Private residential construction spending inched up 0.2% in September, according to the Census Construction Spending data. The September report shows a 4.1% rise compared to a year ago.

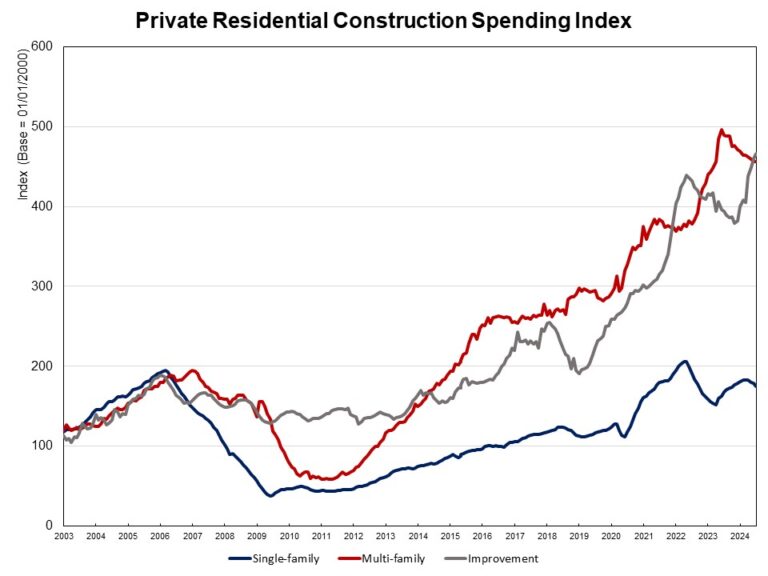

The monthly increase in total private construction spending for September was largely due to more spending on single-family construction. Spending on single-family construction rose by 0.4% in September. This broke a five-month streak of declines, aligning with the modest gains in single-family starts during September. Compared to a year ago, spending on single-family construction was 0.9% higher.

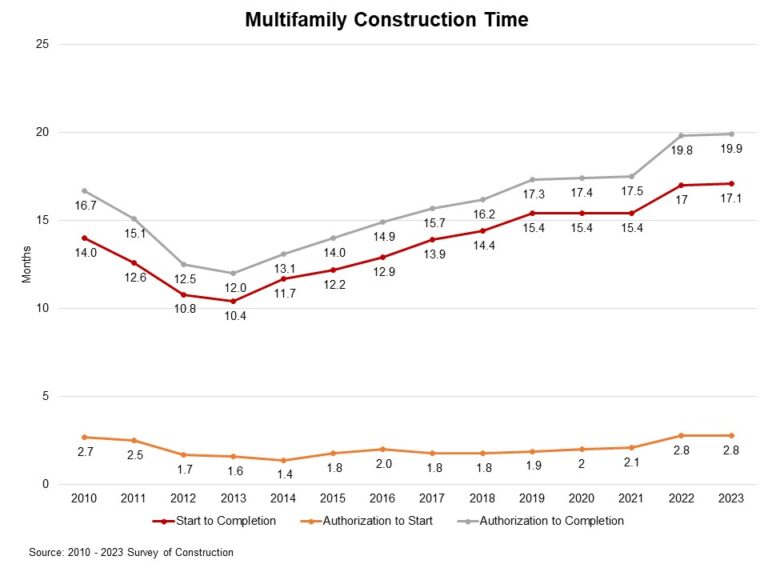

In contrast, multifamily construction spending continued to decline, edging down 0.1% in September after a dip of 0.3% in August. Year-over-year, spending on multifamily construction was down 8.1%, as there is an elevated level of apartments under construction being completed. Meanwhile, private residential improvement spending stayed flat for the month and was 13.5% higher than a year ago.

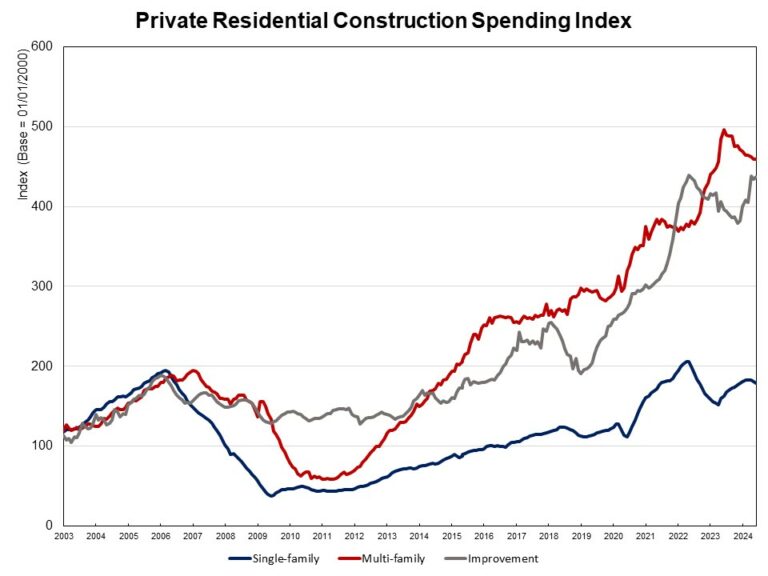

The NAHB construction spending index is shown in the graph below. The index illustrates how spending on single-family construction has slowed since early 2024 under the pressure of elevated interest rates. Multifamily construction spending growth has also slowed down after the peak in July 2023. Meanwhile, improvement spending has increased its pace since late 2023.

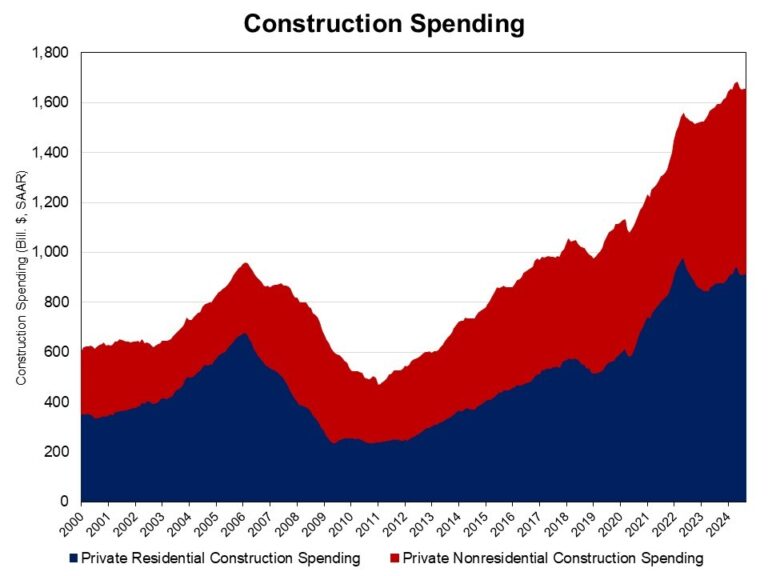

Spending on private nonresidential construction was up 3.5% over a year ago. The annual private nonresidential spending increase was mainly due to higher spending for the class of manufacturing ($39.4 billion), followed by the power category ($6.9 billion).

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .