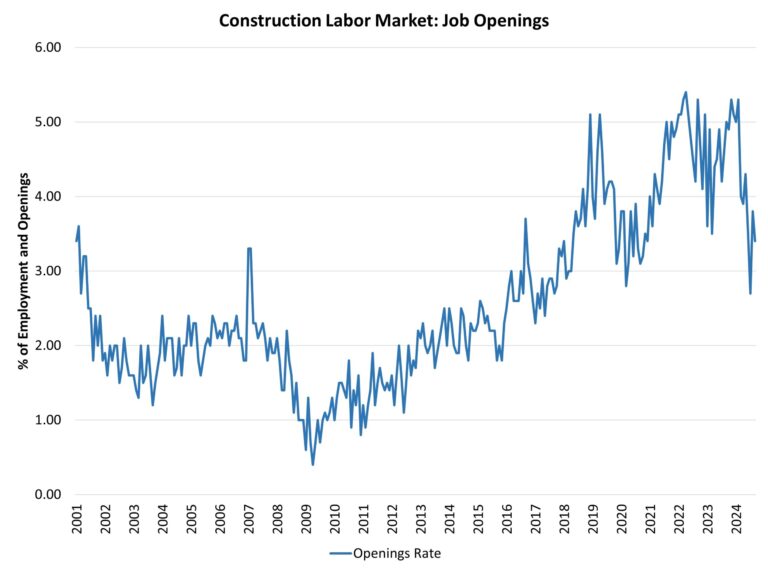

After a period of slowing associated with declines for some elements of residential construction, the count of open construction sector jobs trended lower in the September data, per the Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey (JOLTS). The data indicates the demand for construction labor market remains weaker than a year ago.

In September, after revisions, the number of open jobs for the overall economy declined from 7.86 million to 7.44 million. This is notably smaller than the 9.31 million estimate reported a year ago and a clear sign of a softening aggregate labor market. Previous NAHB analysis indicated that this number had to fall below 8 million on a sustained basis for the Federal Reserve to feel more comfortable about labor market conditions and their potential impacts on inflation. With estimates now remaining near 8 million for national job openings, the Fed has begun a credit easing cycle should continue lowering rates.

The number of open construction sector jobs fell from a revised 328,000 in August to a softer 288,000 in September. Elements of the construction sector slowed in prior months as tight Fed policy persisted. The September reading of opening, unfilled construction jobs is lower than that registered a year ago: 422,000.

The construction job openings rate fell back to 3.4% in September and continues to trend lower.

The layoff rate in construction edged higher to 2.1% in September after a 2% rate in August. The quits rate in construction decreased to just 1.4% in September as job churn slowed.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .

Purple ‘Midnight Fire’ ornamental peppers and cool blue-purple ‘Peacock Red’ kale help set off the butterscotch-colored foliage of a ruffled coral bells (Heuchera sp.) in this fall container design by Stephanie Town of Garden Stories. For more textural interest, the designer added dried dogwood stems, clips of bittersweet berries and wispy Red Rooster sedge (Carex buchananii ‘Red Rooster’).

To transition the container from fall to winter, Town says: “I would transplant the Coral Bells and kale into the bed somewhere. This particular client loves red and a bit of ‘bling,’ so I’ll add spruce tips, red glitter lotus pods and bright red ‘Cardinal’ dogwood, with a skirting of white pine and pepperberry.”

Water requirement: Moderate (watered by hand two to three times a week)

Light requirement: Full sun

Note: Oriental bittersweet can be invasive; American bittersweet is a good substitute. Both species are toxic.