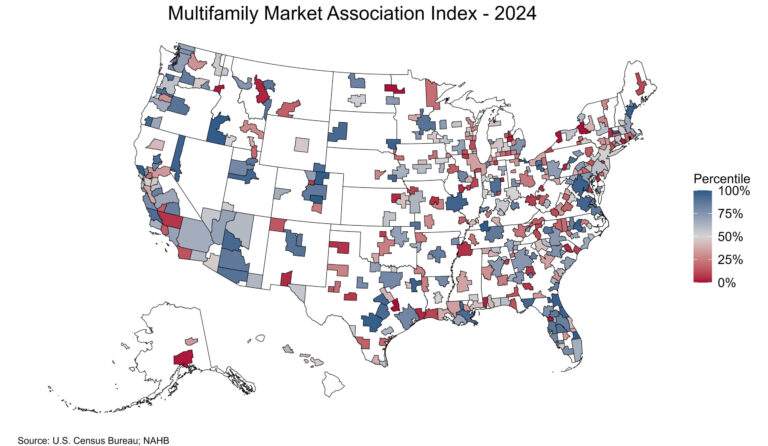

Even though garden/low-rise continues to be strong, overall confidence in the market for new multifamily housing decreased year-over-year in the fourth quarter, according to the Multifamily Market Survey (MMS) released today by the National Association of Home Builders (NAHB). The MMS produces two separate indices. The Multifamily Production Index (MPI) had a reading of 45, down three points year-over-year, while the Multifamily Occupancy Index (MOI) had a reading of 74, down seven point year-over-year.

Multifamily developers are somewhat less optimistic than they were at this time last year, except in the market segment for garden/low-rise apartments. This suggests that the 2025 trend of gains in multifamily market share for outlying metro and non-metro counties—where garden and low-rise structures are more common—is likely to continue in 2026.

Elevated construction costs and the local regulatory environment continue to be major headwinds to faster growth. While interest rates eased slightly in 2025, they still need to come down further to significantly spur new construction.

Multifamily Production Index (MPI)

The MMS asks multifamily developers to rate the current conditions as “good”, “fair”, or “poor” for multifamily starts in markets where they are active. The index and all its components are scaled so that a number above 50 indicates that more respondents report conditions as good rather than poor. The MPI is a weighted average of four key market segments: three in the built-for-rent market (garden/low-rise, mid/high-rise, and subsidized) and the built-for-sale (or condominium) market.

The component measuring garden/low-rise was the only one to experience an increase year-over-year in the fourth quarter of 2025, rising two points to 54. This component has been above 50 every quarter in 2025. The other three components experienced year-over-year declines during the quarter. The component measuring mid/high-rise fell eight points to 31, the component measuring built-for-sale units dropped six points to 36, and the component measuring subsidized units decreased five points to 47.

Multifamily Occupancy Index (MOI)

The survey also asks multifamily property owners to rate the current conditions for occupancy of existing rental apartments in markets where they are active as “good”, “fair”, or “poor”. Like the MPI, the MOI and all its components are scaled so that a number above 50 indicates more respondents report that occupancy is good than poor. The MOI is a weighted average of three built-for-rent market segments (garden/low-rise, mid/high-rise, and subsidized).

All three MOI components experienced year-over-year decreases in the fourth quarter of 2025; the mid/high-rise component plummeted 12 points to 62, the garden/low-rise component decreased five points to 76, and the subsidized component dipped three points to 88. Nevertheless, all three MOI components remain well above the break-even point of 50.

The MMS was re-designed in 2023 to produce results that are easier to interpret and consistent with the proven format of other NAHB industry sentiment surveys. Until there is enough data to seasonally adjust the series, changes in the MMS indices should only be evaluated on a year-over-year basis.

Please visit NAHB’s MMS web page for the full report.

This article was originally published by a eyeonhousing.org . Read the Original article here. .