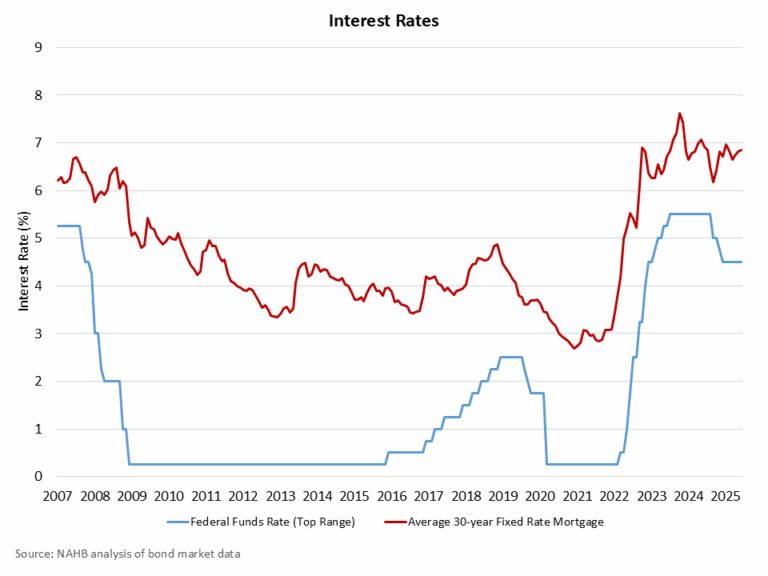

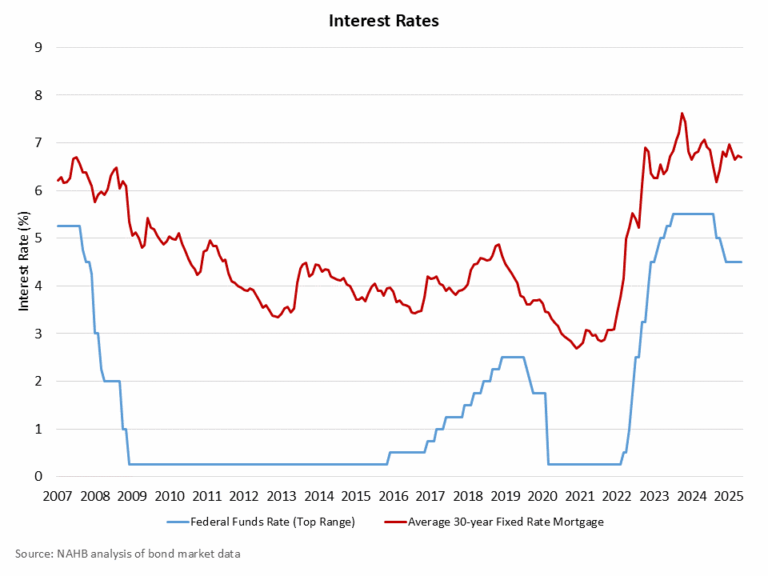

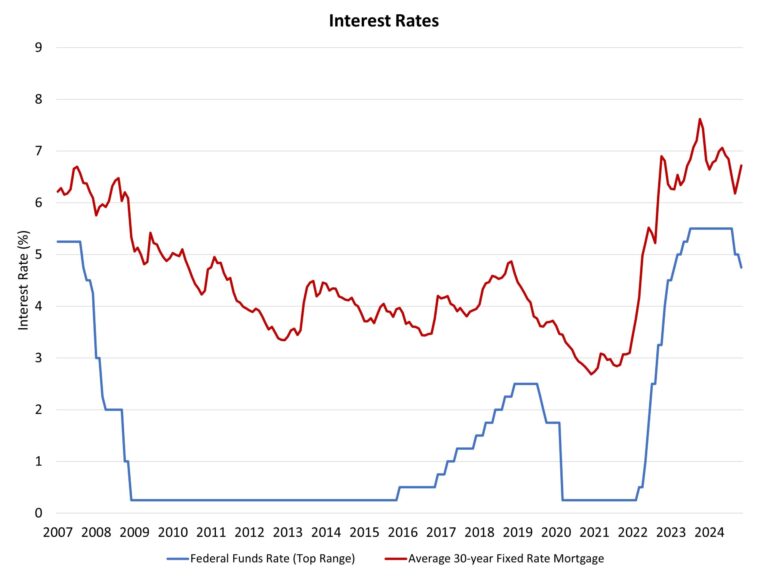

The central bank’s Federal Open Market Committee (FOMC) cut rates a third and final time in 2025, reducing the target range for the federal funds rate by 25 basis points to a 3.5% to 3.75% range. This reduction will help reduce financing costs of builder and developer loans.

Furthermore, and explicitly noted by Fed Chair Powell as separate from policy considerations, to maintain an appropriate level of reserves as a means of monetary policy implementation and to enable smooth market functioning, the Fed will initiate purchases of short-term Treasury securities on December 12th.

The tone of today’s meeting was more dovish than investors expected. Overall, the Fed faces a complicated outlook with risks on both sides of its dual mandate: supporting the labor market and maintaining stable prices. Interest rate-sensitive sectors such as housing continue to face restrictive conditions. The slightly dovish stance of today’s announcement suggests the FOMC perceives greater near-term downside risk for the labor market component of its mandate, despite an improving outlook for GDP growth.

There was a notable level of dissent at the December meeting. Two voting members of the FOMC (Goolsbee and Schmid) preferred no change to the target rate. In contrast, Governor Miran supported a 50-basis-point reduction. This marks the largest level of dissent since September 2019.

The Fed’s statement noted that job gains have slowed, and the unemployment rate has edged higher through September. In contrast to recent policy statements, the Fed did not note unemployment as “low.” The slowing of the labor market is due to both a decline in immigration and a pullback in hiring by firms. The December view of the economy was somewhat obscured by missing or delayed government data due to the now-ended government shutdown.

Chair Powell noted in his press conference that activity in the housing sector remains “weak.” Powell also noted that supply remains low, and homeowners remain locked-in due to low-rate mortgages. Finally, the Fed Chair indicated that the U.S. has not built enough housing, leading to affordability challenges due to a structural housing shortage.

Chair Powell also noted that inflation has been lowered but remains “elevated,” because of recent monetary policy actions. Inflation expectations have declined, and long-term expectations remain anchored to the central bank’s 2% target.

This framing of the economic situation is consistent with the December rate cut as being an insurance policy of easing given weakening of the labor market due to policy uncertainty and tariffs. That is, the Fed’s cut biases policy to responding to future weakening of economic growth rather than to concerns about inflation reaccelerating (some FOMC members have argued, for example, that markets can look through any tariff effects, which will be one-off impacts).

Looking forward, the Fed’s outlook for the economy and monetary policy is mixed. Estimates from the central bank’s Summary of Economic Projections (SEP) indicate an expectation of stronger economic growth next year, with a 2026 2.3% fourth quarter year-over-year growth rate. This is an upward revision compared to the 1.8% estimate from September. The SEP estimates also reveal an expectation of a 4.4% unemployment rate in 2026 and decline for inflation (core PCE) of 2.4%, relative to 2.9% in 2025. The revised SEP does not anticipate the economy reaching the Fed’s target inflation rate of 2% until 2028.

With respect to policy, the SEP outlook suggests one rate cut in 2026 and one final rate cut in 2027. The “dot plot” of individual responses suggests one respondent, presumably Governor Miran, foresees approximately five rate cuts in 2026. The policy outlook is clouded by the fact that the Fed will have new leadership next year, with a new Chair taking office in May 2026.

This article was originally published by a eyeonhousing.org . Read the Original article here. .