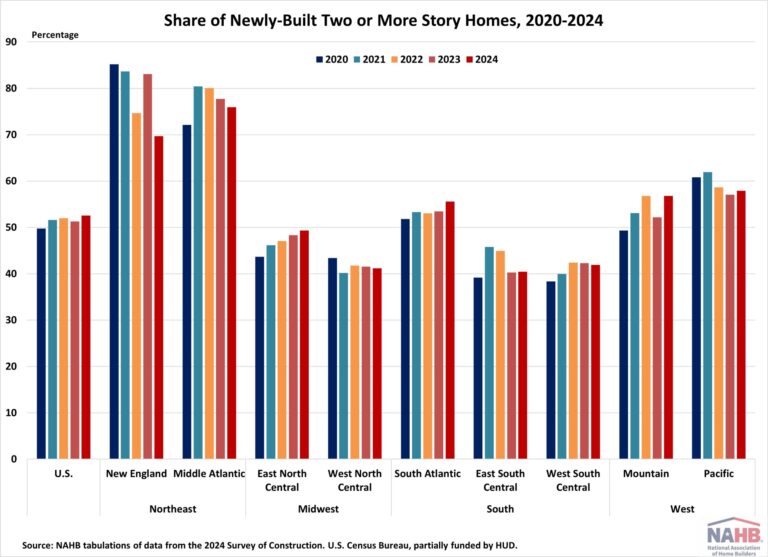

Over half of new single-family homes built in 2024 were two or more stories, according the recent release of the Census Bureau’s Survey of Construction (SOC). After declining in 2023, the share of homes started with two or more stories increased again in 2024, continuing the upward trend in place since 2020.

Nationwide, the share of new homes with two or more stories rose from 51.3% in 2023 to 52.5% in 2024, while the share of new homes with one story fell from 48.7% to 47.5%. Nationally, there were more multi-story homes built in 2024, however, this share varied significantly across the nation.

New homes started in the Midwest and South generally showed a stronger preference for single-story homes. In the Midwest (West North Central and East North Central), 58.8% and 50.7% of new homes started were one story, while in the South (East South Central and West South Central), the shares were 59.5% and 58.1%. However, the South Atlantic division was an exception, with one story homes falling to 44.4%, the lowest since 2019.

Although single story homes are more common in the Midwest and South, their shares declined in 2024 across the East North Central (Midwest), South Atlantic (South) and East South Central (South). This suggests a slow upward trend in two or more story homes across the South after COVID.

Following the national trend, five of the nine divisions saw a greater share of newly-built two or more story homes. The highest two or more story shares of new homes were concentrated in the Northeast and West, with Middle Atlantic and New England at 75.9% and 69.7%, while the Pacific and Mountain reached 57.9% and 56.8%, respectively. However, both Northeast divisions declined from 2023 levels, with New England dropping to its lowest two or more story share since NAHB started tracking in 2017. Meanwhile, new homes started with two or more stories in the Mountain and Pacific divisions both experienced increases in their two or more stories shares.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .

Construction Firms

1. Business activity outlook increased. The Expected Business Activity Indicator, related to project inquiries and new committed projects, increased by 10 points, to 62, for the fourth quarter of 2024, from 52 for the third quarter of 2024. This means more construction firms anticipate quarter-over-quarter growth than anticipate a decline.

Expectations for project inquiries increased by 7 points, to 59 (from 52 for Q3), and expectations for new committed projects increased by 12 points, to 64 (from 52 for Q3).

Both build-only and design-build firms are more optimistic for Q4 than they were for the previous quarter. The expected activity indicator for build-only firms increased 9 points, to 62 (from 53 for Q3), and for design-build firms it increased 10 points, to 61 (from 51 for Q3).

The indicator is based on survey questions about whether businesses expect the number of project inquiries and new projects to increase, decrease or remain unchanged in the coming three months compared with the previous three months.