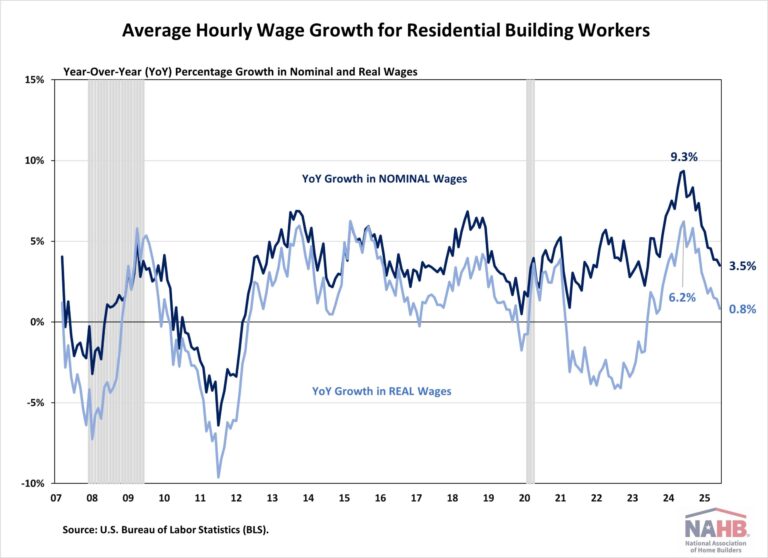

Both real and nominal wage growth for residential building workers slowed during the second quarter of 2025, reflecting a broader cooling in the construction labor market, according to the latest report from the U.S. Bureau of Labor Statistics (BLS).

In nominal terms, average hourly earnings (AHE) for residential building workers rose to $39.35 in June 2025, a 3.5% increase from $38.02 a year ago. This marks a continued deceleration in the year-over-year wage growth, which peaked at 9.3% in June 2024. The recent slowdown reflects a slowdown in residential construction activity and a decline in labor demand across the sector. Meanwhile, the number of open, and unfilled construction sector jobs has continued to trend downward, in line with the overall slowdown in housing activity.

Despite the slowdown in wage growth, residential building workers’ wages remain competitive:

11.4% higher than the manufacturing sector ($35.32/hour)

25.3% higher than the transportation and warehousing sector ($31.4/hour)

2.3% lower than the mining and logging sector ($40.29/hour)

Note:

Data used in this post relate to all employees in the residential building industry. This group includes both new single-family housing construction (excluding for-sale builders) and residential remodelers but does not include specialty trade contractors.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .