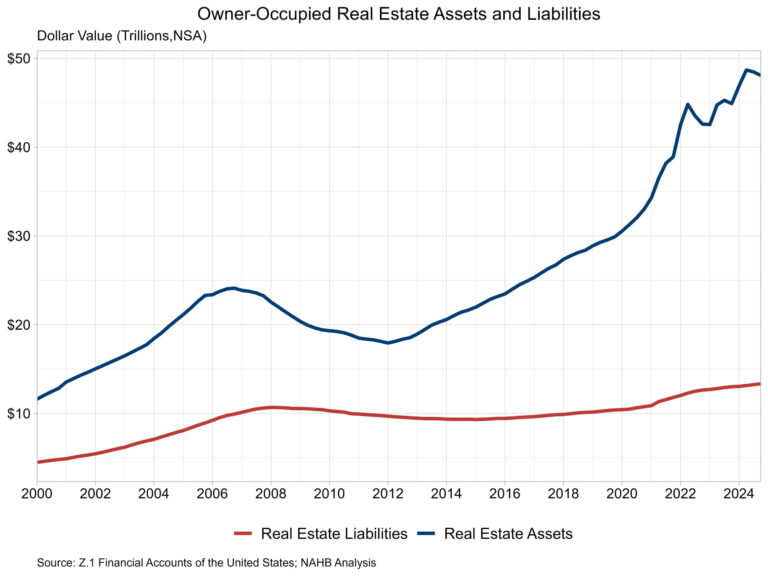

The market value of household real estate assets fell from $48.1 trillion to $47.9 trillion in the first quarter of 2025, according to the most recent release of U.S. Federal Reserve Z.1 Financial Accounts. The value of household real estate assets declined for three consecutive quarters after peaking at $48.8 trillion in the second quarter of 2024 but remains 2.1% higher over the year.

Real estate secured liabilities of households’ balance sheets, i.e. mortgages, home equity loans, and HELOCs, increased 0.3% over the first quarter to $13.4 trillion. This level is 2.9% higher compared to the first quarter of 2024.

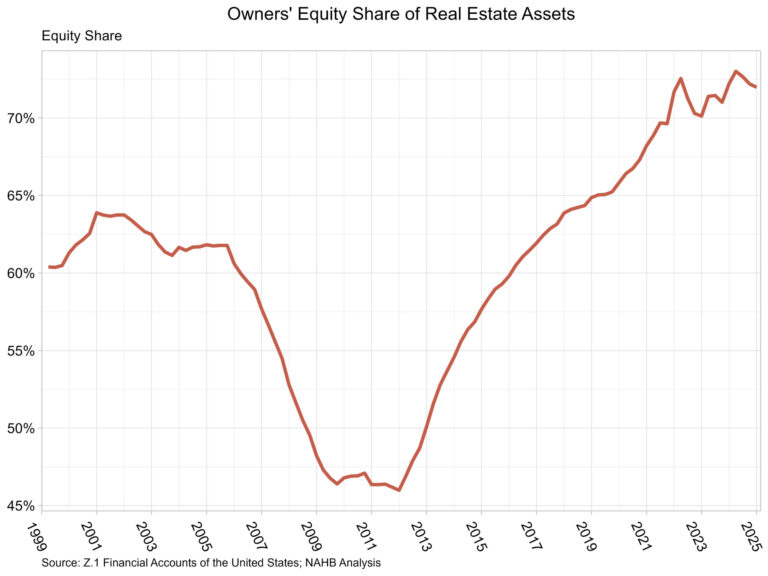

Owners’ equity share of real estate assets was 72.0% in the first quarter, marking a small decline in owners’ equity share which matches the decline in the market value of households real estate assets. The share in the first quarter of 2024 was 72.2%.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .