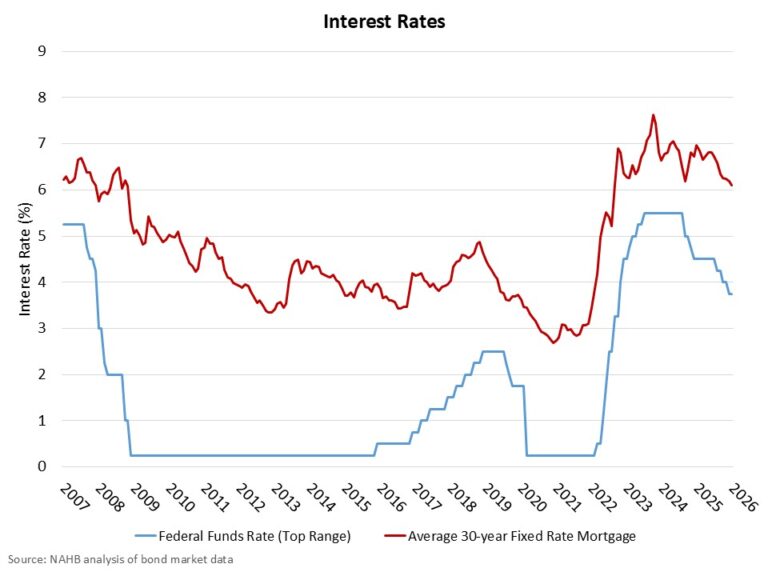

The Fed paused its easing cycle at the conclusion of the January meeting of the Federal Open Market Committee, the central bank’s monetary policy body. The Fed held the short-term federal funds rate at a top rate of 3.75%, the level set in December. This marked the first policy pause since the Fed resumed easing in September of last year.

The Fed characterized the economy as being in solid health. The January statement noted:

Available indicators suggest that economic activity has been expanding at a solid pace. Job gains have remained low, and the unemployment rate has shown some signs of stabilization. Inflation remains somewhat elevated.

The Fed’s statement noted the central bank will continue to consider risks associated with both sides of its dual mandate, to maintain maximum employment and stable prices. It is worth noting that the January statement did not include a reference to a concern of higher risk from a weakening labor market, as was specified in December. Thus, the January statement suggests the Fed sees balanced risks from inflation and current labor market conditions.

There was little forward guidance in today’s statement. There were two dissenting votes (Waller, a Fed Chair candidate, and Miran), who voted for a quarter point cut. Both economists have previously made the argument for more dovish monetary policy due to limited tariff effects and an improving productivity outlook that would mute future inflation pressure.

Chair Powell has two remaining meetings at the helm at the Fed. President Trump has promised an announcement soon regarding the next chair, whose candidates include Governor Waller, White House economist Kevin Hassett, prior Fed Governor Kevin Warsh and Rick Reider from Blackrock. Reider’s prospects appeared to have increased in recent weeks.

NAHB is forecasting two additional rate cuts for 2026, based on expectation of modest easing of inflation and a cooled labor market.

While reductions for the federal funds rate do not have a direct effect on mortgage interest rates, which remain slightly above 6%, federal funds rate reductions do lower interest rates on builder and developer loans, helping the supply-side of the housing market. Supplying more housing and at lower cost is key to solving the ongoing housing affordability challenge. Lower financing costs are part of the overall solution.

This article was originally published by a eyeonhousing.org . Read the Original article here. .