With the Federal Reserve beginning an easing of monetary policy and builder sentiment improving, single-family starts posted a modest gain in September while multifamily construction continued to weaken because of tight financing and an ongoing rise in completed apartments.

Overall housing starts decreased 0.5% in September to a seasonally adjusted annual rate of 1.35 million units, according to a report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau.

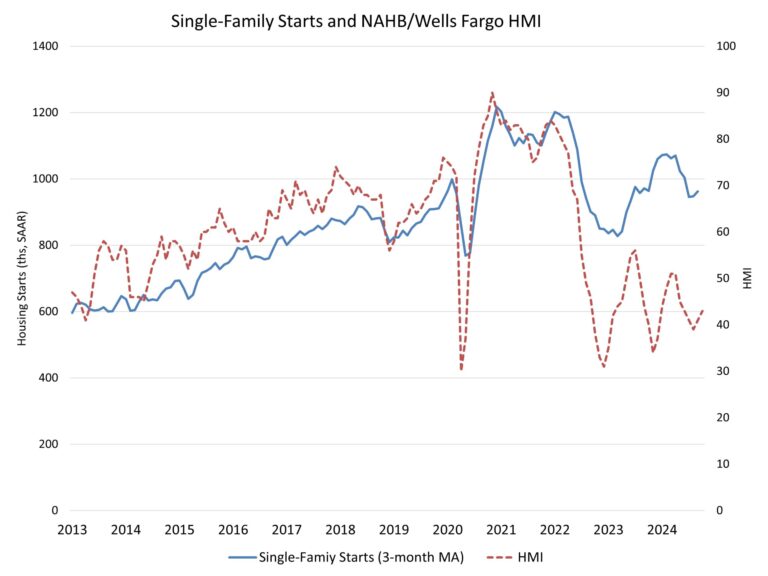

The September reading of 1.35 million starts is the number of housing units builders would begin if development kept this pace for the next 12 months. Within this overall number, single-family starts increased 2.7% to a 1.03 million seasonally adjusted annual rate. On a year-to-date basis, single-family construction is up 10.1%. The September gain for single-family home building mirrored an increase for the NAHB/Wells Fargo HMI.

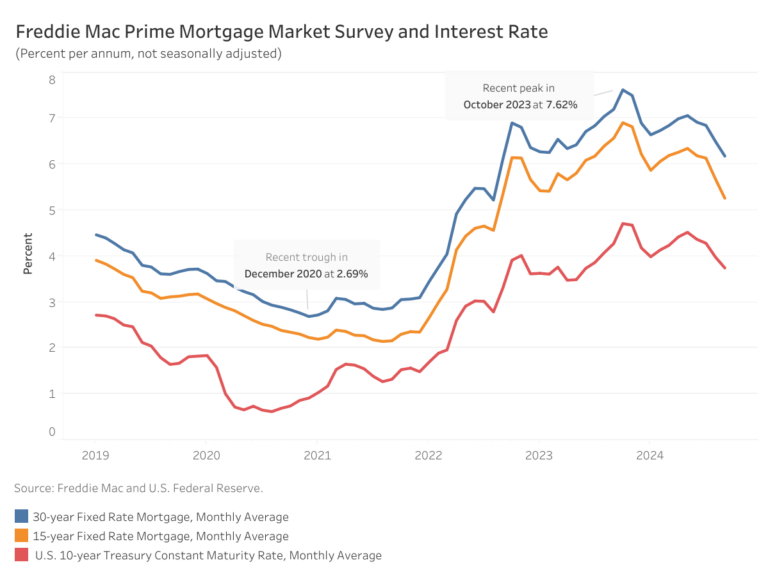

While single-family home building increased in September, higher mortgage interest rates in October are likely to place a damper on growth in next month’s data. Nonetheless, NAHB is forecasting a gradual, if uneven, decline for mortgage rates in the coming quarters, with corresponding increases for single-family construction.

The multifamily sector, which includes apartment buildings and condos, decreased 9.4% to an annualized 327,000 pace. This marks the weakest pace since May. Multifamily construction will remain weak as completions of apartments are elevated.

On a regional and year-to-date basis, combined single-family and multifamily starts are 9.0% higher in the Northeast, 2.0% lower in the Midwest, 4.6% lower in the South and 5.4% lower in the West.

Overall permits decreased 2.9% to a 1.43 million unit annualized rate in September. Single-family permits increased 0.3% to a 970,000 unit rate. Multifamily permits decreased 8.9% to an annualized 458,000 pace. This is the weakest reading since May.

Looking at regional data on a year-to-date basis, permits are 0.8% higher in the Northeast, 2.6% higher in the Midwest, 2.2% lower in the South and 5.1% lower in the West.

The number of single-family homes under active construction totaled 642,000 in September. After stabilizing recently, this is down just 4.5% from a year ago. The number of multifamily units under construction declined 3.4% in September to an 842,000 total. This is 16.5% lower than a year ago and is the smallest count since February 2022.

As a sign of the reversal for multifamily construction, the seasonally adjusted annual rate of multifamily construction was 680,000 in September. This was roughly twice the pace of multifamily starts, meaning for every two apartments finishing construction, only one new unit began construction. The pace of multifamily completions was up 41% compared to a year ago.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .

1. Cozy up with warm layers. Have you felt that first nip in the air yet? When you do, think about swapping out lighter-weight bedding for flannel sheets and fluffy duvets. Bring added warmth to the other rooms in your house with throws and pillows in rich fabrics like wool, velvet or faux fur. Thicker area rugs and curtains not only feel cozier, but they also can actually help your home feel warmer — and cut down on your energy bills.

Find bedding in the Houzz Shop