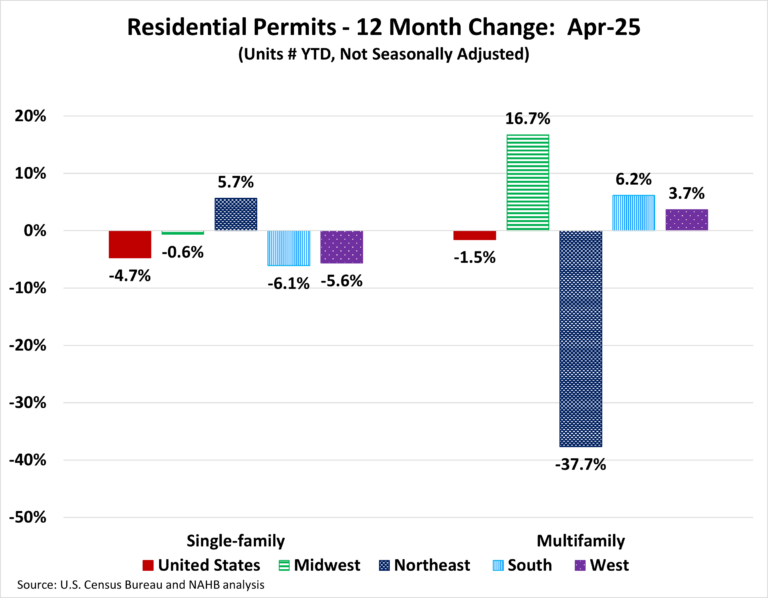

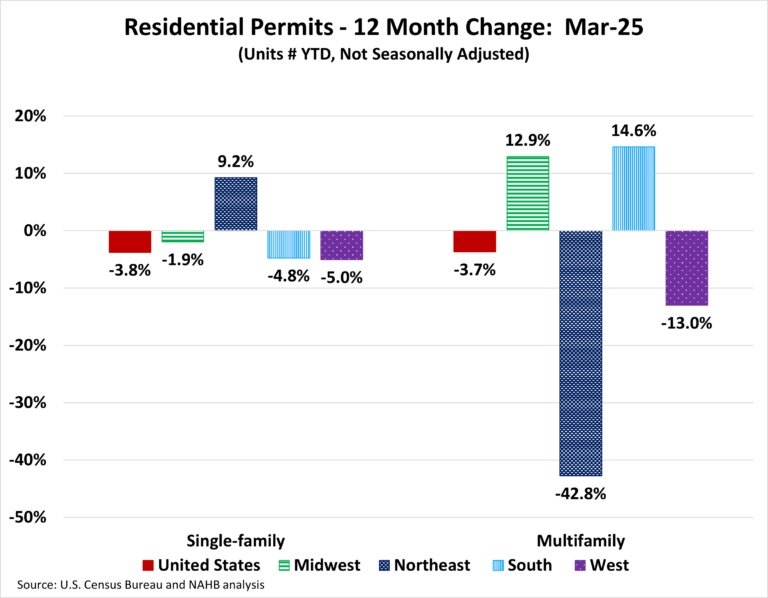

Housing permits continued a downhill trend for the fourth month in a row, pointing to a broader residential construction slowdown for 2025. Over the first four months of 2025, the total number of single-family permits issued year-to-date (YTD) nationwide reached 320,259. On a year-over-year (YoY) basis, this is a decline of 4.7% over the April 2024 level of 336,124. For multifamily, the total number of permits issued nationwide reached 154,668. This is 1.5% below the April 2024 level of 157,076.

Year-to-date ending in April, single-family permits were down in three out of the four regions. The Northeast posted an increase of 5.7%. The Midwest was down by 0.6%, the West was down by 5.6%, and the South was down by 6.1% in single-family permits during this time. For multifamily permits, three out of the four regions posted increases. The Midwest was up by 16.7%, the South was up by 6.2%, and the West was up by 3.7%. Meanwhile, the Northeast declined steeply by 37.7%.

Between April 2025 YTD and April 2024 YTD, 18 states posted an increase in single-family permits. The range of increases spanned 27.0% in Hawaii to 0.2% in Maine. The remaining 32 states and the District of Columbia reported declines in single-family permits with New Mexico reporting the steepest decline of 27.5%.

The ten states issuing the highest number of single-family permits combined accounted for 63.6% of the total single-family permits issued. Texas, the state with the highest number of single-family permits, issued 52,654 permits over the first four months of 2025; This is a decline of 7.4% compared to the same period last year. The second highest state, Florida, decreased by 9.3%, while the third highest, North Carolina, posted a decline of 1.5%.

Between April 2025 YTD and April 2024 YTD, 26 states recorded growth in multifamily permits, while 24 states and the District of Columbia recorded a decline. Alaska (+312.5%) led the way with a sharp rise in multifamily permits from 24 to 99, while New York had the biggest decline of 58.7% from 14,389 to 5,946.

The ten states issuing the highest number of multifamily permits combined accounted for 61.1% of the multifamily permits issued. Over the first four months of 2025, Florida, the state with the highest number of multifamily permits issued, experienced an increase of 18.7%. Texas, the second-highest state in multifamily permits, saw an increase of 6.8%. California, the third largest multifamily issuing state, increased by 0.2%.

At the local level, below are the top ten metro areas that issued the highest number of single-family permits.

For multifamily permits, below are the top ten local areas that issued the highest number of permits.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

Construction Firms

1. Business activity outlook increased. The Expected Business Activity Indicator, related to project inquiries and new committed projects, increased by 10 points, to 62, for the fourth quarter of 2024, from 52 for the third quarter of 2024. This means more construction firms anticipate quarter-over-quarter growth than anticipate a decline.

Expectations for project inquiries increased by 7 points, to 59 (from 52 for Q3), and expectations for new committed projects increased by 12 points, to 64 (from 52 for Q3).

Both build-only and design-build firms are more optimistic for Q4 than they were for the previous quarter. The expected activity indicator for build-only firms increased 9 points, to 62 (from 53 for Q3), and for design-build firms it increased 10 points, to 61 (from 51 for Q3).

The indicator is based on survey questions about whether businesses expect the number of project inquiries and new projects to increase, decrease or remain unchanged in the coming three months compared with the previous three months.