In 2024, most new single-family homes included laundry connections on the first floor (70%), according to the Census Bureau’s Survey of Construction. The first floor is also where most customers prefer to have the laundry, as shown in Chapter 2 of What Home Buyers Really Want.

The second floor was the next most common location, accounting for 28% of new single-family homes, while laundry areas in the basement accounted for just 2%. The share of new homes with laundry in any other location was negligible.

Across all Census Divisions, the first floor remains the most common location for laundry, even in regions where two-story homes are more prevalent. Nevertheless, some regional differences exist. In the West South Central division, 91% of homes had a laundry area on the first floor, compared to just 51% in the Pacific division. Meanwhile, a second-floor laundry was most popular in the Pacific division at 46%, and least common in the West South Central at 8%.

Not surprisingly, laundry connections in basements are more common in areas of the country where basements themselves are more common: primarily in the northern regions. The West North Central division led with 14% of homes featuring a basement laundry, followed by New England at 9%. These two divisions are also among the few where most new homes include a full or partial basement.

Among age-restricted homes, where accessibility and main-level living are key design priorities, 93% featured laundry on the first floor.

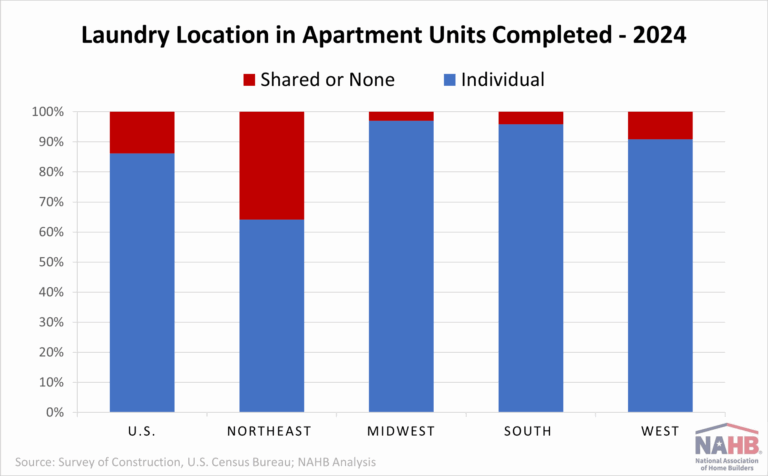

Multifamily Laundry Trends

For multifamily units completed in 2024, 88% of apartments included an individual laundry, while 12% offered shared or no laundry facilities. This share has remained relatively stable since 2015, reflecting continued renter demand for in-unit laundry.

Regionally, the Northeast has the highest shared or no laundry facilities percentage at 33%. In contrast, shared or no laundry facilities remained far less common elsewhere: 3% in the Midwest, 4% in the South, and 9% in the West.

The pattern extends to the built-for-rent (BFR) segment, where 88% of units had an individual laundry, unchanged from the prior two years. In contrast, built-for-sale multifamily units saw a decrease—from 92% with individual laundry in 2023 to 81% in 2024—suggesting a possible shift toward more affordable condo projects, which are more likely to include shared facilities.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article was originally published by a eyeonhousing.org . Read the Original article here. .