In 2023, nearly 6.45 million homes, around 5% of U.S housing stock, were classified as inadequate according to the American Housing Survey (AHS). Of these, 1.65 million homes were classified as severely inadequate, showing significant concerns over housing quality. While this reveals ongoing issues in nation’s housing conditions, it signals probable market growth for remodeling and home improvements in the year ahead.

The U.S. Department of Housing and Urban Development (HUD) defines physical adequacy based on whether a home meets the basic standard of “a decent home and a suitable living environment”. Homes are severely inadequate if they exhibit major deficiencies, such as exposed wiring, lack of electricity, missing hot or cold running water, or the absence of heating or cooling systems. Additionally, homes with at least five significant structural problems such as water leaks, large open cracks or holes in the floor also belong to this category. Moderately inadequate homes have three or four significant structural issues, or have problems such as incomplete kitchen facilities, lack of vented heating equipment, or prolonged toilet breakdowns.

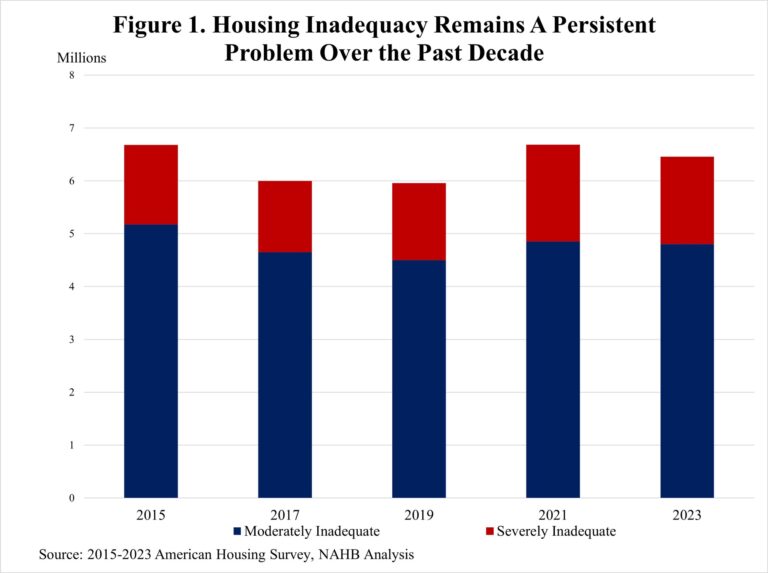

Housing inadequacy has remained a persistent issue over the past decade, shown in Figure 1. In 2023, around 6.5 million households lived in moderately or severely inadequate housing. While the total number of inadequate homes declined slightly from 6.9 million in 2015 to 6.0 million in 2019, it rebounded to 6.7 million in 2021 and remained elevated in 2023. The majority, around 4.8 million, of inadequate homes were moderately inadequate, while 1.65 million households lived in severely inadequate conditions in 2023.

The share of inadequate homes varies significantly by the age of the home (Figure 2). Older homes have higher rates of inadequacy. Homes built before 1940 have the highest inadequacy rate at 9%, followed by those built between 1940 and 1959 at 7%. While housing units from 1960 to 1979 show a moderate inadequacy rate of 5%, they account for the largest number of inadequate homes, with 1.2 million classified as moderately inadequate and 465,000 as severely inadequate in 2023. In contrast, newer homes (1980-Present) have lower inadequacy rates with the share steadily declining from 4% for homes built between 1980 and 1999 to 3% for those constructed from 2000 to the present.

Geographically, inadequate housing is most concentrated in smaller metro areas. Around 50.4% of moderately inadequate homes (2.4 million units) and 43.6% of severely inadequate homes (720,000 units) are in these areas in 2023. This trend is likely driven by aging housing stock and lower household income compared to major metro areas. However, major metro areas still have a substantial share of inadequate homes, with 29.7% of moderately inadequate (1.4 million) and 38.2% of severely inadequate units (631,000). Non-metro areas have the lowest total numbers, (953,000 moderately inadequate and 720,000 severely inadequate homes), though challenges persist.

In 2023, around 6.45 million households lived in inadequate housing, with more renters (3.5 million) than owners (2.8 million). Housing cost burdens varied greatly among these two groups: Among those households in inadequate homes, 1.9 million owners spent less than 30% of their income on housing, compared to 1.6 million renters. It suggests that many homeowners living in inadequate housing may indeed have the financial capacity to improve their housing conditions if they choose to do so. In contrast, renters in inadequate housing face greater financial constraints, with 1.1 million spending more than 50% of their income on housing, more than double the 480,000 cost-burdened owners. This disparity highlights the challenges renters are facing, including limited affordable housing options and a lack of control over property conditions.

This article was originally published by a eyeonhousing.org . Read the Original article here. .

With its white villas, bougainvillea and pine-planted valleys overlooking the Mediterranean sea, the La Corniche Boulevard in Marseilles, France, is a dream location. When a family of four found this two-story 1930s building for sale, they jumped at the chance to own it.

They hired interior designer Chrystel Laporte of Un jour d’avril and landscape architect Élodie Wehrlen of Côté Outdoor to help them turn it into their dream home. Designer Laporte began the design process by listening closely to the owners’ desires and collecting inspirational photos to reflected their wishes. “These mood boards help me tailor the feel of the rooms throughout the project,” she says.

“I also paid attention to the home and looked at its plan in 2D. I always worked from the existing space and examined its lines of sight to create a surprise,” she says. As a former graphic artist, she’s always attuned to the best framing, as illustrated here with this tantalizing slice of sparkling Mediterranean sea on display in the main bedroom, which was previously a bathroom.