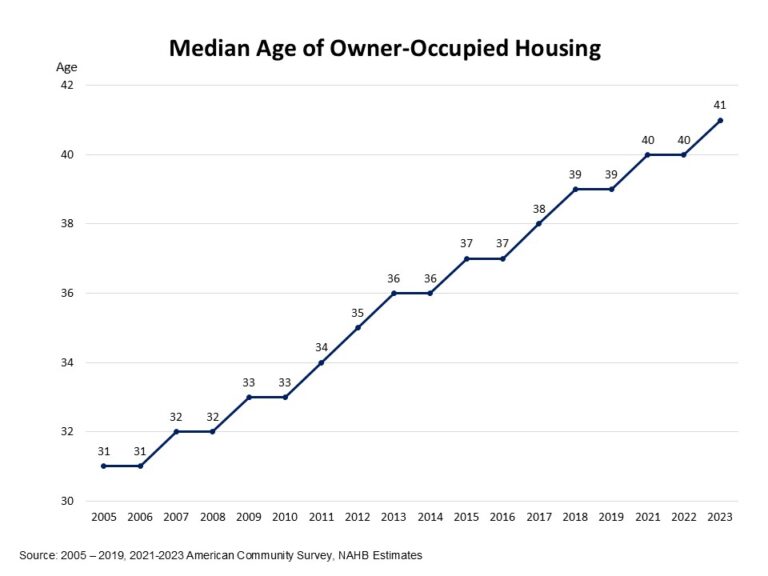

Around 48% of the U.S. housing stocks dates back to the 1980s and earlier. The median age of owner-occupied homes has climbed to 41 years in 2023, up from 31 years in 2005 according to the latest data from the American Community Survey[1]. The U.S. owner-occupied housing stock has aged rapidly particularly, particularly since the Great Recession, as the residential construction continues to fall behind in delivering new homes.

Currently, new home construction faces headwinds such as rising material costs, persistent labor shortage and elevated interest rates. These challenges have contributed to an insufficient supply of new construction, making the nation’s owner-occupied housing stock significantly older over time. As a result, the aging housing stock signals a future growing remodeling market. Older structures require updates to add new amenities or need repairs or replacements of old components.

Moreover, the lock-in effect from historically low mortgage rates during the pandemic period has led many homeowners to stay put and renovate their existing homes to accommodate the growing needs of their families. Over the long run, the aging of the housing stock implies that remodeling may grow faster than new construction.

From 2020 to 2023, new construction added nearly 2.6 million owner-occupied homes, accounting for only 3% of total owner-occupied housing stock as of 2023. Relatively newer homes built between 2010 and 2019 took up around 9% of the stock, while those constructed between 2000 and 2009 made up 15%. In contrast, around 48% of the owner-occupied homes were built before 1980, including around 35% built before 1970.

Due to modest supply of housing construction, the share of relatively newer owner-occupied homes (those built within past 13 years) has declined greatly, from 18% in 2013 to only 12% in 2023. Meanwhile, the share of older homes that are at least 44 years old has increased significantly, rising from 39% in 2013 to 48% in 2023. This shift further reflects the ongoing aging of the U.S. housing stock, highlighting the growing importance of the remodeling sector to address the growing needs of homeowners nationwide.

[1] : Census Bureau did not release the standard 2020 1-year American Community Survey (ACS) due to the data collection disruptions experienced during the COVID-19 pandemic. The data quality issues for some topics remain in the experimental estimates of the 2020 data. To be cautious, the 2020 experimental data is not included in the analysis.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .