Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors’ opinions or evaluations.

The housing market might finally be entering a transitional phase.

Summer sales have been tepid thus far, but there are signs that activity could heat up by the end of the summer as mortgage rates plunge to their lowest levels in roughly 15 months and much-needed resale inventory continues to enter the market, giving buyers more options.

Other good news for home shoppers is the ongoing decline in the median price for a new home—now below the median resale home price—even as builders continue offering buyer incentives.

Nonetheless, experts say the housing market will only see renewed momentum once mortgage rates drop enough to ease affordability challenges and incentivize homeowners locked in at low rates to move so inventory grows substantially to meet demand.

Housing Market Forecast for 2024

U.S. home prices posted a 5.9% annual gain for May, down from a 6.4% annualized gain in April, according to the latest S&P CoreLogic Case-Shiller Home Price Index. Yet, even as this annual gain marks a slowdown, the index still broke the previous month’s record high, indicating home prices are still out of reach for many.

“Affordability is the main constraint on the housing market,” Lisa Sturtevant, chief economist at Bright MLS, said in an emailed statement. “The market will move toward more of a balanced housing market in the second half of the year, but prospective home buyers will still face competition.”

Though affordability obstacles persist for buyers, other indicators suggest that the market is tilting toward buyers. Zillow reports that roughly 25% of its listings saw price cuts in June. The last time the rate was this high for cuts this time of year was in 2018.

Meanwhile, experts are hopeful that the Federal Reserve (Fed) will finally cut the federal funds rate in September, as inflation is cooling down sustainably toward the Fed’s 2% target.

Mortgage rates indirectly track this benchmark interest rate banks use as a guide for overnight lending. With the federal funds rate at its highest level in over two decades, mortgage rates—and borrowers—have been feeling the added impact on their ability to afford a home.

Will the Housing Market Finally Recover in 2024?

For a housing recovery to occur, several conditions must unfold.

“For the best possible outcome, we’d first need to see inventories of homes for sale turn considerably higher,” says Keith Gumbinger, vice president at online mortgage company HSH.com. “This additional inventory, in turn, would ease the upward pressure on home prices, leveling them off or perhaps helping them to settle back somewhat from peak or near-peak levels.”

Of course, mortgage rates would need to cool off, which seems promising given the recent declines. The average 30-year fixed mortgage rate has been below 7% since the first week of June and has largely trended down, landing at 6.49% in the week ending August 15.

However, when mortgage rates finally go on the descent, Gumbinger says don’t hope they cool too quickly. Rapidly falling rates could create a surge of demand that wipes away any inventory gains, causing home prices to rebound.

“Better that rate reductions happen at a metered pace, incrementally improving buyer opportunities over a stretch of time, rather than all at once,” Gumbinger says.

He adds that mortgage rates returning to a more “normal” upper 4% to lower 5% range would also help the housing market, over time, return to 2014-2019 levels. Yet, Gumbinger predicts it could be a while before we return to those rates.

NAR To Implement Settlement Agreement Changes in August

Following years of litigation, the NAR has agreed to pay $418 million to settle a series of high-profile antitrust lawsuits filed in 2019 on behalf of home sellers. The settlement received preliminary court approval in April. A judge is expected to grant final approval in November. Meanwhile, NAR announced that the new required practices will go into effect on August 17.

The required new rules prohibit broker compensation offers on multiple listing services (MLS), the private databases that allow local real estate brokers to publish and share information about residential property listings.

Moreover, sellers will no longer be responsible for paying buyer broker commissions—upending an accepted practice that has been in place for years—and real estate agents participating in the MLS must establish written representation agreements with buyers.

If you sold a home in the past 10 years, you may be eligible for a small piece of this settlement pie. Visit realestatecommissionlitigation.com for more information about filing a claim.

Housing Inventory Forecast: When Will There Be Sufficient Supply To Reduce Prices?

Despite more resale homes entering the market, the inventory shortage remains severe and likely will for some time, thanks to multiple headwinds.

For one, many homeowners remain “locked in” at ultra-low mortgage rates, unwilling to exchange for a higher rate in a high-priced housing market. Consequently, demand continues to outpace housing supply—and likely will for the remainder of this year.

“I don’t expect to see a meaningful increase in the supply of existing homes for sale until mortgage rates are back down in the low 5% range, so probably not in 2024,” says Rick Sharga, founder and CEO of CJ Patrick Company, a market intelligence and business advisory firm.

New home construction has provided some relief, with inventory at its highest since early 2008. However, more than this welcome supply is needed to fill the inventory gap.

Still, while inventory is some 33% lower than pre-pandemic averages, there is a bright spot in the data—current inventory levels sit at their smallest deficit since fall 2020, according to Zillow analysis. Inventory may improve further if home prices and mortgage rates stay high.

Here’s what the latest home values look like around the country.

Home Builder Sentiment Ticks Down Again

Builder sentiment continues to wilt with the summer heat.

High mortgage rates and sticky inflation are primarily to blame for the dampened outlook for new construction, with builder confidence inching down from 43 to 42 in June, according to the most recent National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI). This reading marks the third consecutive month of downward movement and negative sentiment.

A reading of 50 or above means more builders see good conditions ahead for new construction.

Meanwhile, the construction of new homes, which had been on a tear, helping to fill the hole left by scant resale inventory, continues to sputter.

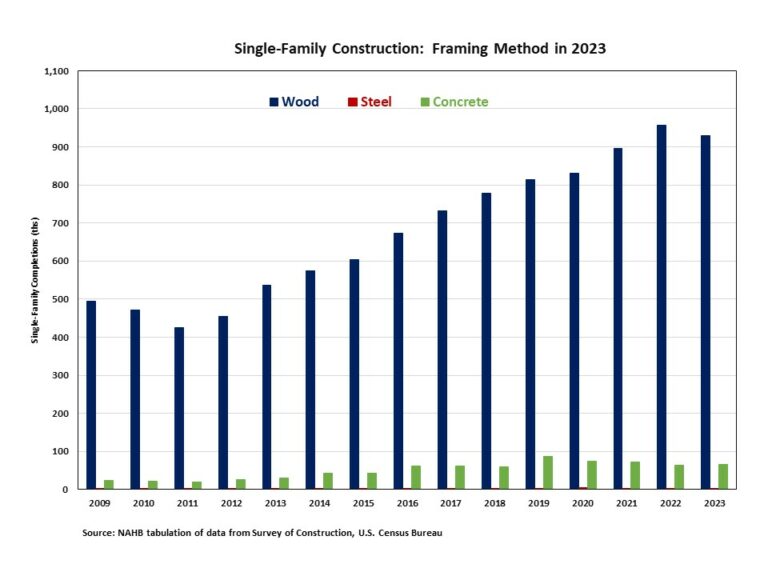

New single-family home permits fell to their lowest seasonally adjusted annual rate since May 2023 amid builder blahs, dipping 2.3% month-over-month in June, according to the latest data from the U.S. Census Bureau and the U.S. Department of Housing and Urban Development (HUD). Housing starts were down 2.2%, and completions rose only 1.8% from May.

Meanwhile, prospective buyers have reason to be optimistic: 31% of builders slashed prices in June to bolster sales compared to 25% in May, according to an NAHB press statement. A majority of builders were also open to offering incentives.

Residential Real Estate Stats: Existing, New and Pending Home Sales

New and existing home sales were down in June, but pending sales are looking up. Here’s what the latest home sales data has to say.

Existing-Home Sales

Existing-home sales slumped 5.4% in June, according to the latest report from NAR, marking the fourth straight month of declines as home prices reached their highest on record, putting off potential buyers. Sales also fell 5.4% compared to June last year.

Could we finally be tipping over into a buyer’s market? Experts seem to think so.

“Homes are sitting on the market a bit longer, and sellers are receiving fewer offers,” said Lawrence Yun, chief economist at NAR, in the report. “More buyers are insisting on home inspections and appraisals, and inventory is definitively rising on a national basis.”

Meanwhile, resale homes hit an eye-popping $426,900, a bridge too far for many prospective buyers.

Still, there’s an upside to out-of-reach home prices prompting sales declines—resale inventory has been loosening since December and hit its highest levels in over four years.

The latest NAR data shows inventory growing 3.1% month-over-month, logging 1.32 million unsold homes at the end of June. Supply crossed a key threshold, with 4.1 months of inventory available at the current monthly sales pace. Most experts consider a balanced market between four and six months.

New Home Sales

Meanwhile, despite their appeal, new homes were also not invulnerable to the high mortgage rates we saw this spring.

Amid rates hovering near or above 7%, June sales of newly constructed single-family houses inched down 0.6% compared to May sales and plunged 7.4% from a year ago, according to the latest U.S. Census Bureau and HUD data.

The good news for prospective buyers is that the slow pace of new home sales continues to push up new home inventory. Even so, buyers aren’t biting.

“Many buyers are holding off on jumping into the market, hoping to see lower mortgage rates or lower home prices later this year,” said Hannah Jones, senior economic research analyst at Realtor.com, in an emailed statement.

Speaking of lower home prices, those shopping for new construction will be happy to hear that the median price for a new home in June fell $100 to $417,300, putting the national median new home price below the national median existing-home price by $9,600.

The South and Midwest regions registered the lowest median new home sales prices in Q2 at roughly $372,000, according to pending U.S. Census Bureau and HUD quarterly sales data.

Recent Home Sales Data

Source: U.S. Census Bureau and U.S. Department of Housing and Urban Development and NAR

See More See Less

Pending Home Sales

Home sales may heat up toward the end of summer.

NAR’s Pending Homes Sales Index jumped 4.8% in June compared to the previous month, with contract signings increasing in all four U.S. regions. This welcome reading follows a dismal April and May when the index plummeted by nearly 10%.

Buyers took advantage of the increase in inventory coupled with the average 30-year fixed rate breaking below 7% in June and sliding further over the month.

A pending home sale marks the point in the purchase transaction when the buyer and seller agree on price and terms and is considered a leading indicator of a closed existing-home sale within the next one to two months.

Despite the month-over-month bump, pending transactions were down 2.6% annually. Still, experts anticipate that reading could improve in a few months when rates could be meaningfully lower compared to 2023.

“The number of pending sales in June would have been even higher, but some home buyers are holding back, anticipating lower mortgage rates later this year,” said Sturtevant in an emailed statement.

Affordability Challenges Hinder Summer Housing Market From Gathering Steam: Will Fall Be Better for Buyers?

Though home prices and mortgage rates remain high, there are signs the housing market is moving back into balance—albeit slowly and unevenly across regions.

In the week ending June 27, when mortgage rates were 6.86%, borrowers who put 20% down on a $417,300 median-priced resale home with a 30-year mortgage had to shell out a monthly mortgage payment of $2,189, not including property taxes and insurance.

Someone who purchased a resale home a year ago is paying only $32 less per month.

Even so, the latest NAR Housing Affordability Index shows that challenges remain.

The index receded to a preliminary reading of 93.1 in May. A national index reading below 100 indicates that a median-priced home is unaffordable for the typical family earning a median income.

At the NAR Real Estate State Forecast Summit in July, Yun noted that the current monthly payment for a median-priced house, excluding insurance and property taxes, has more than doubled since 2019.

To add insult to injury, it now costs first-time home buyers $1 million to buy a starter home in over 237 U.S. cities—up from 84 five years ago—according to a Zillow report. Though the national median price for a starter home is an affordable $196,611, it’s probably easier to find a needle in a haystack.

So, when can prospective buyers finally hope to get some relief?

Doug Duncan, senior vice president and chief economist at Fannie Mae, cautions against holding your breath.

