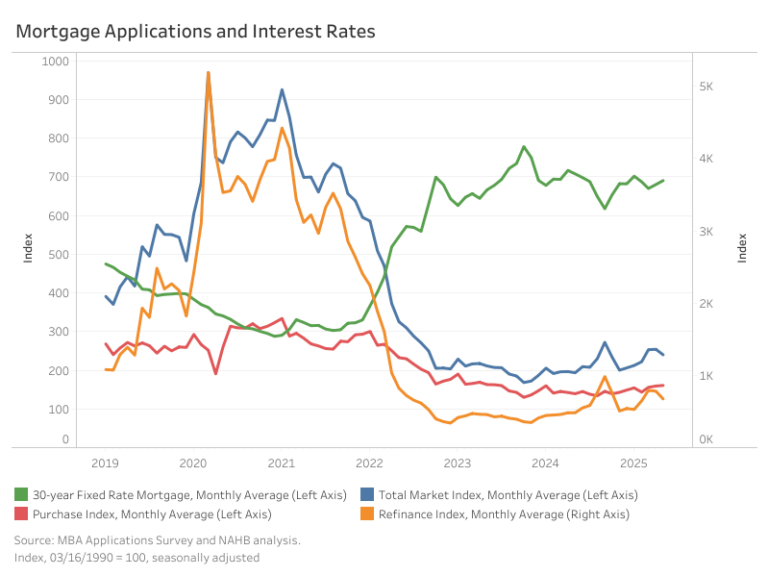

Mortgage loan applications declined in May, driven by a drop for refinancing activity. According to the Mortgage Bankers Association (MBA) weekly survey, the Market Composite Index, which measures mortgage application volume, fell 5.5% month-over-month on a seasonally adjusted (SA) basis. Despite the monthly dip, application volume remains 23.7% higher than in May 2024.

The average 30-year fixed mortgage rate rose for the second consecutive month, climbing 10 basis points to 6.9%. Purchase activity remained resilient, posting a modest 1.3% monthly gain from the previous month, while the Refinance Index declined 13.7% (SA). Compared to a year ago, mortgage rates are still 18 basis points lower, with purchase and refinance applications up 15.8% and 39.8%, respectively.

Average loan sizes also declined. In May, the average loan amount for the overall market, which includes purchases and refinances, declined 3.1% to $390,800. Purchase loan sizes stayed flat at $443,600, while refinance loan sizes dropped 12.8% to $296,000. The average size for adjustable-rate mortgages (ARMs) ticked up 0.5%, from $1.05 million to $1.06 million.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .