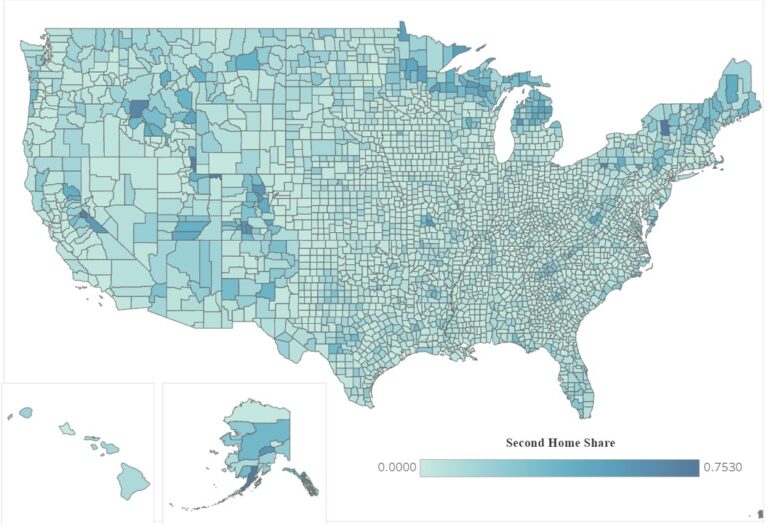

In 2023, the total number of second homes was 5.7 million, accounting for 4% of the total housing stock, according to NAHB estimates of the 2023 American Community Survey. Second homes have been in a steady decline over the past few years, from 7.15 million in 2020, to 6.5 million in 2022, dropping to 5.7 million in 2023.

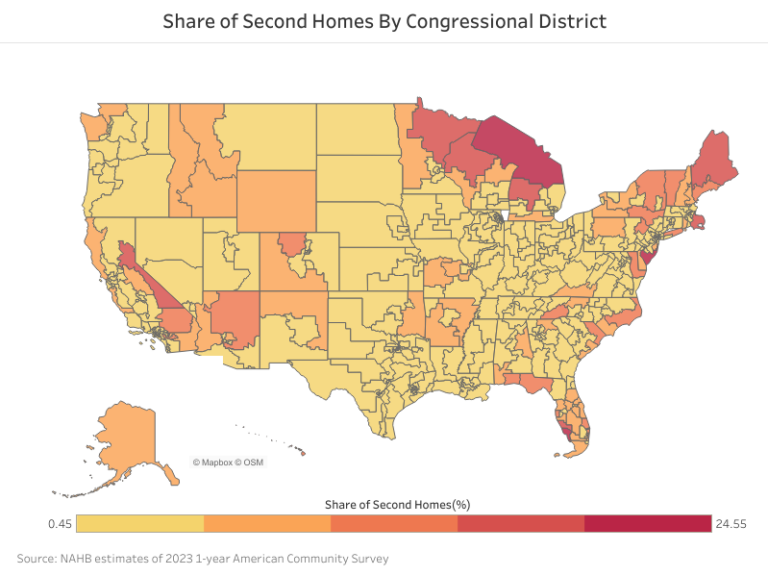

The distribution of second homes across the U.S. reveals important geographic patterns, particularly when examined at the congressional district level. This analysis focuses on the number and the location of second homes qualified for or defined by the home mortgage interest deduction using the Census Bureau’s 2023 American community Survey (ACS). It does not account for homes held primarily for investment or business purposes.

Half of the nation’s second homes are concentrated in a small number of congressional districts, primarily in these states: Florida, California, New York, Texas, Michigan, North Caroline, Pennsylvania, and Arizona. Florida alone accounted for 15.8% of all second homes, with 16 out of its 28 congressional districts having more than 25,000 second homes each. Florida’s 19th Congressional District had the largest stock of second homes, with 123,853 units. In contrast, Wyoming’s At Large Congressional District had the smallest stock, with 17,623 second homes.

Analysis of congressional district data shows that second homes are not just concentrated in conventional coastal and resort areas. Second homes make up a significant portion of the housing stock in various districts across the country. Michigan’s 1st Congressional District had the highest share of second homes, with 24.5% of its housing stock qualified as second homes. Wisconsin’s 7th Congressional District had 82,755 second homes, almost 20% of its total housing stocks.

While some congressional districts have a higher percentage of second homes, many other congressional districts also show a notable prevalence of second homes. In 2023, 32 congressional districts in 17 states had at least 10% of housing units that were second homes. Of these congressional districts, 8 congressional districts were in Florida, 4 in New York, 3 in California, and 2 in Maine, Michigan, North Carolina, and 1 congressional district each in Arizona, Colorado, Hawaii, Maryland, Massachusetts, Minnesota, New Jersey, Pennsylvania, South Carolina, Vermont, Wisconsin.

NAHB estimates are based on the definition used for home mortgage interest deduction: a second home is a non-rental property that is not classified as taxpayer’s principal residence. Examples could be: (1) a home that used to be a primary residence due to a move or a period of simultaneous ownership of two homes due to a move; (2) a home under construction for which the eventual homeowner acts as the builder and obtains a construction loan (Treasury regulations permit up to 24 months of interest deductibility for such construction loans); or (3) a non-rental seasonal or vacation residence. However, homes under construction are not included in this analysis because the ACS does not collect data on units under construction.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .

Dupes also preserved and replicated some of the original millwork and added more personality with details such as an ogee edge on the island’s marble-look quartz countertop. The kitchen gained some space as well, after a full bathroom behind the wall on the left became a powder room.

Perimeter cabinetry and pantry paint: Pure White, Sherwin-Williams; island base paint: Mt. Rainier Gray, Benjamin Moore; tile: Eveningstar mosaic (accent), Seaport in Arctic White (field) and Thassos marble pencil liner in white (trim), TileBar

Read more about this project