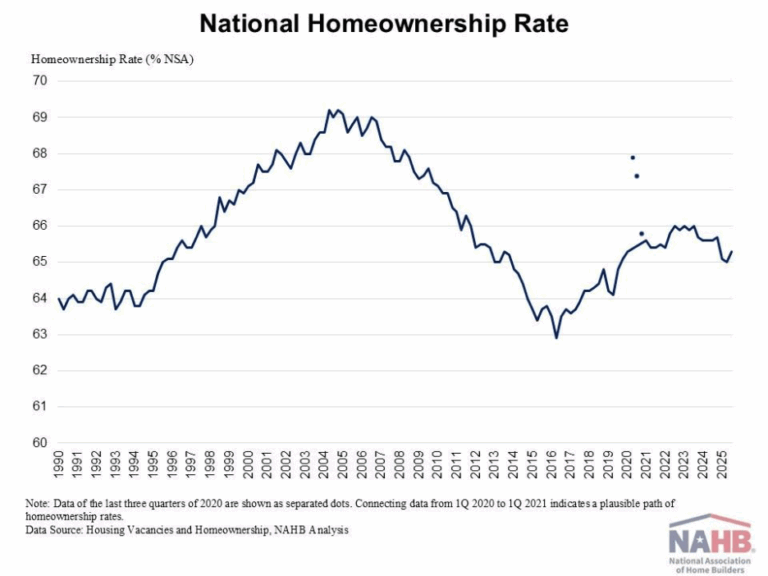

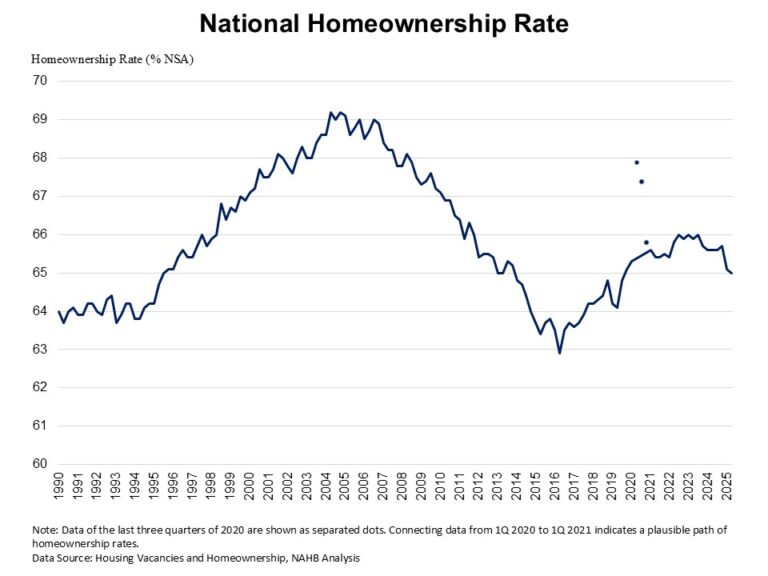

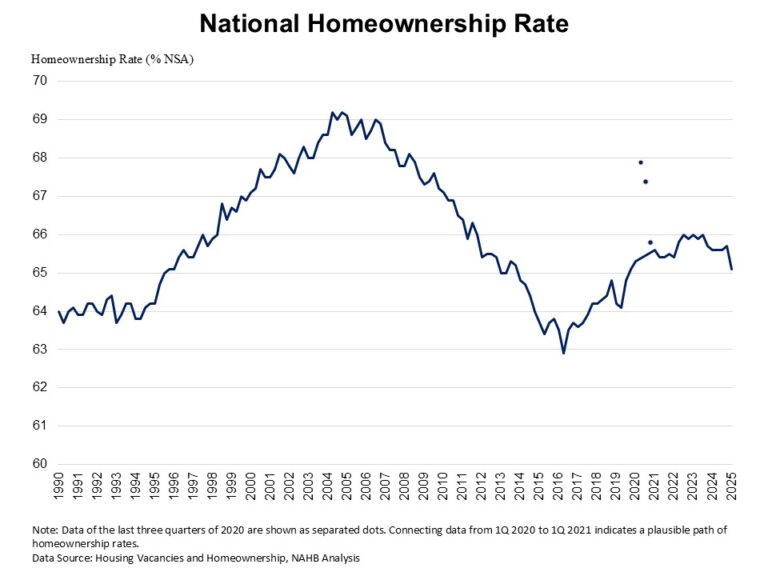

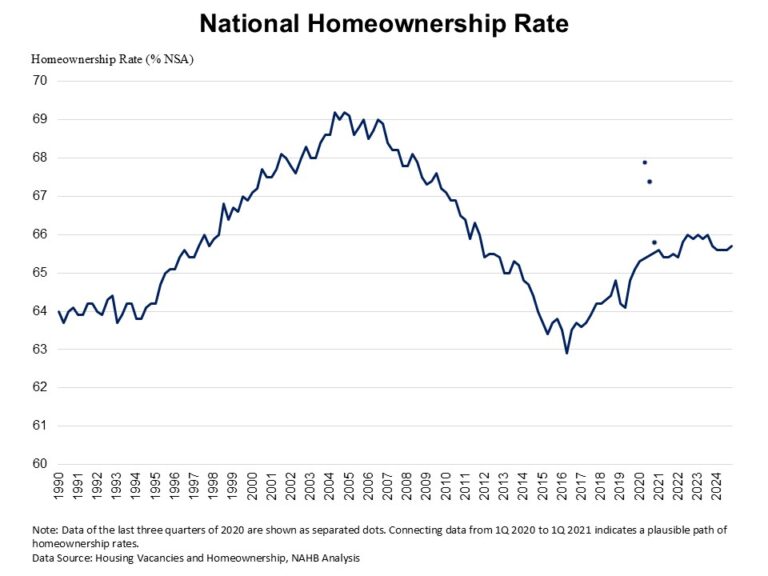

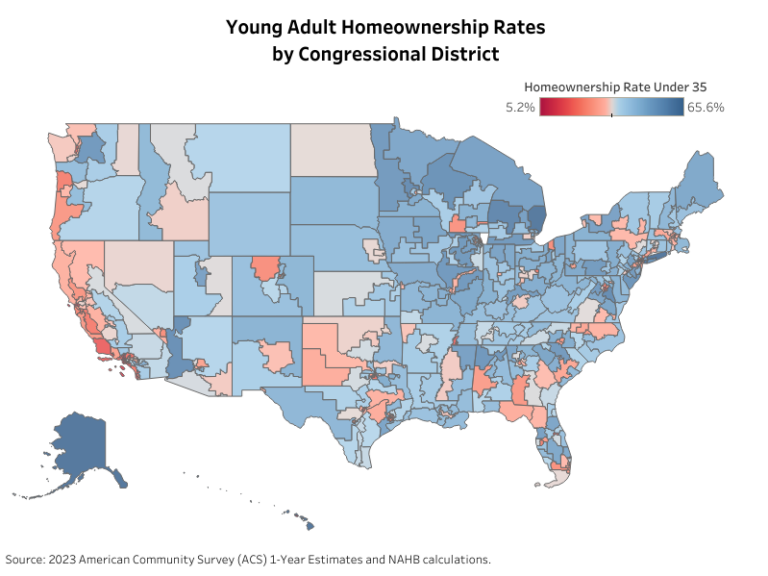

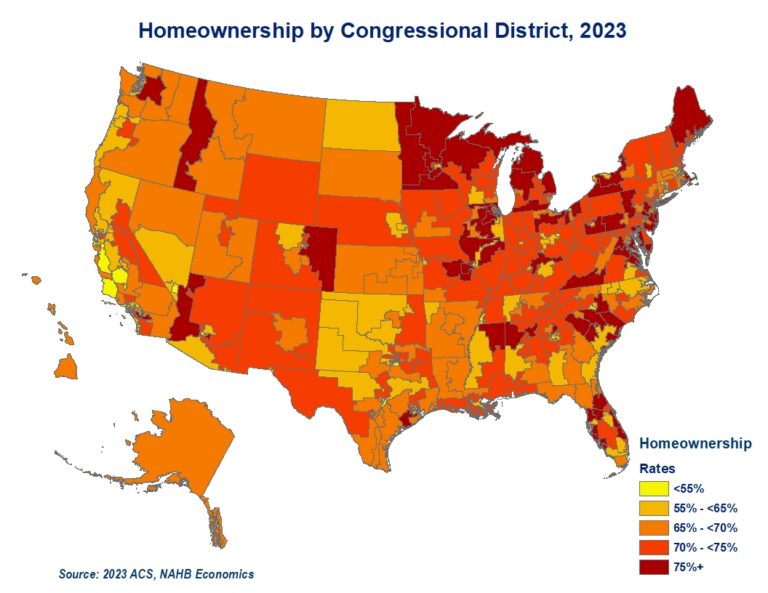

Homeownership is an important voter issue for the upcoming election with both presidential candidates putting forth housing policies to tackle the housing affordability crisis. In a recent NAHB post, the national homeownership rate sat at 65%, but there are large disparities in homeownership when broken down by race. For Black/African American households, the homeownership rate was 45%. Hispanic/Latino households fared slightly better at 51%, while all other minority households had a homeownership rate of 55%.

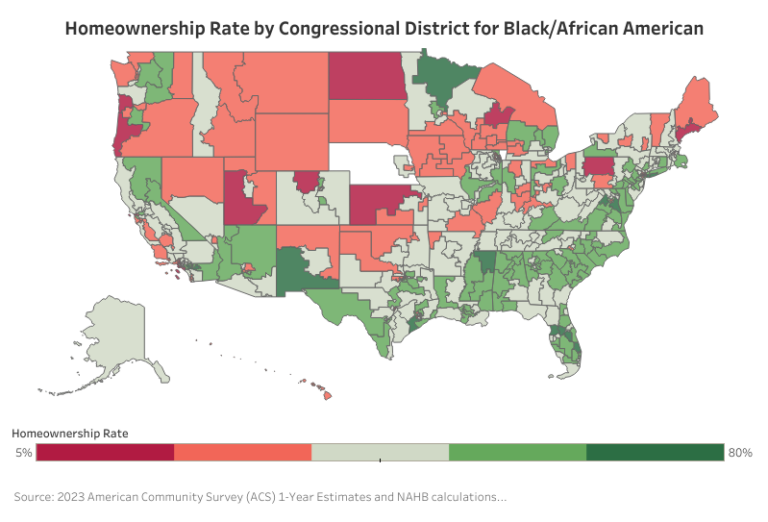

According to the 2023 American Community Survey (ACS), the district with the highest homeownership rate for Black/African American households was Maryland’s 5th District at 80%, although the overall homeownership rate for this district was slightly higher at 82%. In this district, 43% of the households were Black/African American. On the opposite spectrum, California’s 34th District had the lowest Black/African American homeownership rate in the nation at just 5%. This district also had one of the lowest overall homeownership rates in the country at 22%. The table below highlights the top five districts where Black/African American homeownership is the highest.

Congressional DistrictBlack/African American Homeownership RateOverall Homeownership RateShare of PopulationMaryland, District 580%82%43%New York, District 475%81%16%California, District 4172%75%5%Virginia, District 1072%79%8%Florida, District 2171%79%11%Source: 2023 American Community Survey and NAHB calculations.

The top 3 districts with the highest homeownership of Hispanics/Latino households were in the Midwest. Michigan’s 1st District held the highest homeownership rate for the Hispanics/Latino households (78%), although they constituted for 2% of the district’s population. The overall homeownership rate for the district was slightly higher (80%), however, in Texas’ 23rd District, Hispanics/Latino’s homeownership rate was slightly higher than the overall district rate at 75% compared to 74%. In this district, Hispanics/Latinos formed a significant portion of the population, accounting for nearly 60%.

Congressional DistrictHispanic/Latino Homeownership RateOverall Homeownership RateShare of PopulationMichigan, District 178%80%2%Minnesota, District 676%81%3%Illinois, District 1676%80%5%Arizona, District 975%77%22%Texas, District 2375%74%58%Source: 2023 American Community Survey and NAHB calculations.

For all other minority households, Minnesota’s 6th District stood out with the highest homeownership rate at 85%. This rate also exceeded the overall homeownership rate for this district of 81%. In fact, the top 10 congressional districts with the highest homeownership rate for this group exceeded the district-wide homeownership rates. Tennessee’s 8th District, which has the second-highest minority homeownership rate at 83%, surpassed the overall district rate by 11 percentage points.

Congressional DistrictAll Other Race Homeownership RateOverall Homeownership RateShare of PopulationMinnesota, District 685%81%4%Tennessee, District 883%72%2%Virginia, District 1083%79%19%Texas, District 2281%76%20%Illinois, District 1481%76%12%Source: 2023 American Community Survey and NAHB calculations.

There were also significant geographical variations of homeownership rates between each racial group with Black/African American households experiencing the largest variations across the country. Black/African American homeownership was concentrated in southern states while notably lower in the Midwest, Mountain West, and parts of the Northeast. In contrast, Hispanic/Latino homeownership tended to be higher in Southwest districts, while other minority groups maintained stronger rates nationwide.

Overall, a consistent geographical pattern of homeownership across minority households can be found. For example, North Dakota and neighboring districts stood out with much lower minority homeownership. On the other hand, Southern states, where median sale prices per square foot for single-family detached homes were below the national average of $150, generally exhibited higher rates of minority homeownership.

Additional housing data for your congressional district are provided by the US Census Bureau here.

Footnote(s):

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.