In April 2020, total payroll employment in the United States fell by an unprecedented 20.5 million, following a loss of 1.4 million in March, as the COVID-19 pandemic brought the economy to a sudden halt. The unemployment rate surged by 10.4 percentage points to 14.8% in April. It was the highest rate effectively since the Great Depression. Tracking the labor market impact is critical for understanding the follow-on effect on home building activity during the last five years.

As people stayed at home and businesses shut down under government directives, millions of Americans lost their jobs. Initial unemployment insurance claims soared to 2.9 million during the week of March 21, 2020. For the following 19 consecutive weeks, more than one million Americans filed for unemployment each week, totaling roughly 50.9 million claims over just five months.

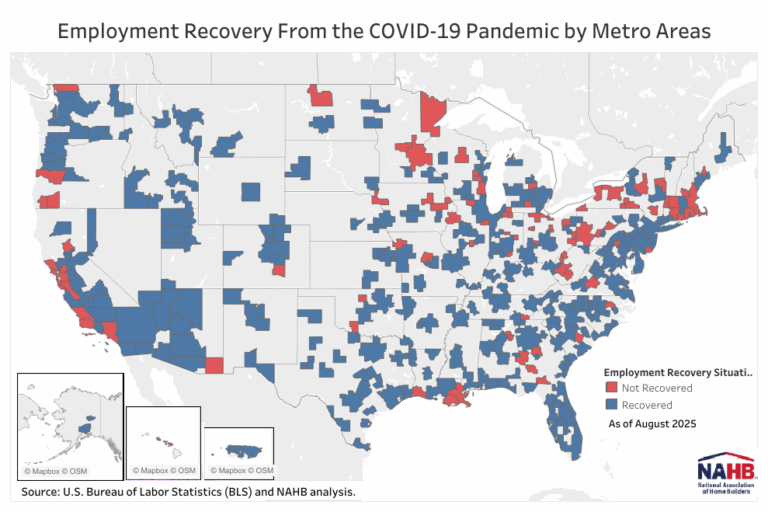

While the national labor market suffered an unprecedented collapse in both speed and depth, the effects varied significantly across U.S. metro areas. Local economies experience dramatically different outcomes depending on their industrial composition, the feasibility of remote work, and the strictness of local public health restrictions. A map of metro areas across the United States reveals striking variations in employment losses from February 2020 to the pandemic’s employment trough. Nonfarm employment payrolls declined by anywhere from 5% to 35% across 393 metro areas.

Kahului-Wailuku, Hawaii, experienced the steepest job losses, with employment plummeting by 35%. This metro area’s deep dependence on tourism and hospitality, particularly in accommodation and food services, left it vulnerable to travel restrictions and widespread shutdown. Similarly, Atlantic City-Hammonton, New Jersey, as a prime tourism destination, was devastated by pandemic-related closures. By May 2020, its total employment dropped 34% from the February 2020 level.

Some metro areas experienced major setbacks tied to their dominant industries. In Elkhart-Goshen, Indiana, as the heart of the U.S. RV manufacturing industry, employment plunged 34% as production ground to a halt.

At the other end of the spectrum, Logan, UT-ID, recorded the mildest downturn, with a relatively modest 5% employment drop, reflecting a more resilient local economy.

In sheer numbers, New York-Newark-Jersey City, New York-New Jersey saw the largest employment losses in the nation, shedding nearly 2 million jobs, or about 20% of its pre-pandemic workforce. Los Angeles–Long Beach–Anaheim, California, followed closely, losing 1.1 million jobs, about 17% of its February 2020 level.

Despite the historic scale of these losses, the U.S. labor market rebounded faster than many anticipated. Within just 26 months, overall employment had fully recovered, surpassing its February 2020 level to reach 152.4 million by June 2022. Yet, as with the initial losses, the recovery varied widely across metro areas. By August 2025, 93 of the 393 metro areas had still not regained their pre-pandemic employment levels.

Lake Charles, Louisiana, remains the slowest to recover, with employment at only 87% of its February 2020 level. The region’s setbacks have been compounded by multiple disasters—COVID-19, followed by Hurricanes Laura and Delta in 2020—that disrupted both infrastructure and labor markets. Kankakee, Illinois (92% recovered), and Weirton–Steubenville, West Virginia–Ohio (93%), also lagged, highlighting how recovery can be delayed by structural and regional challenges.

In contrast, many other metro areas have not only recovered but expanded beyond their pre-pandemic employment levels. As of August 2025, 300 metro areas have fully rebounded, with some even booming. Wildwood–The Villages, Florida, leads the nation with employment reaching 127% of its February 2020 level, followed by St. George, Utah, at 125%.

Notably, the areas that suffered the sharpest employment declines in 2020 did not necessarily experience the slowest recoveries. Las Vegas–Henderson–North Las Vegas, Nevada, for instance, lost 277,900 jobs, about 26% of its workforce, but has rebounded strongly, reaching 109% of its pre-pandemic employment. By contrast, Enid, Oklahoma, which lost just 1,600 jobs, remains slightly below its February 2020 level, still 2% short of full recovery.

The story of employment loss and recovery across U.S. metro areas underscores the uneven geography of the COVID-19 economy. The resilience of local economies has since reshaped the post-pandemic landscape, revealing not only where recovery has taken root but also where it remains incomplete. And of course, the health of local labor markets has important impacts on the status of local home building and remodeling conditions.