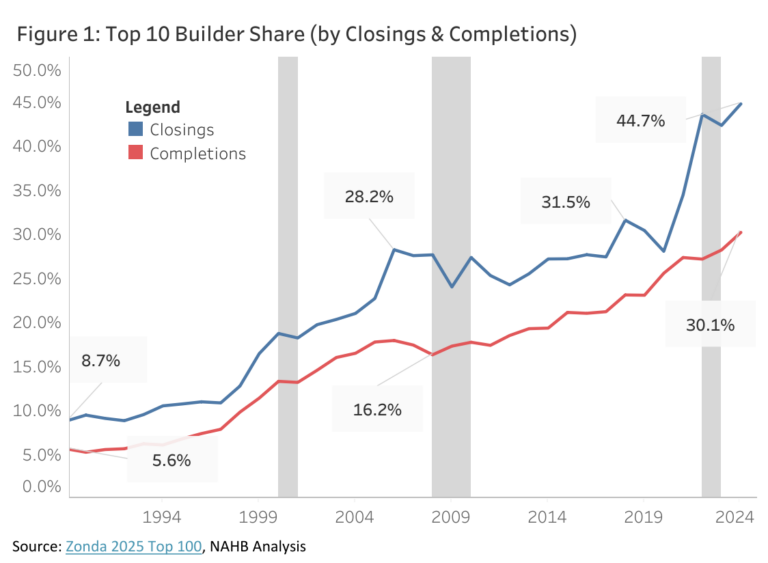

The top ten builders captured a record 44.7% of all new U.S. single-family home closings in 2024, up 2.4 percentage points from 2023 (42.3%). This is the highest share ever captured by the top ten builders since NAHB began tracking BUILDER magazine data on new single-family home closings in 1989. The 2024 share constitutes 306,932 closings out of 686,000 new single-family houses sold in 2024. However, closings by the top 10 builders only represent 30.1% of new single-family home completions, a wider measure of home building that covers not-for-sale home construction. Also of note, the top 15 builders accounted for more than half of all closings (51%) for the first time ever in 2024.

The top ten builder share has increased significantly –albeit unevenly– in the last 35 years. In 1989, the top ten builders accounted for only 8.7% of single-family home closings. By 2000, the share had more than doubled to 18.7%, growing to 28.2% by 2006 and 31.5% by 2018. After slight declines in 2019 and 2020, the share exceeded 40% for the first time in 2022 (43.5%) and reached a record high in 2024 (44.7%). (Figure 1).

Meanwhile, the top ten builder share by completions, has also trended upward, with a share of just 5.6% in 1989. It reached double digits for the first time in 1999 (11.3%) and rose to a cycle high of 17.9% in 2006. The share broke the 20% mark for the first time in 2015 (21.0%) and has continued to trend upward since, reaching an all-time high of 30.1% in 2024 (Figure 1).

The top five highest producing builders did not change from 2023 to 2024, with D.R. Horton maintaining its position as America’s largest single-family home builder. D.R. Horton captured 13.6% of the market with 93,311 closings, marking a fourth consecutive year with a market share above 10%, and a 23rd consecutive year atop the list. Results also show that 2024 marked the third year in a row where the top three builders accounted for more than a quarter (29.9%) of overall closings, with Lennar and PulteGroup achieving 11.7% and 4.6%, respectively. With 3.3% and 2.3% of overall closings, NVR and Meritage Homes ranked fourth and fifth on the list, respectively.

Notably, SH Residential Holdings (U.S. subsidiary of Sekisui House, a Japanese homebuilder, who acquired M.D.C. Holdings in 2024) broke into the top ten in 2024, ranking sixth on the list with 2.2% of the market. Clayton Properties Group, ranking 8th in 2023, fell out of the top 10 for the first time since 2019. KB Home (2.1%), Taylor Morrison (1.9%), Century Communities (1.6%), and Toll Brothers (1.6%) round out the top 10 builders for 2024 (Figure 2).

Builder Magazine also released Local Leaders data on the top 10 builders in the top 50 largest new-home markets in the U.S. where ranking is determined by the number of single-family permits, which NAHB will analyze in a later post.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .

Designer Kelsey Haywood of Haywoodmade Interiors had so much confidence in Suffield Green by Farrow & Ball that she drenched this Chicago sunroom in it. The color covers the walls, the trim and the ceiling.

“The way this color plays with the light throughout the day makes it a cheerful and yet very sophisticated green,” Haywood says. “It plays well with neutrals and brass.” The bold move of color drenching paid off. “This is one of my favorite sunrooms that we have done,” Haywood says.

Find a local interior designer on Houzz