of builders reporting they are offering incentives to move buyers off the fence.

In positive signs for the market, builders report that future sales expectations have been above the key breakeven level of 50 for the past three months and the recent easing of monetary policy should help builder loan conditions at the start of 2026. However, builders continue to face supply-side headwinds, as regulatory costs and material prices remain stubbornly high. Rising inventory also has increased competition for newly built homes.

In a further sign of ongoing challenges for the housing market, the latest HMI survey also revealed that 40% of builders reported cutting prices in December, marking the second consecutive month the share has been at 40% or higher since May 2020. It was 41% in November. Meanwhile, the average price reduction was 5% in December, down from the 6% rate in November. The use of sales incentives was 67% in December, the highest percentage in the post-Covid period.

Derived from a monthly survey that NAHB has been conducting for more than 40 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

The HMI index gauging current sales conditions increased one point to 42, the index measuring future sales rose one point to 52 and the gauge charting traffic of prospective buyers held steady at 26.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell one point to 47, the Midwest rose two points to 43, the South increased two points to 36 and the West gained four points to 34.

The HMI tables can be found at nahb.org/hmi.

Editor’s Note: With the official 2026 release schedule for the Survey of Construction still unavailable from the U.S. Census Bureau, NAHB confirms the HMI for January 2026 will be released on January 16. A schedule for the rest of the year will be available as soon as possible.

This article was originally published by a eyeonhousing.org . Read the Original article here. .