The cost of credit for residential construction and development declined in the fourth quarter of 2025, according to NAHB’s quarterly survey on Land Acquisition, Development & Construction (AD&C) Financing. In particular, the average contract rate declined on all four categories of loans tracked in the survey: from 7.95% in the third quarter to 7.61% on loans for land acquisition, from 7.68% to 7.44% on loans for land development, from 7.89% to 7.47% on loans for speculative single-family construction, and from 7.90% to 7.16% on loans for pre-sold single-family construction.

Meanwhile, the average initial points paid by builders and developers fell on three of the four types of AD&C loans: from 0.83% to 0.44% on loans for land development, from 0.75% to 0.34% on loans for speculative single-family construction, and from 0.67% to 0.37% on loans for pre-sold single-family construction. The only exception was loans specifically for land acquisition, on which the average initial points increased slightly—from 0.66% to 0.70%.

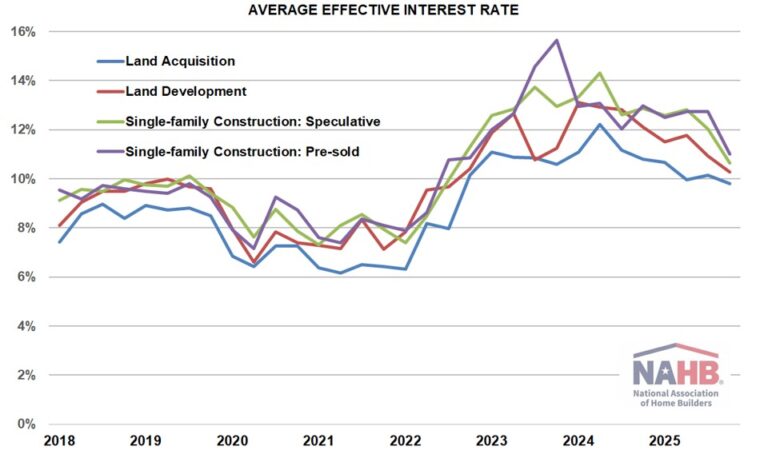

The small increase in points on land acquisition loans was not enough to offset the drop in the contract interest rate, however, so the average effective interest rate (which takes both the contract rate and initial points into account) declined across the board: from 10.15% to 9.81% on loans for land acquisition, from 10.92% to 10.28% on loans for land development, from 12.04% to 10.64% on loans for speculative single-family construction, and from 12.74% to 11.01% on loans for pre-sold single-family construction.

In all four cases, this was the lowest the average effective rate has been since the period of generally rising interest rates in 2022.

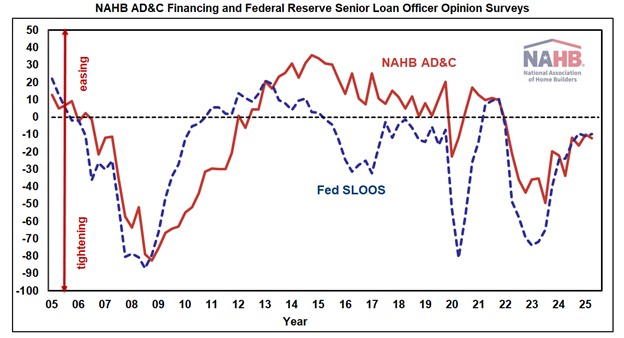

Notwithstanding the drop in rates, builders and developers continued to report tightening credit conditions in the fourth quarter of 2025. The net easing index derived from NAHB’s AD&C survey posted a reading of -9.3 (the negative number indicating that credit has tightened since the previous quarter). This is quite similar to the results from the perspective of lenders reported in the Federal Reserve’s survey of senior loan officers. The net easing index derived from the Fed survey posted a reading of -1.8 in the fourth quarter. Both the NAHB and Fed survey have now reported consistently tightening credit conditions for 16 consecutive quarters. In both cases, however, the net easing index in Q4 2025 came closer to the break-even point of zero (between tightening and easing) than it has at any time since the first quarter of 2022.

More details from the Fed’s survey of lenders—including measures of demand and net easing for residential mortgages—appeared in a previous post.

Also, in the NAHB AD&C survey, 35% of respondents who built single-family homes during the fourth quarter of 2025 reported financing some of the construction with a construction-to-permanent (one-time-close) loan made to the ultimate home buyer. On average, 59% of the homes these respondents built were financed in this manner.

More detail on credit conditions for residential builders and developers is available on NAHB’s AD&C Financing Survey web page.

This article was originally published by a eyeonhousing.org . Read the Original article here. .