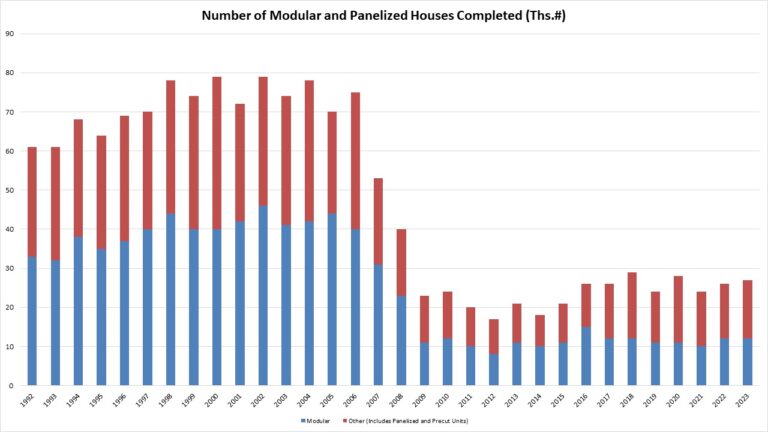

The total market share of non-site built single-family homes (modular and panelized) was just 3% of single-family homes in 2024, according to completion data from the Census Bureau Survey of Construction data and NAHB analysis. This is the same as the 3% share in 2023. This share has been steadily declining since the early-2000s despite the high-level of interest for non-site built construction. This low market share in fact runs counter to some media commentary on off-site construction suggesting recent gains. Nonetheless, there exists potential for market share gains in the years ahead due to the need to increase productivity in the residential construction sector.

In 2024, there were 28,000 total single-family units built using modular (13,000) and panelized/pre-cut (15,000) construction methods, out of a total of 1,019,000 single-family homes completed. It is worth noting that the Census definitions of off-site construction are relatively narrow. In a separate survey, the Home Innovation Research Labs Survey of U.S. Home Builders has a higher share for panelized construction (5-12%) due to a wider definition of “panelized” construction.

While the Census-measured market share is small, there exists potential for expansion. This 3% market share for 2024 represents a decline from years prior to the Great Recession. In 1998, 7% of single-family completions were modular (4%) or panelized (3%). This marked the largest share for the 1992-2024 period.

One notable regional concentration is found in the Midwest and the Northeast. These two regions have the highest market share of homes built using non-site build methods. In the Midwest, 7% (8,000 homes) of the region’s 136,000 housing units were completed using these methods. In the Northeast, 5% (3,000 homes) of the region’s 66,000 housing units were completed using non-site build methods. However, numerically, the South continues to be the biggest market for this type of construction where 13,000 homes were built using non-site build methods.

With respect to multifamily construction, approximately 3% of multifamily buildings (properties, not units) were built using modular and panelized methods. This is significantly lower than the 7% share in 2023 but on par with the average for the last 5 years. It is notable that modular construction method accounted for 2% of this share. In previous years it was only panelized construction methods that made up the higher share of non-site build methods in multifamily construction. Prior to last year, the highest levels of modular and panelized methods share in multifamily construction was in 2000 and 2011, where 5% of multifamily buildings were constructed with modular (1%) or panelized construction methods (4%).

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .

Bathroom at a Glance

Who lives here: A couple and the wife’s elderly mother

Location: Laguna Niguel, California

Size: 185 square feet (17 square meters)

Designer: Janna Parr of Sea Pointe Design & Remodel

Before: The aging bathroom, with its peeling floral wallpaper, lacked both safety and style. A basic angled wood double vanity had large plain mirrors and a hard-to-clean tile countertop. The only drawer storage came from a small makeup station in the center, leaving hair and skincare products cluttering the surface. “We had a challenge with the angled wall and did not want to turn it into a structural project,” Parr says. “We couldn’t really move walls. There was also a peeling soffit above with a fluorescent light that we wanted to eliminate.”

Across from the vanity, the step-up tub and shower (visible here in the mirrors) raised safety concerns and felt outdated. The homeowners chose to keep the water closet as is. “We didn’t change anything in there,” Parr says.

Find a bathroom designer