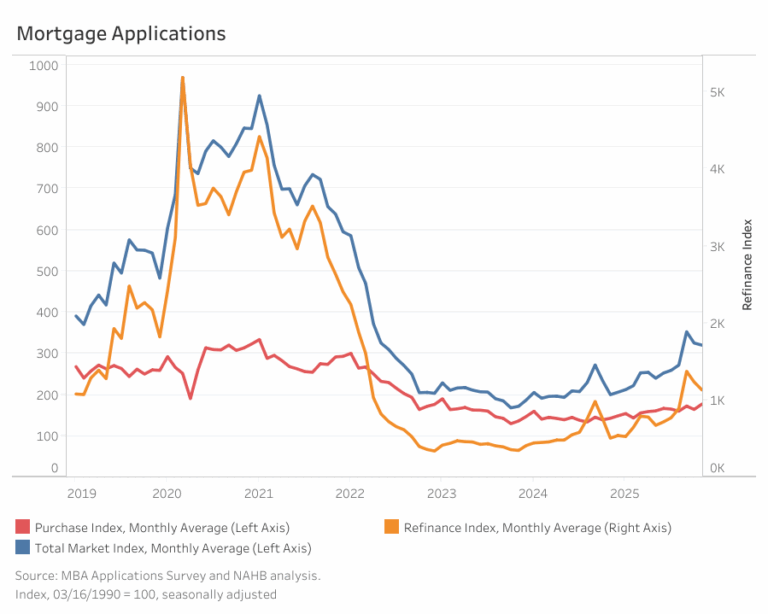

Mortgage activity continued to climb in November, posting the largest year-over-year increase in more than five years. Every major category increased on a year-over-year basis as mortgage rates continue to trend lower, led by strong increases in refinancing and adjustable-rate mortgage activity.

The Mortgage Bankers Association’s (MBA) Market Composite Index, a measure of total mortgage application volume, fell 1.6% from October on a seasonally adjusted basis but was 60% higher than a year ago.

The average contract interest rate for 30-year fixed mortgages basis continued to fall for the sixth month in a row to 6.36%, the lowest in over a year. After a strong jump in September, refinancing activity in November decreased 8.3% month-over-month. However, refinancing increased 123.7% on an annual basis, the largest gain in over a year. Meanwhile, purchase applications increased 7.9% over the month and rose 34.1% compared to a year ago, the highest increase since 2021.

By loan type, fixed-rate mortgage applications were unchanged from October but were 57.6% higher year-over-year. Adjustable-rate mortgage applications dropped 19% month-over-month, yet surged 94.9% from a year earlier, following an 116% annual gain in October.

The average loan size across all mortgages was $396,000, down 3% from the previous month. The average purchase loan size was $429,000, down 2% from last month, while the average refinance loan size declined 4% to $369,000. For adjustable-rate mortgages, the average loan size increased 3% to $969,000, compared to a 2% decline for fixed-rate mortgages to $348,000.

This article was originally published by a eyeonhousing.org . Read the Original article here. .