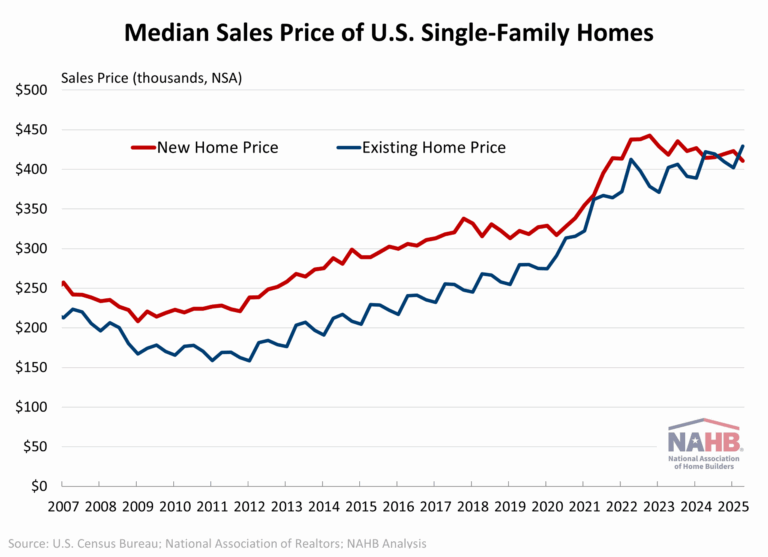

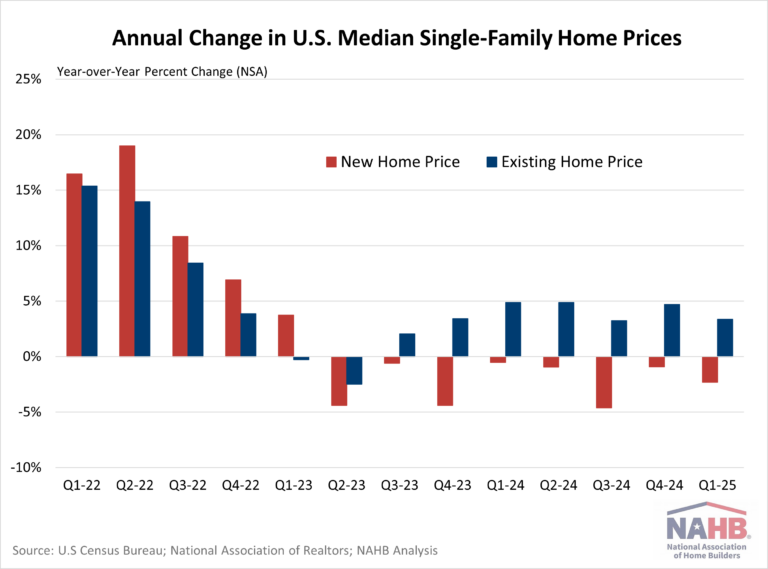

In the second quarter of 2025, the median price for a new single-family home was $410,800, which was $18,600 lower than the median price of existing homes, which stood at $429,400. This marks the largest historical gap where existing home prices exceeded those of new homes, according to U.S. Census Bureau and National Association of Realtors data (not seasonally adjusted – NSA)

Typically, new homes carry a price premium over existing homes. From 2010 to 2019, this pattern held steady, with an average difference of $66,000. However, over the past five years, the gap has narrowed significantly, averaging just $24,800. Notably, this trend reversed in 2024. In both the second and third quarters, the median price of existing homes surpassed that of new homes.

Both new and existing homes saw dramatic increases in prices post-pandemic due to higher construction costs and limited supply. While overall home prices remain elevated compared to historical norms, new homes prices have moderated due to tactical builder business decisions, whereas existing homes prices continue to increase because of lean supply and perhaps a lack of price discovery for existing homeowners.

Indeed, the median price for a new single-family home sold in the second quarter of 2025 decreased 0.9% from the previous year. New home prices have continued to experience year-over-year declines for nine consecutive quarters.

Meanwhile, the median price for existing single-family homes increased 1.7% from one year ago. Existing home prices have continued to experience year-over-year increases for eight consecutive quarters.

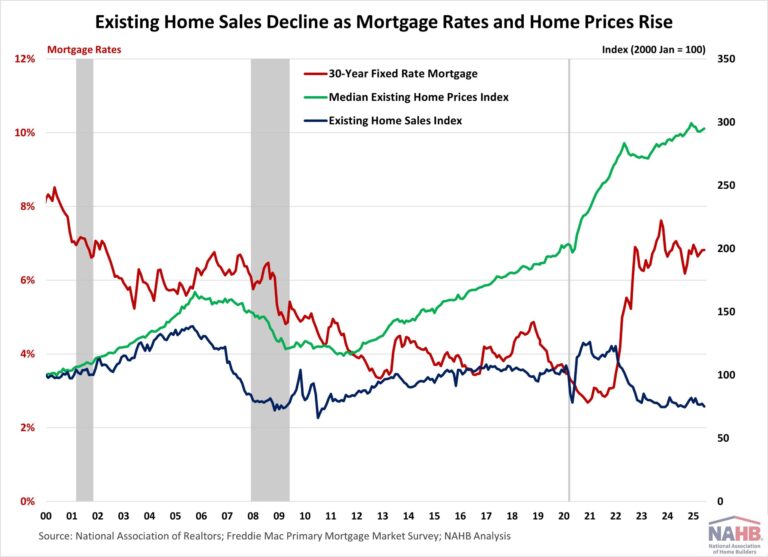

There are several factors as to why new and existing homes are selling at similar price points. Tight inventory continues to push up prices for existing homes, as many homeowners who secured low mortgage rates during the pandemic are hesitant to sell due to current high interest rates.

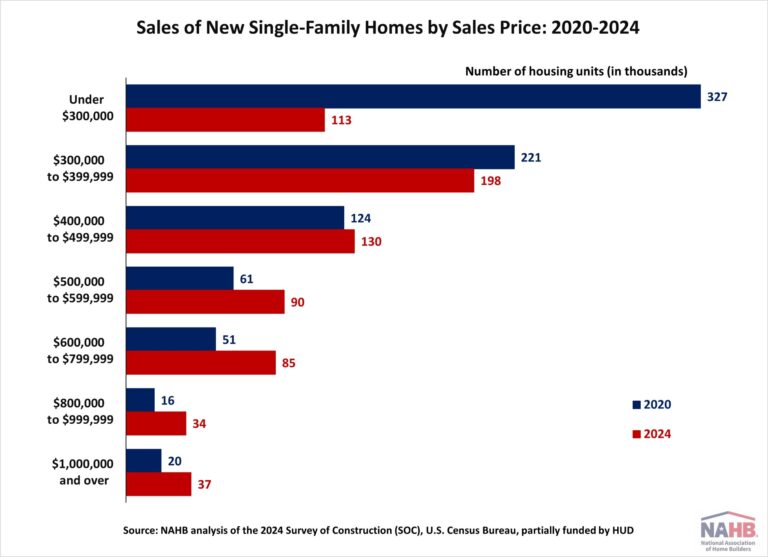

Meanwhile, new home pricing is more volatile – prices change due to the types and locations of homes being built. Despite various challenges facing the industry, home builders are adapting to affordability challenges by building on smaller lots, constructing smaller homes, and offering incentives. Additionally, there has been a shift in home building toward the South, associated with less expensive homes because of policy effects.

Moreover, the least expensive region for new homes in the first quarter was the South, with a median price of $372,100. The Midwest followed closely behind at $385,300. For existing homes, the Midwest was the most affordably region at $328,800, followed by the South at $376,300.

New homes were most expensive in the Northeast with a median price of $796,700, while the West sold at $531,100. For existing homes, the West led as the most expensive region at $646,100 homes, followed by Northeast at $646,100.

The new home price premium was most pronounced in the Northeast, where new homes sold for $269,500 more than existing homes. The West and South followed the national trend, with existing homes priced $4,200 more than new homes in the West and $115,000 more in the South.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .