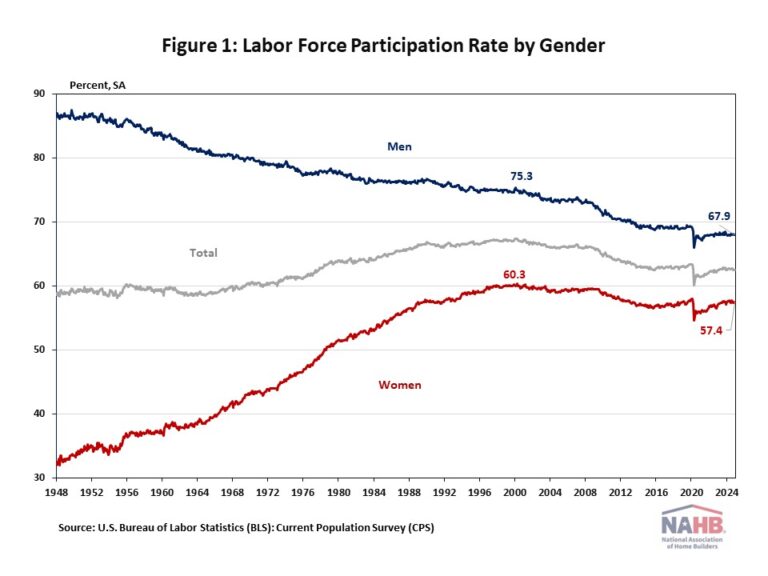

A key indicator of the labor market is the labor force participation rate. This rate is the percentage of working-age adults in a population who are working or looking for work. The rate is a critical measure connected to both housing demand and housing supply (via the construction labor force).

According to the Employment Situation Summary reported by the Bureau of Labor Statistics (BLS), the labor force participation rate remained at 62.5% for the third month in December 2024. After the labor force participation rate reached 67.3% at the beginning of 2000, it has been trending lower. When COVID-19 hit the labor market, the labor force participation rate dropped dramatically from 63.3% in February 2020 to 60.1% in April 2020. The latest labor force participation rate remains below its pre-pandemic levels of 63.3% at the beginning of 2020.

The participation rate is directly connected to the supply of labor. Labor supply varies across different demographic groups, such as age, gender, race, and educational attainment.

Gender

Over time, labor force participation changed dramatically by gender due to evolving societal norms around gender roles. Historically, women experienced a significant increase in labor force participation while men’s participation rates declined. However, over the past 20 years both genders’ labor force participation rates have moved in parallel and been trending downwards. Women’s labor force participation rate is 2.9 percentage points below the peak level in 2000 of 60.3%, while men’s labor force participation rate is 7.4 percentage points lower than the level in 2000 of 75.3%.

According to the latest data from the Current Population Survey (CPS), women currently make up roughly half of the U.S. labor force, representing about 47% of the labor force market. By industry, women accounted for more than half of all workers within several sectors in 2023, such as education and health services (74.4%), other services (53.3%), financial activities (51.1%), and leisure and hospitality (50.8%). Comparably, women were substantially underrepresented (relative to their share of total employment) in manufacturing (29.5%), agriculture (29.3%), transportation and utilities (24.3%), mining (15.3%), and construction (10.8%).

Men tend to have a higher labor force participation rate than women historically, even though this gap has narrowed from 54.7 percentage points in January 1948 to a difference of 10.5 percentage points in December 2024.

Age

The labor force participation rate differs across age groups as well. People ages 65 and older had the lowest labor force participation rate of 19.2%, followed by the youngest age group (16-19 years old) with a participation rate of 36.9%.

Among all age groups, workers aged 25-54, also known as prime-age workers, have the highest labor force participation rate of 83% in 2023. They form the core of the U.S. labor force, accounting for nearly two-thirds (63.8%) of the total labor force. Prime-age workers’ labor force participation rate has fully recovered from the COVID-19 pandemic, surpassing the prior peak of February 2020. The high labor force participation among prime-age men and the rapid increase in prime-age women’s labor force participation contributed to the increase in the labor force over time. By December 2024, prime-age women’s participation rate had hovered near its highest level of 78.1% on record, and 89.0% of prime-age men stayed in the labor force market.

Race and Ethnicity

Labor force participation varies among the largest race and ethnic groups living in the United States, and each group’s labor participation differs according to their gender as well.

Men had a higher labor force participation rate than women in each racial and ethnic group. Among men ages 16 years and over, Hispanic men were the most likely to be in the labor force, with a participation rate of 75.1%, followed by Asian men (76.8%), White men (68.2%), and Black men (65.6%). Among women ages 16 and over, Black women (61.0%) were most likely to participate in the labor force, followed by Hispanic women (58.7%), Asian women (58.1%), and White women (56.5%).

Educational Attainment

Higher levels of educational attainment are generally associated with higher labor force participation rates and lower unemployment rates. It is true for both men and women, and the four selected racial and ethnic groups that people with higher educational attainment tend to have greater employment opportunities and potentially later retirement ages.

With the same level of educational attainment, men are more likely to work than women. Among men with less than a high school diploma, the labor force participation rate was 59.4%, compared to a 34.3% participation rate for women with the same level of educational attainment. The gap of the labor force participation rate between men and women narrows as people achieve higher educational attainment. Women with the highest broad level of education (a bachelor’s degree or higher) have a 69.6% participation rate, a 7.3 percentage point difference from men with the same level of education (76.9%).

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.