While new homes remain largely unaffordable, builder efforts to improve housing affordability paid dividends in the second quarter of 2025, according to the latest data from the National Association of Home Builders (NAHB)/Wells Fargo Cost of Housing Index (CHI). The CHI results from the second quarter of 2025 show that a family earning the nation’s median income of $104,200 needed 36% of its income to cover the mortgage payment on a median-priced new home. Low-income families, defined as those earning only 50% of median income, would have to spend 71% of their earnings to pay for the same new home.

The figures are somewhat higher for the purchase of existing homes in the U.S., showing that it took more income to buy an existing home. A typical family would have to pay 37% of their income for a median-priced existing home while a low-income family would need to pay 74% of their earnings to make the same mortgage payment.

The second quarter of 2025 marked the largest historical gap where existing home prices exceeded those of new homes. Different dynamics in the two sectors are responsible for the price divergence. On one hand, builders are offering incentives for smaller homes on smaller lots, with streamlined options and features, and thus shifting their production toward less expensive homes. Many existing homeowners, meanwhile, are locked-in their homes by low mortgage rates, limiting resale inventory, and causing existing home prices to increase.

The percentage of a family’s income needed to purchase a new home was unchanged at 36% from the first to the second quarter, while the low-income CHI fell from 72% to 71% over the same period. Median new home prices edged down 1%, from $416,900 in Q1 2025 to $410,800 in Q2 2025, while the average 30-year mortgage rate slipped from 6.91% to 6.88%.

Affordability of existing homes, on the other hand, edged lower for both median- and low-income families between the first and second quarters. Median existing home prices rose 7% during this period, from $402,300 to $429,400. The share of income needed to pay for an existing home rose from 35% to 37% for a typical family and from 70% to 74% for a low-income family during this period.

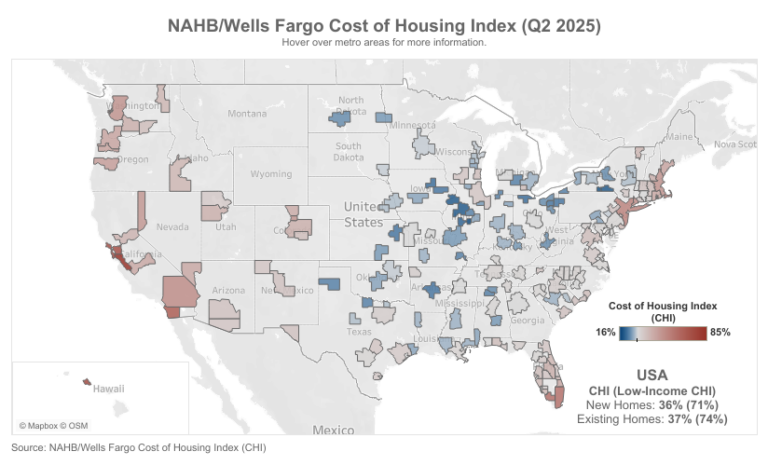

CHI is also available for 175 metropolitan areas, calculating the percentage of a family’s income needed to make the mortgage payment on an existing home based on the local median home price and median income in those markets.

In 10 out of 175 markets in the second quarter, the typical family is severely cost-burdened (must pay more than 50% of their income on a median-priced existing home). In 85 other markets, such families are cost-burdened (need to pay between 31% and 50%). There are 80 markets where the CHI is 30% of earnings or lower.

The Top 5 Severely Cost-Burdened Markets

San Jose-Sunnyvale-Santa Clara, Calif., was the most severely cost-burdened market on the CHI, where 93% of a typical family’s income is needed to make a mortgage payment on an existing home. This was followed by:

Urban Honolulu, Hawaii (73%)

San Francisco-Oakland-Fremont, Calif. (72%)

San Diego-Chula Vista-Carlsbad, Calif. (67%)

Naples-Marco Island, Fla. (60%)

Miami-Fort Lauderdale-Palm Springs, Fla. (60%)

Low-income families would have to pay between 119% and 186% of their income in all six of the above markets to cover a mortgage.

The Top 5 Least Cost-Burdened Markets

By contrast, Decatur, Ill., was the least cost-burdened markets on the CHI, where typical families needed to spend just 17% of their income to pay for a mortgage on an existing home. Rounding out the least burdened markets are:

Elmira, N.Y. (18%)

Peoria, Ill. (19%)

Davenport-Moline-Rock Island, Iowa-Ill. (19%)

Binghamton, N.Y. (19%)

Low-income families in these markets would have to pay between 33% and 38% of their income to cover the mortgage payment for a median-priced existing home.

Visit nahb.org/chi for tables and details.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .