Builder sentiment edged higher to begin the year on hopes for an improved economic growth and regulatory environment. At the same time, builders expressed concerns over building material tariffs and costs and a larger government deficit that would put upward pressure on inflation and mortgage rates.

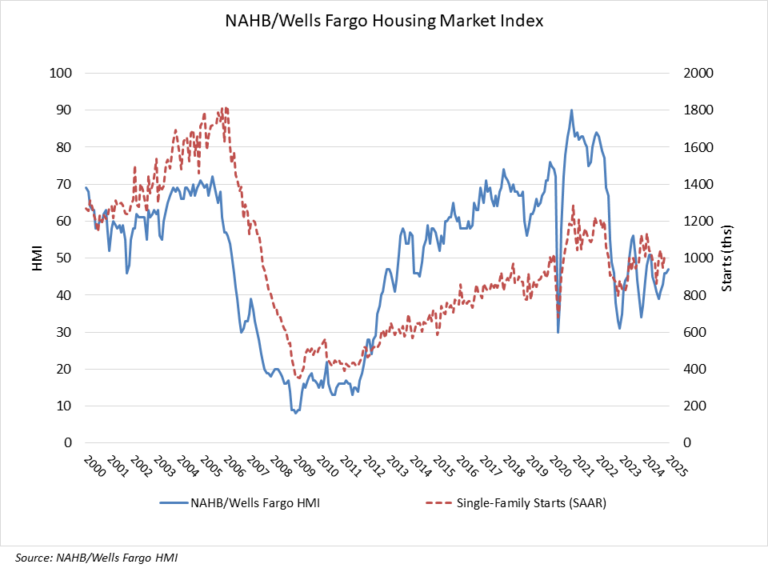

Builder confidence in the market for newly built single-family homes was 47 in January, up one point from December, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI).

Builders are facing continued challenges for housing demand in the near-term, with mortgage rates up from near 6.1% in late September to above 6.9% today. Land is expensive and financing for private builders remains costly. However, there is hope that policymakers are taking the impact of regulatory hurdles seriously and will make improvements in 2025.

NAHB is forecasting a slight gain for single-family housing starts in 2025, as the market faces offsetting upside and downside risks from an improving regulatory outlook and ongoing elevated interest rates,. And while ongoing, but slower, easing from the Federal Reserve should help financing for private builders currently squeezed out of some local markets, builders report cancellations are climbing as a direct result of mortgage rates rising back up near 7%.

The latest HMI survey also revealed that 30% of builders cut home prices in January. This share has been stable between 30% and 33% since last July. Meanwhile, the average price reduction was 5% in January, the same rate as in December. The use of sales incentives was 61% in January. This share has remained between 60% and 64% since last June.

Derived from a monthly survey that NAHB has been conducting for more than 35 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

The HMI index gauging current sales conditions rose three points to 51 and the gauge charting traffic of prospective buyers posted a two-point gain to 33. The component measuring sales expectations in the next six months fell six points to 60 because of the elevated interest rate environment. While this serves as a cautionary note, the future sales component is still the highest of the three sub-indices and well above the breakeven level of 50.

Looking at the three-month moving averages for regional HMI scores, the Northeast increased five points to 60, the Midwest moved one point higher to 47, the South posted a one-point gain to 46 and the West fell one point to 40. The HMI tables can be found at nahb.org/hmi.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .