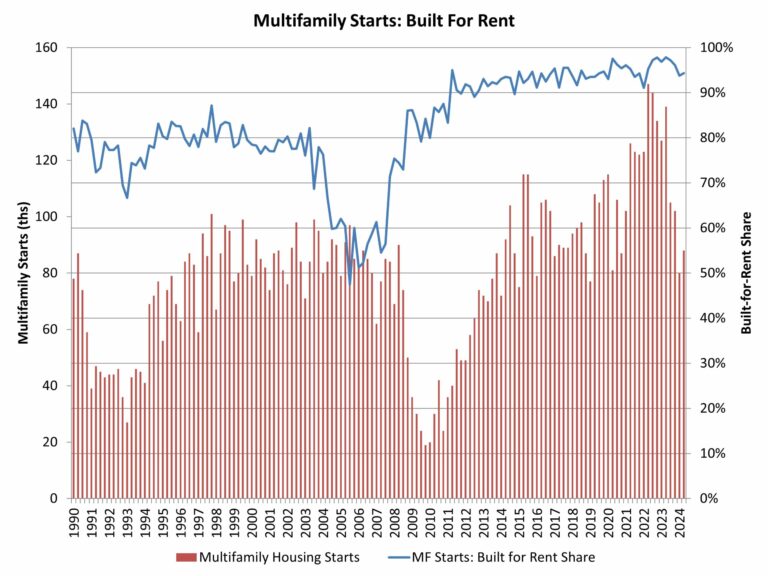

According to NAHB analysis of quarterly Census data, the count of multifamily, for-rent housing starts declined significantly during the second quarter of 2024. For the quarter, 88,000 multifamily residences started construction. Of this total, 83,000 were built-for-rent. This marks a notable 37% decline from the second quarter of 2023 for the multifamily built-for-rent category.

The market share of rental units of multifamily construction starts was flat at a still elevated 94% for the second quarter as the small condo market remained held back due to higher interest rates. In contrast, the historical low share of 47% was set during the third quarter of 2005, during the condo building boom. An average share of 80% was registered during the 1980-2002 period.

For the second quarter, there were just 5,000 multifamily condo unit construction starts.

An elevated rental share of multifamily construction is holding typical apartment size below levels seen during the pre-Great Recession period. According to second quarter 2024 data, the average square footage of multifamily construction starts was relatively unchanged at 1,034 square feet. The median declined to 955 square feet. These estimates are near multidecade lows.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .