With inflation gradually easing and builders anticipating mortgage rates will moderate in coming months, builder sentiment moved higher for a second consecutive month despite challenging affordability conditions.

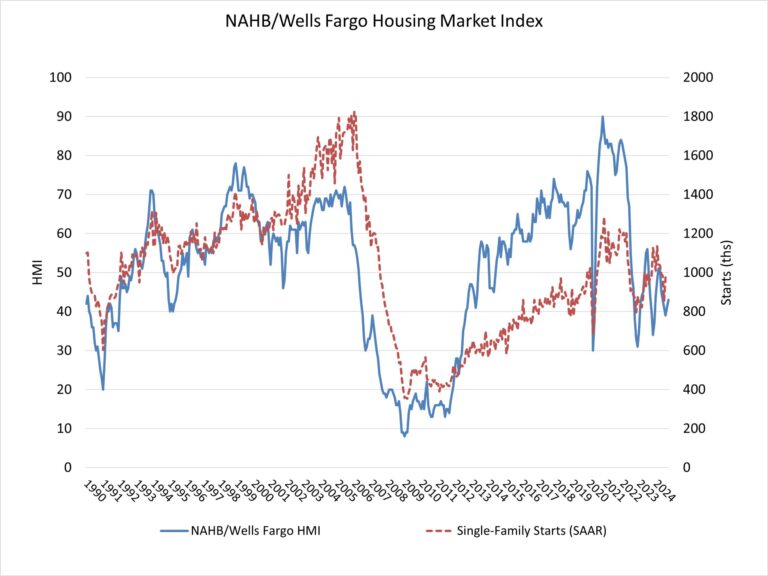

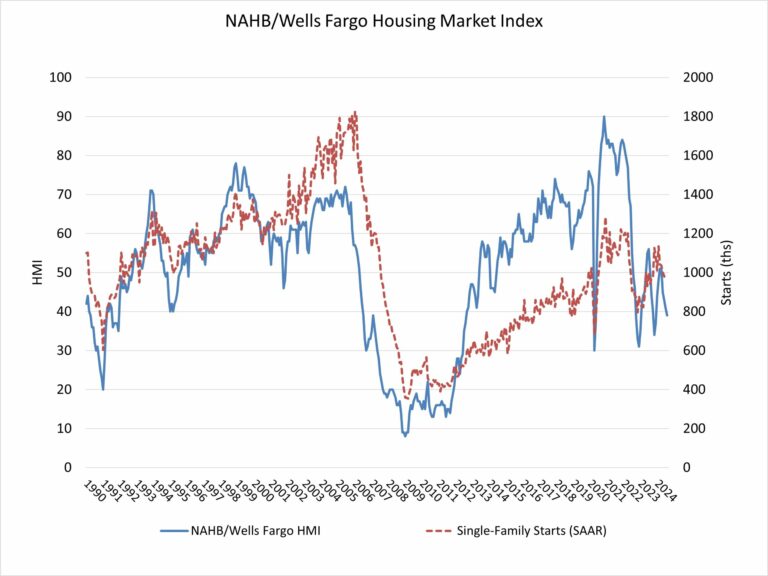

Builder confidence in the market for newly built single-family homes was 43 in October, up two points from a reading of 41 in September, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI).

Despite the beginning of the Fed’s easing cycle, many prospective home buyers remain on the sideline waiting for lower interest rates. We are forecasting uneven declines for mortgage interest rates in the coming quarters, which will improve housing demand but place stress on building lot supplies due to tight lending conditions for development and construction loans. However, while housing affordability remains low, builders are feeling more optimistic about 2025 market conditions. A wildcard for the outlook remains the election.

The latest HMI survey also revealed that the share of builders cutting prices held steady at 32% in October, the same rate as last month. Meanwhile, the average price reduction returned to the long-term trend of 6% after dropping to 5% in September. The use of sales incentives was 62% in October, slightly up from 61% in September.

Derived from a monthly survey that NAHB has been conducting for more than 35 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

All three HMI indices were up in October. The index charting current sales conditions rose two points to 47, the component measuring sales expectations in the next six months increased four points to 57 and the gauge charting traffic of prospective buyers posted a two-point gain to 29.

Looking at the three-month moving averages for regional HMI scores, the Northeast increased two points to 51, the Midwest moved two points higher to 41, the South held steady at 41 and the West increased three points to 41. The HMI tables can be found at nahb.org/hmi.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .