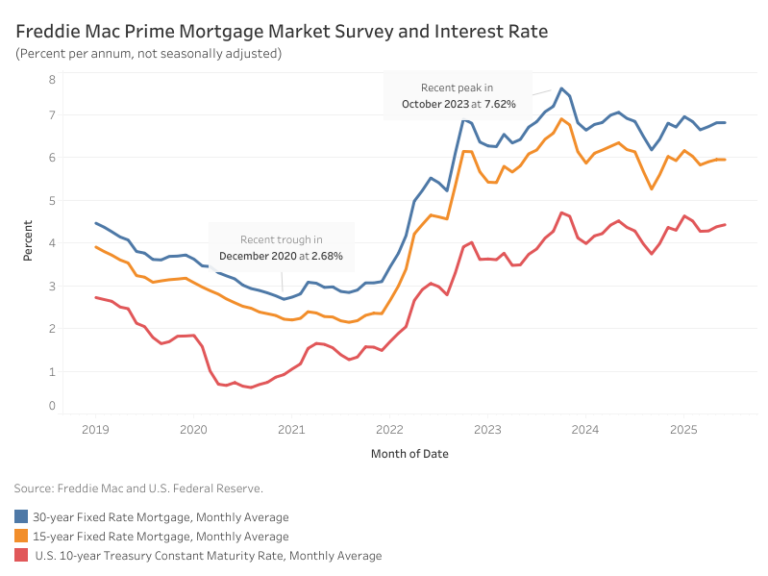

New home sales ended 2025 on a mixed but resilient note, signaling steady underlying demand despite ongoing affordability and supply constraints. The latest data released today (and delayed because of the government shutdown in fall of 2025) indicate that while month-to-month activity shows a small decline, sales remain stronger than a year ago, signaling that buyer interest in newly built homes has improved. The December NAHB/Wells Fargo Housing Market Index showed that 67 percent of builders used sales incentives, the highest percentage post-COVID. Builders offered an average home price reduction of 5 percent during December.

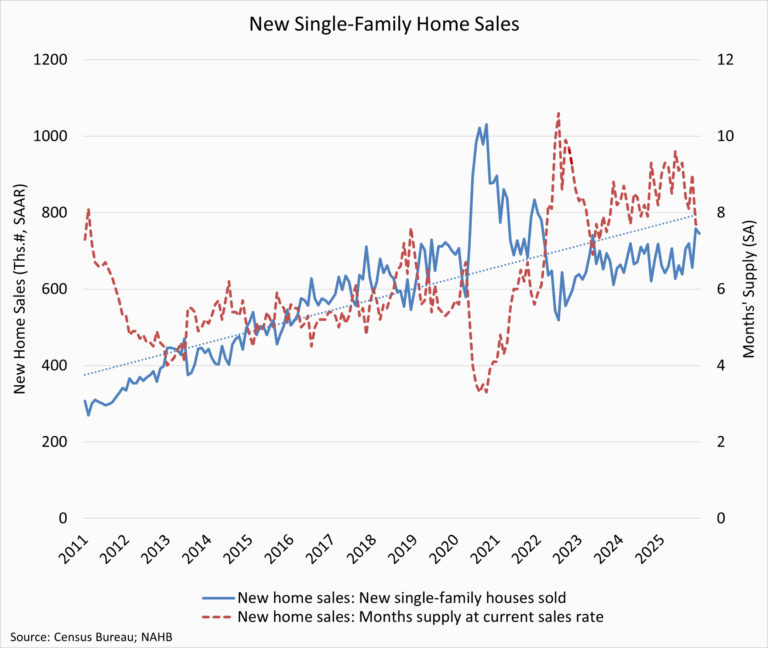

Sales of newly built single-family homes declined 1.7 percent month-over-month in December to a seasonally adjusted annual rate of 745,000 units, according to the U.S. Department of Housing and Urban Development and the U.S. Census Bureau. This represented a 3.8 percent year-over-year increase. An estimated 679,000 homes were sold in 2025, down 1.1 percent from the 2024 rate of 686,000. A new home sale is recorded when a contract is signed or a deposit is accepted, regardless of the stage of construction. The seasonally adjusted annual rate reflects the pace of sales that would occur over a 12-month period if current conditions persisted.

New single-family home inventory totaled 472,000 units in December, 2.7 percent lower than the prior month, and 3.5 percent lower than a year earlier. At the current sales pace, the months’ supply of new homes stood at 7.6 months, down from 8.2 months one year ago, though still above the six-month level that is generally considered balanced.

Combined new and existing home inventory has edged lower in recent months, with total months’ supply declining to 4.0, reflecting slower construction activity. Meanwhile, inventory conditions in the existing home market have retreated after making gradual improvement in prior months. Moderating prices across both markets have helped support buyer demand amid ongoing affordability concerns.

By the end of 2025, there were 128,000 completed, ready-to-occupy homes available for sale on a non-seasonally adjusted basis, up 8.5 percent from a year earlier. Completed homes accounted for a little more than a quarter of the total inventory, while homes under construction made up 51 percent. The remaining 22 percent of homes sold in December had not yet started construction at the time the sales contract was signed.

Home prices showed further signs of easing in 2025. The median new home sale price declined 1.3 percent to $415,000 from $420,300 in 2024. Affordability improved at the lower end of the market, with 20 percent of new homes priced below $300,000. Thirty-four percent of homes were priced above $500,000, while the remaining 46 percent fell within the $300,000 to $500,000 range.

Regionally, year-to-year new home sales were up 1.7 percent in the Midwest and 0.4 percent in the South but declined 4.9 percent in the West and 7.7 percent in the Northeast.

This article was originally published by a eyeonhousing.org . Read the Original article here. .