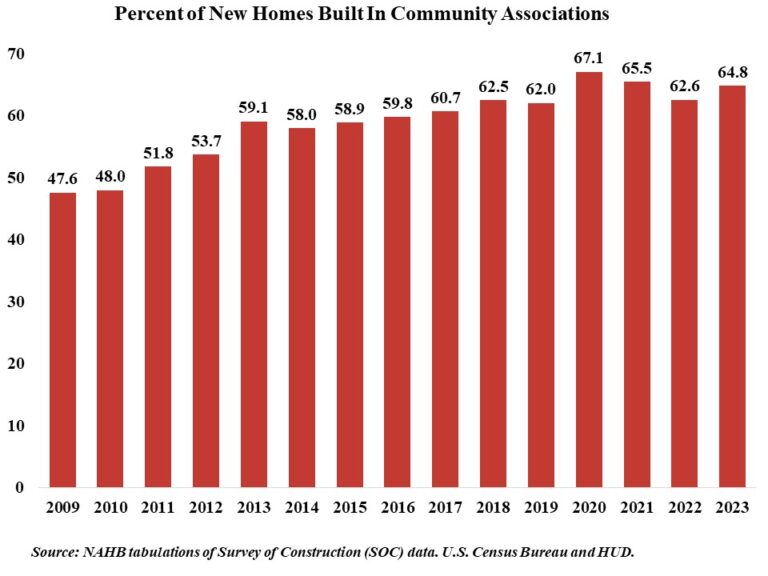

In 2023, 64.8% of all new single-family homes started were built within a community or homeowner’s association. This share increased from the 62.6% recorded in 2022, according to data tabulated from the Census Bureau’s Survey of Construction (SOC). This marks the third highest share since the beginning of the series in 2009, after the high point of 67.1% in 2020 and 65.5% in 2021. Prior to 2021, the share had been on a decade-long upward trend. In absolute numbers, a total of 601,558 homes were started in community associations in 2023.

The Census Bureau defines community or homeowner’s associations as “formal legal entities created to maintain common areas of a development and to enforce private deed restrictions; these organizations are usually created when the development is built, and membership is mandatory.”

A recent NAHB study, What Home Buyers Really Want, asked recent and prospective home buyers to rate the influence that 29 community features would have on their purchase decision. For more than 65% of buyers, being near retail space and park areas, and having walking/jogging trails are the most influential community features. In contrast, only 39% feel the same way about a homeowner’s association.

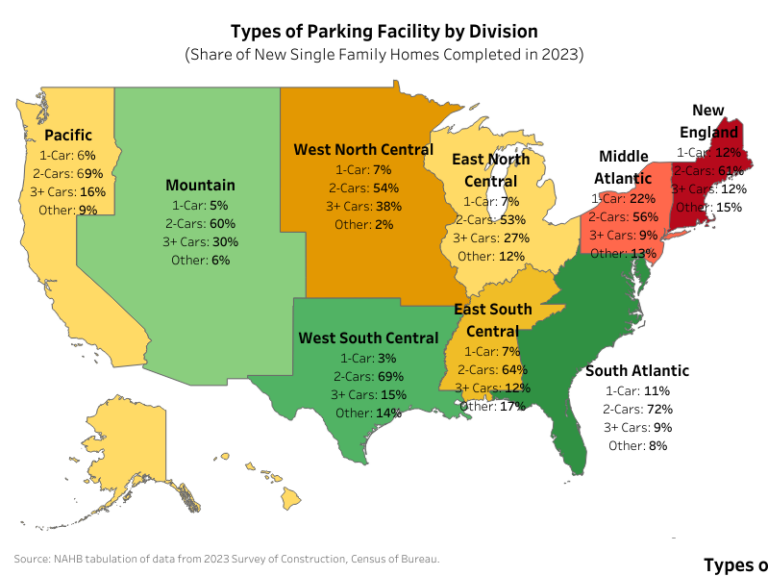

When analyzed by the nine census divisions, the highest share of new homes started within a homeowner’s association was in the Mountain Division, where 81.9% of new homes were in such communities. In the Middle Atlantic Division, on the other hand, the share was only 28.6%. The share of new homes started within a community across U.S. divisions are shown in the map below.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .