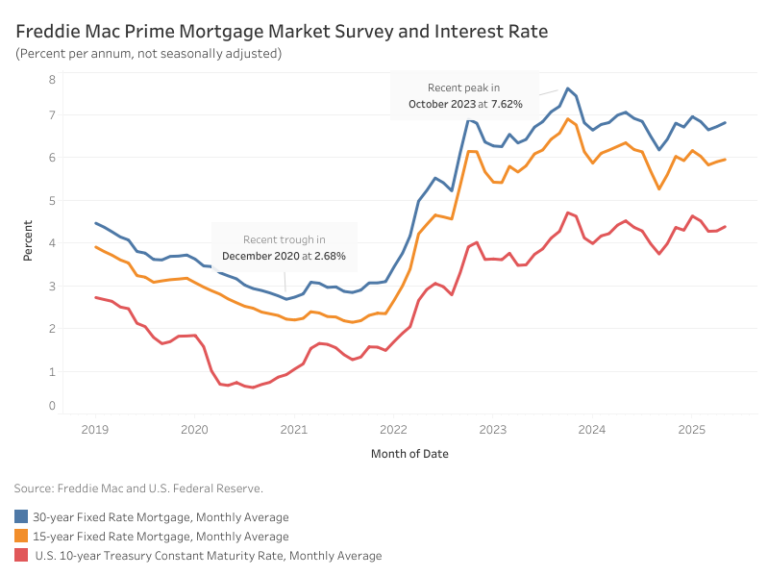

Mortgage rates continued their upward trend in May due to market volatility triggered by fiscal concerns and weaker U.S. Treasury demand. According to Freddie Mac, the average 30-year fixed-rate mortgage rose to 6.82% — a 9-basis-point (bps) increase from April. The 15-year fixed-rate mortgage increased by 5 bps to 5.95%.

The 10-year Treasury yield, a benchmark for mortgage rates, averaged 4.38% in May, with the most recent weekly yield surpassing 4.50%. Long-term treasury yields spiked following two events: first, a credit rating downgrade by Moody’s Ratings, and then, a tepid auction of the 20-year treasury. The weak demand for long-term government bonds necessitated a higher yield to attract investors.

At the core of the market unease is concern over the growing fiscal deficit that intensified as the new “One Big Beautiful Bill” threatens to further widen the federal deficit, which stood at $1.9 trillion as of January 2025. The combination of weakening fiscal credibility and poor auction performance suggests a possible upward repricing of long-term borrowing costs.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .