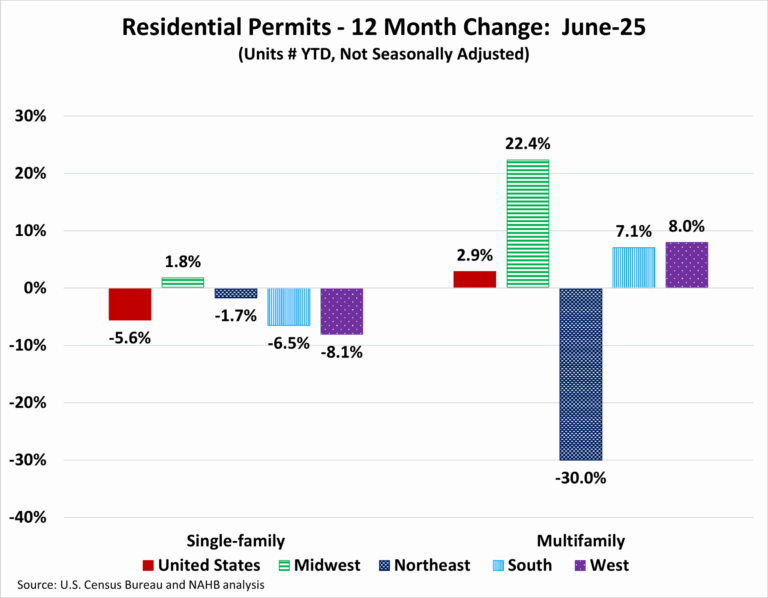

Single-family housing permits continued a downhill trend for the sixth month in a row. The continuous decline in single-family permits highlights persistently weak housing demand, tied to affordability challenges like high mortgage rates. Builders appear cautious amid economic uncertainty, labor constraints, and rising inventories. The uptick in multi-family permits suggests a potentially stabilizing trend, though it’s important to note its volatility. The housing market’s mixed signals—weak single-family coupled with some resilience in multi-family—could mean continued drag on residential investment and the broader economy this year.

Over the first six months of 2025, the total number of single-family permits issued year-to-date (YTD) nationwide reached 485,935. On a year-over-year (YoY) basis, this is a decline of 5.6% over the June 2024 level of 514,728. For multifamily, the total number of permits issued nationwide reached 244,812. This is 2.9% higher compared to the June 2024 level of 237,935.

Year-to-date ending in June, single-family permits were up in one out of the four regions. The Midwest posted a small increase of 1.8%. The Northeast was 1.7% lower, the South was down by 6.5%, and the West was down by 8.1% in single-family permits during this time. For multifamily permits, three out of the four regions posted increases. The Midwest was up by 22.4%, the West was up by 8.0%, and the South was up by 7.1%, Meanwhile, the Northeast declined steeply by 30.0%, driven by the New York-Newark-Jersey City, NY-NJ MSA which declined by 40.0%.

Between June 2025 YTD and June 2024 YTD, 15 states posted an increase in single-family permits. The range of increases spanned 19.9% in Hawaii to 0.2% in Kentucky. The remaining 35 states and the District of Columbia reported declines in single-family permits with the District of Columbia reporting the steepest decline of 24.2%.

The ten states issuing the highest number of single-family permits combined accounted for 63.0% of the total single-family permits issued. Texas, the state with the highest number of single-family permits, issued 78,104 permits over the first six months of 2025; this is a decline of 8.0% compared to the same period last year. The second highest state, Florida, decreased by 10.6%, while the third highest, North Carolina, posted a decline of 0.9%.

Between June 2025 YTD and June 2024 YTD, 29 states recorded growth in multifamily permits, while 21 states and the District of Columbia recorded a decline. Iowa (+165.5%) led the way with a sharp rise in multifamily permits from 1,178 to 3,128, while Alabama had the largest decline of 49.6% from 1,788 to 901.

The ten states issuing the highest number of multifamily permits combined accounted for 61.8% of the multifamily permits issued. Over the first six months of 2025, Florida, the state with the highest number of multifamily permits issued, experienced an increase of 25.0%. Texas, the second-highest state in multifamily permits, saw an increase of 14.1%. California, the third largest multifamily issuing state, increased by 11.5%.

At the local level, below are the top ten metro areas that issued the highest number of single-family permits.

For multifamily permits, below are the top ten local areas that issued the highest number of permits.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .

16. Get seasonal gear ready. What with camping and beach trips, summertime activities come with a lot of gear. Get it cleaned up and ready now, so you’re not surprised by a leaky tent or blown-out beach umbrella when it’s too late to replace them. And if you plan to waterproof anything (tents or outdoor tablecloths, for example), now is the time.

How to Store Your Outdoor Gear for Summer and All Year