Nonfarm payroll employment increased in 30 states and the District of Columbia in July compared to the previous month, while decreasing in 20 states. According to the Bureau of Labor Statistics, nationwide total nonfarm payroll employment increased by 73,000 in July, falling short of expectations and following significant downward revisions to the previous two months’ figures.

On a month-over-month basis, employment data was most favorable in New York, which added 55,500 jobs. Missouri came in second (+17,100), followed by California (+15,000). Meanwhile, a total of 37,100 jobs were lost across 20 states, with Utah reporting the steepest job losses at 5,200. In percentage terms, employment increased the highest in Missouri at 0.6%, while Wyoming saw the largest decline at 0.5% between June and July.

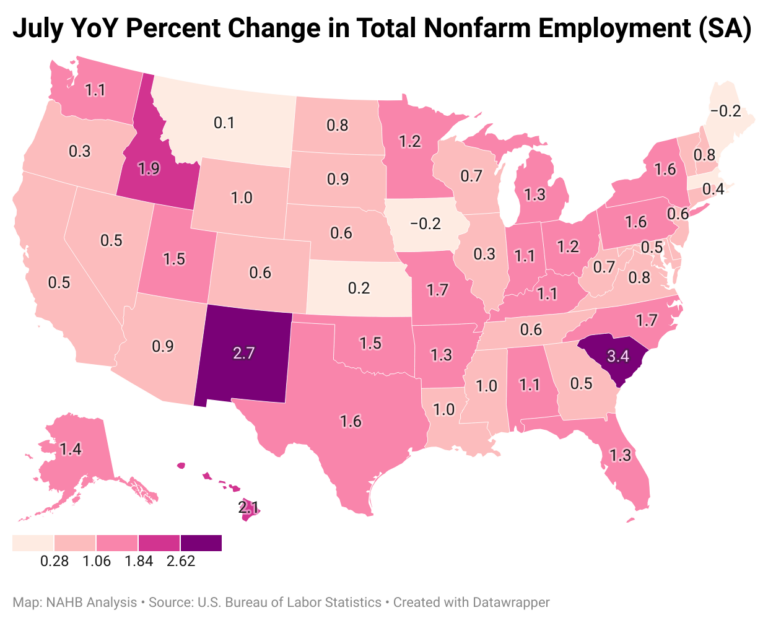

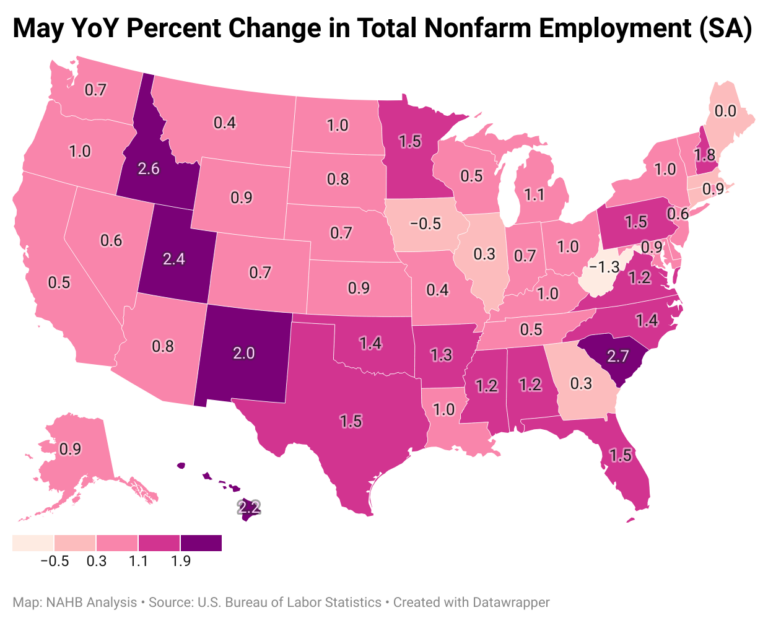

Year-over-year ending in July, 1.5 million jobs have been added to the labor market, which is a 1.0% increase compared to the July 2024 level. The range of job gains spanned from 400 jobs in Montana to 232,500 jobs in Texas. Two states and the District of Columbia lost a total of 8,900 jobs in the past 12 months, with the District of Columbia reporting the steepest job losses at 4,200. In percentage terms, the range of job growth spanned 0.1% in Montana to 3.4% in South Carolina. The range of job losses in Maine, Iowa, and the District of Columbia spanned 0.2%-0.5%.

Construction Employment

Across the nation, construction sector jobs data —which includes both residential and non-residential construction—showed that 22 states reported an increase in July compared to June, while 22 states lost construction sector jobs. The six remaining states and the District of Columbia reported no change on a month-over-month basis. Colorado, with the highest increase, added 3,800 construction jobs, while California, on the other end of the spectrum, lost 3,300 jobs. Overall, the construction industry added a net 2,000 jobs in July compared to the previous month. In percentage terms, Oregon reported the highest increase at 2.6% and Wyoming reported the largest decline at 3.4%.

Year-over-year, construction sector jobs in the U.S. increased by 96,000, which is a 1.2% increase compared to the July 2024 level. Texas added 27,000 jobs, which was the largest gain of any state, while California lost 18,200 construction sector jobs. In percentage terms, New Mexico had the highest annual growth rate in the construction sector at 14.3%. During this period, New Jersey reported the largest decline of 4.9%.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .