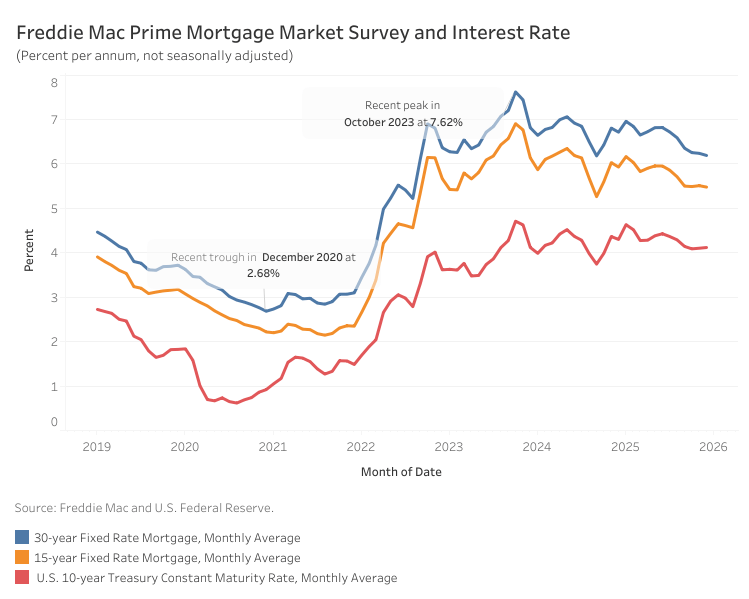

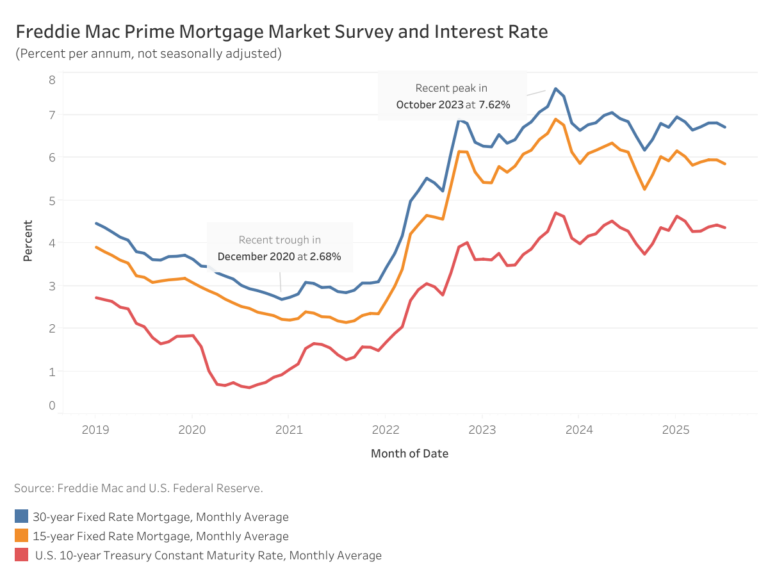

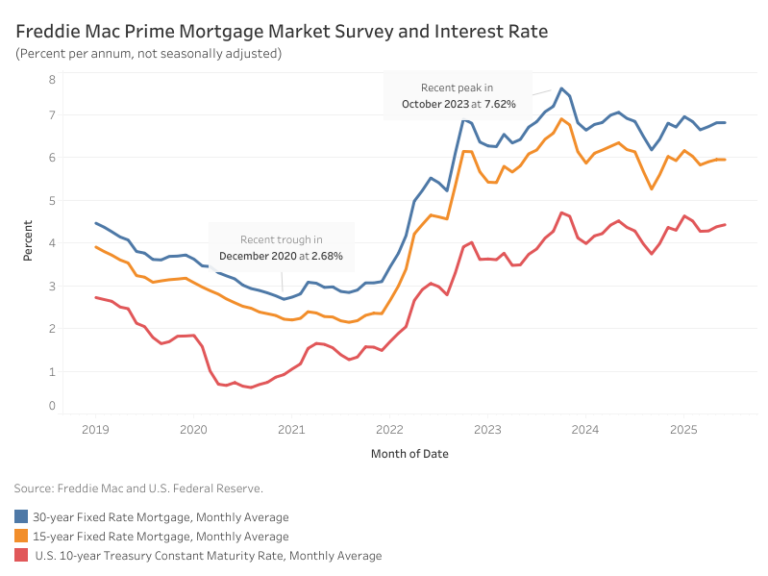

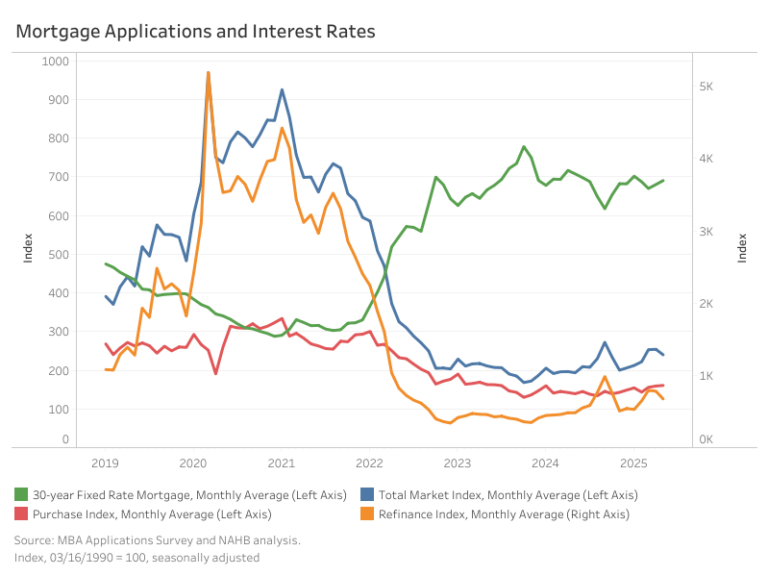

Long-term mortgage rates have been declining since mid- 2025 and ended the year at their lowest level since September 2024. According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.19% in December, 5 basis points (bps) lower than November. Meanwhile, the 15-year rate declined 3 bps to 5.48%. Compared to a year ago, the 30-year rate is lower by about half a percentage point, or 53 basis points (bps). The 15-year rate is also lower by 45 bps.

The 10-year Treasury yield, a key benchmark for long-term borrowing, averaged 4.12% in December – a modest increase of 2 bps from the previous month. Given forward-looking markets, the 10-year Treasury yield declined during the week preceding the Federal Reserve’s third rate cut of the year. However, compared to the prior month, yields ended slightly higher, rising 2 bps, as labor market data released shortly thereafter pointed to slowing job gains and rising unemployment rate.

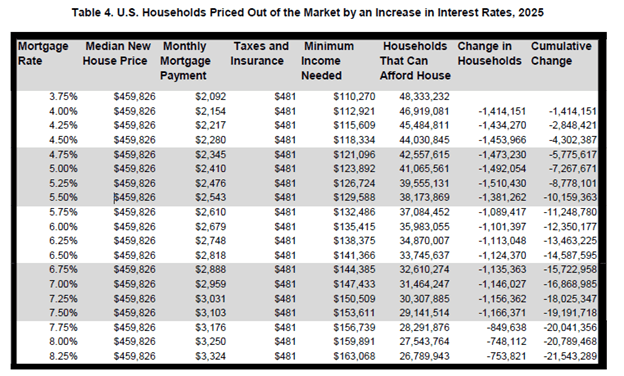

Falling lower mortgage rates have started to translate into gains as existing home sales edged up slightly in November. However, this increase remains limited as mortgage rates above 6% are still considered elevated. Nonetheless, as financing costs continue decline, more households are likely to reenter the housing market. An NAHB analysis shows that a 25 bps reduction in the 30-year mortgage rate, from 6.25% to 6.00%, could bring approximately 1.1 million additional households back into the buyer pool.

NAHB expects the 30-year mortgage rate to average 6.17% in 2026 and would reach 6% by 2027.

This article was originally published by a eyeonhousing.org . Read the Original article here. .