In November, job growth slowed, and the unemployment rate rose to 4.6%, its highest level in four years. At the same time, job gains for the previous two months (August and September) were revised downward. The November’s jobs report indicates a cooling labor market as the economy heads into the final month of the year.

In November, wage growth slowed, increasing 3.5% year over year, down 0.6 percentage points from a year ago. Wage growth has been outpacing inflation for nearly two years, which typically occurs as productivity increases.

National Employment

According to Employment Situation Summary reported by the Bureau of Labor Statistics (BLS), total nonfarm payroll employment rose by 64,000 in November. This represents a notable slowdown from September’s revised gain of 108,000 and reflects continued weakness in overall hiring.

August’s growth was revised downward for the second time, from last month’s estimate of -4,000 to -26,000. September job growth was revised down by 11,000, from +119,000 to +108,000. Combined, these revisions erased 33,000 jobs from previously reported figures. October data, published for the first time, was not revised.

Through November, average monthly job growth in 2025 stands at just 11,000, well below the 168,000 monthly average recorded in 2024.

The unemployment rate rose to 4.6% in November, its highest level since September 2021. Compared to September, the number of persons unemployed rose by 228,000, while the number of persons employed increased by 96,000.

Meanwhile, the labor force participation rate—the proportion of the population either looking for a job or already holding a job—remained unchanged at 62.4%. This remains below its pre-pandemic level of 63.3% recorded at the beginning of 2020. Among prime working-age individuals (aged 25 to 54), the participation rate edged up 0.1 percentage points to 83.8%, the highest level since September 2024.

In November, employment gains were seen in health care (+46,000) and construction (+28,000), while the federal government continued to shed jobs. Federal government employment fell by 6,000 positions in November, following a sharp decline of 162,000 in October. Since peaking in January 2025, federal government employment has fallen by a total of 271,000 jobs.

Construction Employment

Employment in the overall construction sector increased by 28,000 in November, after an upwardly revised 25,000 gain in September. Within the industry, residential construction shed 300 jobs, while non-residential construction gained 28,800 positions.

Residential construction employment now stands at 3.3 million in November, including 958,000 workers employed by builders and remodelers and approximately 2.4 million residential specialty trade contractors.

The six-month moving average of job gains for residential construction remains negative at -3,600 per month, reflecting losses in five of the past six months for June, July, August, October, and November. Over the last 12 months, residential construction has seen a net loss of 42,200 jobs, marking the sixth consecutive annual decline since September 2020. Since the low point following the Great Recession, residential construction has gained 1,334,100 positions.

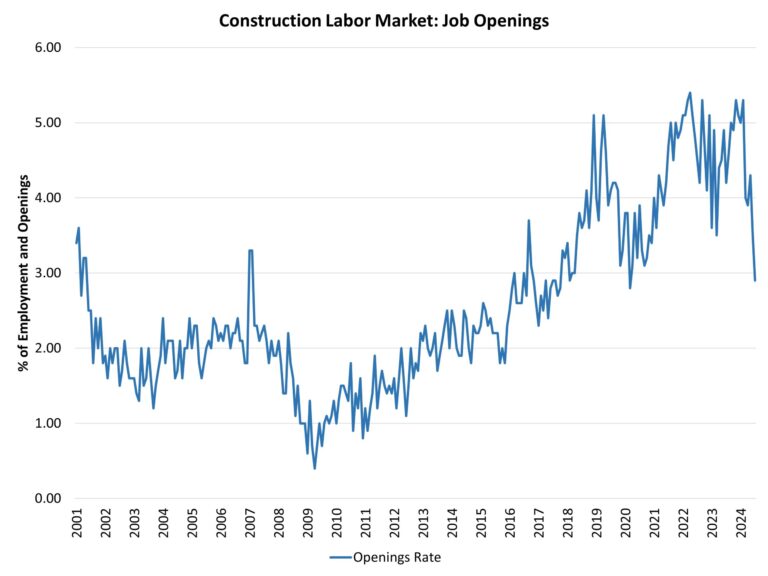

In November, the unemployment rate for construction workers declined to 4.7% on a seasonally adjusted basis. The unemployment rate for construction workers has remained at a relatively lower level, after reaching 15.3% in April 2020 due to the housing demand impact of the COVID-19 pandemic.

This article was originally published by a eyeonhousing.org . Read the Original article here. .