Overall consumer credit continued to rise for the third quarter of 2025, but the pace of growth remains slow. Student loan balances continue to rise as well, slowly returning to pre-COVID growth. Furthermore, credit card and auto loan balances continue to grow but at historically low rates. Although interest rates are still elevated, credit card and auto loan rates continue to decrease slightly.

Total outstanding U.S. consumer credit reached $5.08 trillion for the third quarter of 2025, according to the Federal Reserve’s G.19 Consumer Credit Report. This is an increase of 2.72% at a seasonally adjusted annual rate (SAAR) compared to the previous quarter, and a 2.25% increase compared to last year.

Nonrevolving Credit

Nonrevolving credit, largely driven by student and auto loans (the G.19 report excludes mortgage loans), reached $3.77 trillion (SA) in the third quarter of 2025. This marks a 2.95% increase (SAAR) from the previous quarter, and a 2.14% increase from last year.

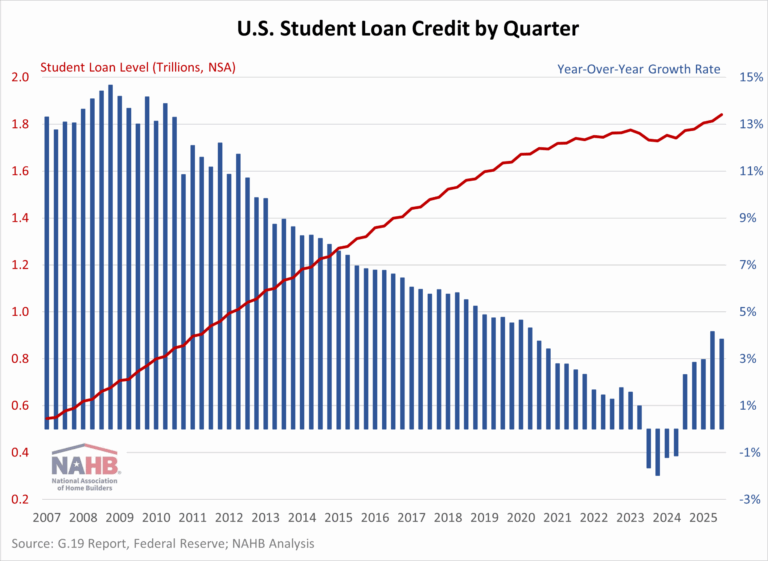

Student loan debt stood at $1.84 trillion (NSA) for the third quarter of 2025, marking a 3.84% increase from a year ago. The end of the COVID-19 Emergency Relief—which allowed 0% interest and halted payments until September 1, 2023—led year-over-year growth to decline for four consecutive quarters, from Q3 2023 through Q2 2024 as borrowers resumed payments and took on less new debt. The past five quarters have shown a return to growth, nearly matching pre-pandemic growth rates.

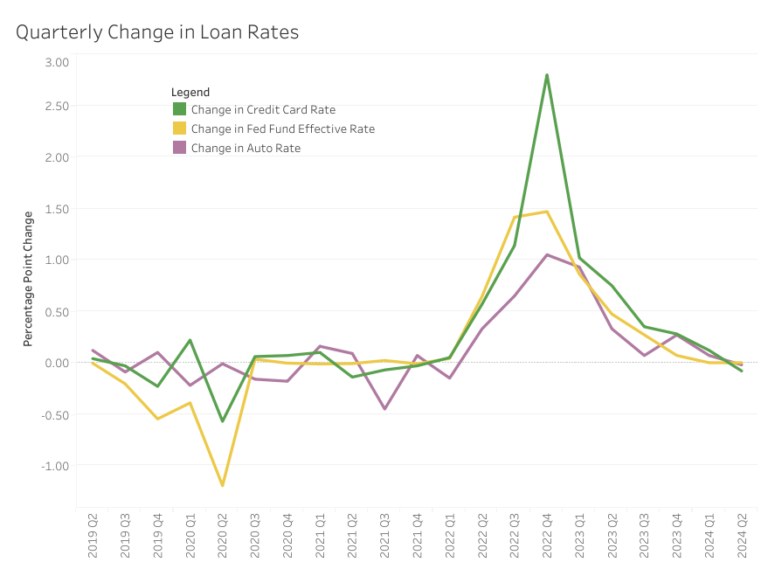

Auto loans reached a level of $1.57 trillion (NSA), showing a year-over-year increase of only 0.30%, marking one of the slowest growth rates since 2010. The deceleration in growth can be attributed to several factors, including stricter lending standards, elevated interest rates, and overall inflation. Auto loan rates for a 60-month new car stood at 7.64% (NSA) for the third quarter of 2025, a historically elevated level. However, auto rates have slowed modestly, decreasing by 0.76 percentage points compared to a year ago.

Revolving Credit

Revolving credit, primarily made up of credit card debt, rose to $1.31 trillion (SA) in the third quarter of 2025. This represents a 2.04% increase (SAAR) from the previous quarter and a 2.55% increase year-over-year. Both measures reflect a notable slowdown, marking some of the weakest growth in revolving credit in several years. This deceleration comes as credit card interest rates remain elevated, with the average rate held by commercial banks (NSA) at 21.39%. Although rates have hovered near historic highs since Q4 2022, the past three quarters have shown modest year-over-year declines, reflecting the impact of rate cuts that began in 2024.

This article was originally published by a eyeonhousing.org . Read the Original article here. .