“While we expect home price growth to decelerate further in the coming quarters, a still-tight inventory of homes for sale and stretched affordability remain significant challenges and, in our view, are likely to constrain mortgage demand and home sales for the foreseeable future,” he said in a press statement.

Pro Tips for Buyers and Sellers

Here are some expert tips to increase your chances for an optimal outcome in this tight housing market.

Pro Tips for Buying in Today’s Real Estate Market

Hannah Jones, a senior economic research analyst at Realtor.com, offers this expert advice to aspiring buyers:

Know your budget. Instead of focusing on price, figure out how much you can afford as a monthly payment. Your monthly housing payment is influenced by the price of the home, your down payment, mortgage rate, loan term, home insurance and property taxes.

Be flexible about home size and location. Perhaps your budget is sufficient for a small home in your perfect neighborhood, or a larger, newer home further out. Understanding your priorities and having some flexibility can help you move quickly when a suitable home enters the market.

Keep an eye on the market where you hope to buy. Determine the area’s available inventory and price levels. Also, pay attention to how quickly homes sell. Not only will you be tuned in when something great hits the market, you can feel more confident moving forward with purchasing a well-priced home. A real estate agent can help with this.

Don’t be discouraged. Purchasing a home is one of the largest financial decisions you’ll ever make. Approaching the market confidently, armed with good information and grounded expectations will take you far. Don’t let the hustle of the market convince you to buy something that’s not in your budget, or not right for your lifestyle.

…Always get pre-approved with a strong and reputable lender as soon as possible. Getting pre-approved will give you a much clearer understanding of your budget and what you can afford, it shows sellers that you’re a qualified buyer and it strengthens your offers.

— Scott Bridges, senior managing director at Pennymac and Forbes Advisor advisory board member

Pro Tips for Selling in Today’s Real Estate Market

Gary Ashton, founder of The Ashton Real Estate Group of RE/MAX Advantage, has this expert advice for sellers:

Research comparable home prices in your area. Sellers need to have the most up-to-date pricing intel on comparable homes selling in their market. Know the market competition and price the home competitively. In addition, understand that in some price points it’s a buyer’s market—you’ll need to be prepared to make some concessions.

Make sure your home is in top-notch shape. Homes need to be in great condition to compete and create a strong “online curb appeal.” Well-maintained homes and attractive front yards are major features that buyers look for.

Work with a local real estate agent. A real estate agent or team with a strong local marketing presence and access to major real estate portals can offer significant value and help you land a great deal.

Don’t put off issues that require attention. Prepare the home by making any repairs or improvements. Removing any objections that buyers may see helps focus the buyer on the positive attributes of the home.

Will the Housing Market Crash in 2024?

As already-high home prices continue trending upward, you may be concerned that we’re in a bubble ready to pop. However, the likelihood of a housing market crash—a rapid drop in unsustainably high home prices due to waning demand—remains low for 2024.

“[T]he record low supply of houses on the market protects against a market crash,” says Tom Hutchens, executive vice president of production at Angel Oak Mortgage Solutions, a non-QM lender.

Moreover, experts point out that today’s homeowners stand on much more secure footing than those coming out of the 2008 financial crisis, with many borrowers having substantial home equity.

“In 2024, I expect we’ll see home appreciation take a step back but not plummet,” says Orphe Divounguy, senior macroeconomist at Zillow Home Loans.

This outlook aligns with what other housing market watchers expect.

“Comerica forecasts that national house prices will rise 2.9% in 2024,” said Bill Adams, chief economist at Comerica Bank, in an emailed statement.

Divounguy also notes that several factors, including Millennials entering their prime home-buying years, wage growth and financial wealth are tailwinds that will sustain housing demand in 2024.

Even so, with fewer homes selling, Dan Hnatkovskyy, co-founder and CEO of NewHomesMate, a marketplace for new construction homes, sees a price collapse within the realm of possibility, especially in markets where real estate investors scooped up numerous properties.

“If something pushes that over the edge, the consequences could be severe,” said Hnatkovskyy, in an emailed statement.

What Experts Are Saying About a Foreclosures Wave in 2024

Lenders began foreclosures on 18,574 properties nationwide in June, down 17% from the previous month and down 22.7% from a year ago, according to real estate data firm Attom.

Meanwhile, completed foreclosures edged up a hair compared to the previous month, with real estate-owned properties, or REOs, increasing by 0.1%. More notably, REOs were down 10% from a year ago. REOs are homes that didn’t sell at foreclosure auctions, with mortgage lenders taking possession of the properties.

These June figures cap off a six-month span of decreases in foreclosure filings compared to the year prior, with the first half of 2024 running 4.4% lower than the same period in 2023.

“These shifts could suggest a potential stabilization in the housing market; however, monitoring these evolving patterns remains crucial to understanding the full impact on the real estate sector,” said Rob Barber, CEO at Attom, in the report.

Whatever patterns evolve in the coming months, experts generally don’t expect to see a wave of foreclosures in 2024.

“Foreclosure activity continues to lag behind pre-pandemic levels and is still at about 70% of 2019 numbers,” says Sharga.

Sharga explains that a significant factor contributing to today’s comparatively low levels of foreclosure activity is that homeowners—including those in foreclosure—possess an unprecedented amount of home equity.

Homeowners with mortgages saw a collective increase of $1.5 trillion in home equity, lifting total net homeowner equity to over $17 trillion in Q1 2024, the highest figure since late 2022, according to the latest CoreLogic home equity report.

Meanwhile, more homeowners are getting richer as home price growth surges. The percentage of equity-rich mortgages rose in 48 out of 50 states between Q1 and Q2 this year, according to Attom.

“For a homeowner in the early stage of foreclosure, that equity helps them avoid a foreclosure sale, either by leveraging the equity to pay down past due mortgage bills, or by selling their property in order to protect the equity they’d otherwise lose at the auction,” Sharga says.

When Will Be the Best Time To Buy a Home in 2024?

Buying a house—in any market—is a highly personal decision. Because homes represent the largest single purchase most people will make in their lifetime, it’s crucial to be in a solid financial position before diving in.

Use a mortgage calculator to estimate your monthly housing costs based on your down. But if you’re trying to predict what might happen next year, experts say this is probably not the best home-buying strategy.

“The housing market—like so many other markets—is almost impossible to time,“ Divounguy says. “The best time for prospective buyers is when they find a home that they like, that meets their family’s current and foreseeable needs and that they can afford.”

Gumbinger agrees it’s hard to tell would-be homeowners to wait for better conditions.

“More often, it seems the case that home prices generally keep rising, so the goalposts for amassing a down payment keep moving, and there’s no guarantee that tomorrow’s conditions will be all that much better in the aggregate than today’s.”

Divounguy says “getting on the housing ladder” is worthwhile to begin building equity and net worth.

Historically, families with children often find the summer months to be the best time to buy. With that said, recent trends suggest late fall or early winter can also be a great time for homebuyers to purchase a new property due to less buying pressure. Once the summer ends, many buyers have completed their purchase and are no longer in the market, which means less competition.

– Scott Bridges, senior managing director at Pennymac and Forbes Advisor advisory board member

Frequently Asked Questions (FAQs)

Will declining mortgage rates cause home prices to rise?

Declining mortgage rates will likely incentivize would-be buyers anxious to own a home to jump into the market. Expect this increased demand amid today’s tight housing supply to put upward pressure on home prices.

What will happen if the housing market crashes?

Most experts do not expect a housing market crash in 2024 since many homeowners have built up significant home equity. The issue is primarily an affordability crisis. High interest rates and inflated home values have made purchasing a home challenging for first-time homebuyers.

Is it smart to buy real estate before a recession?

If you’re in a financial position to buy a home you plan to live in for the long term, it won’t matter when you buy it because you will live in it through economic highs and lows. However, if you are looking to buy real estate as a short-term investment, it will come with more risk if you buy at the height before a recession.