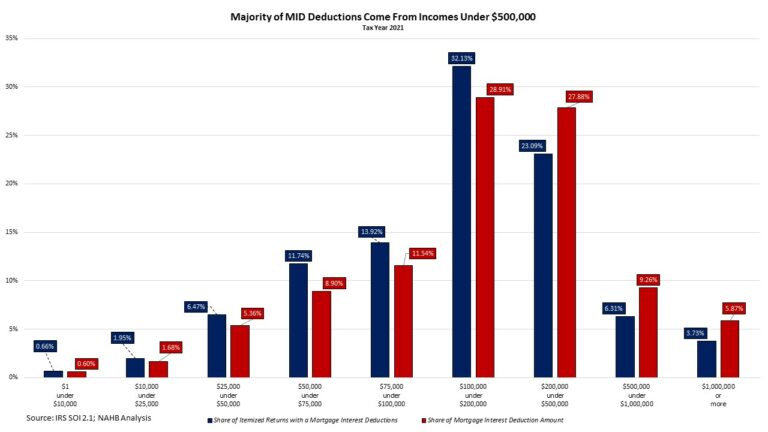

Since the passage of the Tax Cuts and Jobs Act (TCJA) in 2017, tax returns that itemize Schedule A deductions, such as the mortgage interest deduction (MID) , have fallen significantly with only 9.6% of all returns using an itemized deduction in tax year 2021. In 2017, the share of returns claiming an itemized deduction was 30.9%. Taxpayers who do not itemize their tax returns claim the standard deduction instead, and thus do not directly benefit from deductions such as the MID.

Looking across different adjusted gross income — or AGI, which is a measure of total income minus adjustments, such as deductions — levels , the prevalence of itemizing has fallen for all AGI levels. In 2017, five AGI levels had over half of tax returns claiming an itemized deduction. In contrast, in 2021 (the latest published IRS Statistics of Income data) only the two highest AGI levels had over half of returns claiming an itemize deduction.

The TCJA significantly increased the standard deduction and placed a limit of $10,000 on the state and local income tax (SALT) deduction . These two factors contributed to the trend of fewer itemized returns since 2017. Moreover, these changes explain why the use of the mortgage interest deduction has grown less progressive since 2017. Namely, the mortgage interest deduction can only be claimed through itemizing. So fewer itemizing taxpayers has led to fewer home owners utilizing the mortgage interest deduction, particularly at lower AGI levels.

Standard Deduction vs. Itemized Deduction

The total number of returns filed in 2021 was 159.5 million, while the number of returns with itemized deductions stood at just 14.8 million returns. These returns totaled an estimated $659.7 billion in itemized deductions. The total amount of the standard deduction claimed stood at an estimated $2.5 trillion in 2021 — well above the itemization amount, as significantly more taxpayers utilized the standard deduction.

Depicted in the graph above, there is a distinctive difference between the share of returns in a particular AGI level and its proportion of the total adjusted gross income. Levels below $100,000 constitute 77.2% of all returns, but only make up 30.9% of the total adjusted gross income. Levels above $100,000 constitute 22.8% of all returns while making up 69.1% of the total adjusted gross income.

Among returns that utilized the itemized deduction, most fell in the $100,000-$200,000 AGI class, with 30.4% claiming itemized returns. Despite this, the $1 million AGI level make up 29.6% of the total itemization deduction amount — the highest level of deduction amounts — but only constituted 4.1% of itemized returns.

In contrast to the itemized tax returns, most tax returns claiming the standard deductions were in the lower AGI range between $1-100,000 (75.3%). This AGI range also received the highest share of the total standard deduction amount (75.4%). The standard deduction return distribution follows more closely to that of all returns when compared to itemized returns as far fewer taxpayers utilize itemized deductions and those who do tend to be in higher income groups.

Mortgage Interest Deduction

After the passage of the 16th amendment, the first income tax code written by Congress allowed for the deduction of interest paid on many debts ranging from business to personal debts, including mortgages. The mortgage interest deduction notably expanded following World War II. Homeownership became an important wealth building tool for a vast majority of Americans during this period.

The current principal limit of the mortgage interest deduction stands at $750,000 ($375,000 if married filing separately), meaning taxpayers can deduct interest on the first $750,000 of debt secured by the taxpayer’s main home or second home . Interest on home equity loans and lines of credit are deductible only if the funds are used to buy, build or substantially improve a taxpayer’s home up to a $100,000 limit.

After the expiration of the 2017 tax rules in 2025, the mortgage interest deduction will return to prior law, in which the principal limit was $1 million, and home owners will be allowed to deduct interest on the first $100,000 of home equity debt regardless of the purpose of the debt. (However, AMT rules complicate this general rule somewhat.) It is important to note that the current principal limit is not indexed for inflation, which is a policy shortcoming given the post-COVID rise in home prices.

Among tax returns that were itemized in 2021, 11.5 million (76.6%) claimed the mortgage interest deduction. The total amount of mortgage interest deducted was $143.5 billion, which includes points. (If debt predates 2017, deduction is allowed for points) According to the Bureau of Economic Analysis, total mortgage interest paid in 2021 — deducted and non-deducted together — was $458.2 billion , which amounts to around 31.3% of total mortgage interest payments claimed as a tax deduction in 2021.

Across income groups, the group with the highest mortgage interest deduction amount was for incomes between $100,000-$200,000 at a 28.9% share of the total. The $200,000-$500,000 income group deducted the second largest share at 27.9%. Nonetheless, the vast majority (84.9%) of mortgage interest deducted was from itemizers with incomes under $500,000.

Given that it is much more likely for itemizers to be from higher income groups, specifically AGI levels greater than $500,000, it is perhaps surprising that most of the mortgage interest deduction claimed accrued to individuals making less than $500,000 as these taxpayers typically use itemized deductions less frequently.

Proposal to Expand the Mortgage Tax Benefit: A Tax Credit

In 2021, there were an estimated 83.4 million owner-occupied housing units with 51.1 million holding a mortgage. A housing tax credit would allow vastly more households to receive a tax benefit from owning a home than, as only approximately 11 million currently do by deducting mortgage interest on their tax returns.

With fewer taxpayers itemizing, what was once an effective and broadly claimed tax incentive no longer serves its original purpose to make homeownership more affordable for the middle-class. NAHB believes the mortgage interest deduction should be updated to reflect today’s tax code and better serve the segment of prospective home owners who face unprecedented affordability challenges. A well-structured housing tax incentive, such as a mortgage interest credit, would help achieve this policy goal.

NAHB supports converting the mortgage interest deduction into a targeted, ongoing homeownership tax credit, which could be claimed against mortgage interest and property taxes paid. A tax credit that is properly targeted would increase progressivity in the tax code and promote housing opportunity by providing a tax incentive more accessible to lower and middle-class households, as well minority and first-generation home buyers. Such a credit would provide a benefit to all home owners who pay mortgage interest and have income tax liability to offset. Such a proposal should be considered today and given serious consideration during the 2025 tax debate.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.